What's 🔥 in Enterprise IT/VC #351

Openview's Product Benchmark report w/new goalposts for "fast growth"

Ok What’s 🔥 readers, it’s time for us to run for the hills as Jim thinks we’re cool now. As many of you may already know, when Jim anoints a company or space, the opposite result usually happens.

Unfortunately Jim, it’s too late as growth across enterprise and PLG land is slowing as the goalposts for fast growth have moved this year according to the latest Openview Product Benchmark report for 2023 (always happy for boldstart to contribute to this important data - stay tuned for a deeper dive into dev tools coming soon)

Now look at how many companies are now growing >75% YoY as it’s significantly down from 49% of surveyed companies in 2021 to 22% 🤯 2 years later.

The real question for many founder and investors is if the deceleration post-COVID tailwinds in enterprise will turn into re-acceleration and if so, by how much in 2024.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Must read for founders…"Is your product too opinionated"

Part V of Dev Tools Founder toolkit ready from Anna Debenham, our operating partner at boldstart and former product at Snyk. Anna shares how to be opinionated using MAYA principle - Most Advanced Yet Acceptable with plenty of examples of how to sell the future but deliver value to users today

👇🏼 There is zero reason why you shouldn’t incorporate using Stripe Atlas especially now that it takes care of your 83(b) election to start clock on equity ownership and QSBS tax treatment

Enterprise Tech

Well said by Sam Hogan who is founder of a thin AI wrapper AI company himself. IMO, still super early, first movers can be at a disadvantage, and it will take time for the dust to settle but there are pockets in the enterprise to deploy 💰 wisely. Can’t wait to announce some of these in the coming months. All of this piggybacking off news from The Information: “Jasper, Mutiny AI Startups Cut Workers As Chatbot Rivalry Grows”

If you missed my newsletter from last week covering the state of AI Adoption in Enterprises, then take a look here - ‘AI in the enterprise - "tryers" vs. "buyers" - still early but...”

On the still early curve…Infosys one of leading SIs (System Integrators) for the Global 2000 will invest $2B on AI in next 2 years - here’s current state of play for their customers - lots of pilots…

Infosys recently launched its AI-first offering Topaz. All major IT companies have announced their investment plans in AI and automation. During TCS’ earnings conference call, TCS CEO K Krithivasan said the flavour of the quarter was generative AI.

“In every conversation I have had with the clients over the last three months, this has unfailingly come up. Gen AI promises to transform most knowledge work by assisting and augmenting people and improving their productivity,” he said.

“We are currently working on over 50 proofs of concept and pilots, and have more than 100 opportunities in the pipeline,” he said. It plans to create a talent pool of over 100,000 Gen AI trained associates and the company has over 50,000 employees trained in AI/ML solution-building skills. HCLTech said the focus is on generative AI and that it is training over 20,000 employees on GenAI capabilities.More on incumbents - Wix AI Site generator 🤯

Piling on - fun times ahead!

Congrats Codesee, a portfolio co, on launch of AI code understanding - more on TechCrunch here and you can join waitlist now - and if you’re wondering about interest in dev tools powered by AI, over 400 orgs signed up for waitlist in 24 hours

Yet another example of incumbent doubling down on AI with Wix Site Generator 🤯

The era of AIOps was started many years ago but never worked - will this time be different? One of the OGs of that first era, Moogsoft, raised $92M, and was just bought by Dell for an undisclosed price

AI ain’t free continued as Microsoft will charge $30 per user per month and Salesforce $50 per user per month

In a release, San Francisco-based Salesforce (CRM) said Sales GPT costs $50 per user per month and comes with a "limited" number of credits for its generative AI tool, Einstein GPT. Service GPT also sports a $50 per user per month price and has a "limited" number of credits for Einstein GPT as well.

How Superhuman went from zero AI expertise to delivering killer AI features in 3 months

We created an AI team that ran in theta mode, staffed with one designer, one marketer, and several engineers. I was the embedded executive, and helped with product, design, engineering, and marketing. We worked incredibly hard, pulled out every stop, and operated independently of almost all company processes. In other words, we recreated the first year of Superhuman!

Once we created the team, we had to decide what to build. There was no shortage of ideas. For example, should we automatically summarize long emails? Or write drafts in advance for you to review? Or let you split your inbox with simple natural language?

These ideas are all great — and we will definitely pursue them — but they are also all preemptive. The user sets up preemptive features once, and they work automatically thereafter. Not only do preemptive features cost much more to run, they must also meet a higher bar of quality. For example, imagine if automatic summaries or prewritten drafts were low quality. You would tune them out, or just turn them off!

We instead decided to start with features that are on-demand. These are features where the user explicitly asks the AI to do a task. These are tasks like replying to specific emails, summarizing specific conversations, translating drafts, and editing text — all while using the user's own voice and tone.

When building on-demand features, you can worry much less about cost, as cost is always bound by usage. You can also ship while iterating, since results are not automatically shown in the user interface. Best of all, you can combine what you learn about cost with what you learn from iterating, and get ready to build their preemptive counterparts. For example, start with on-demand summaries, and then build preemptive summaries; start with on-demand drafts, and then build preemptive drafts.

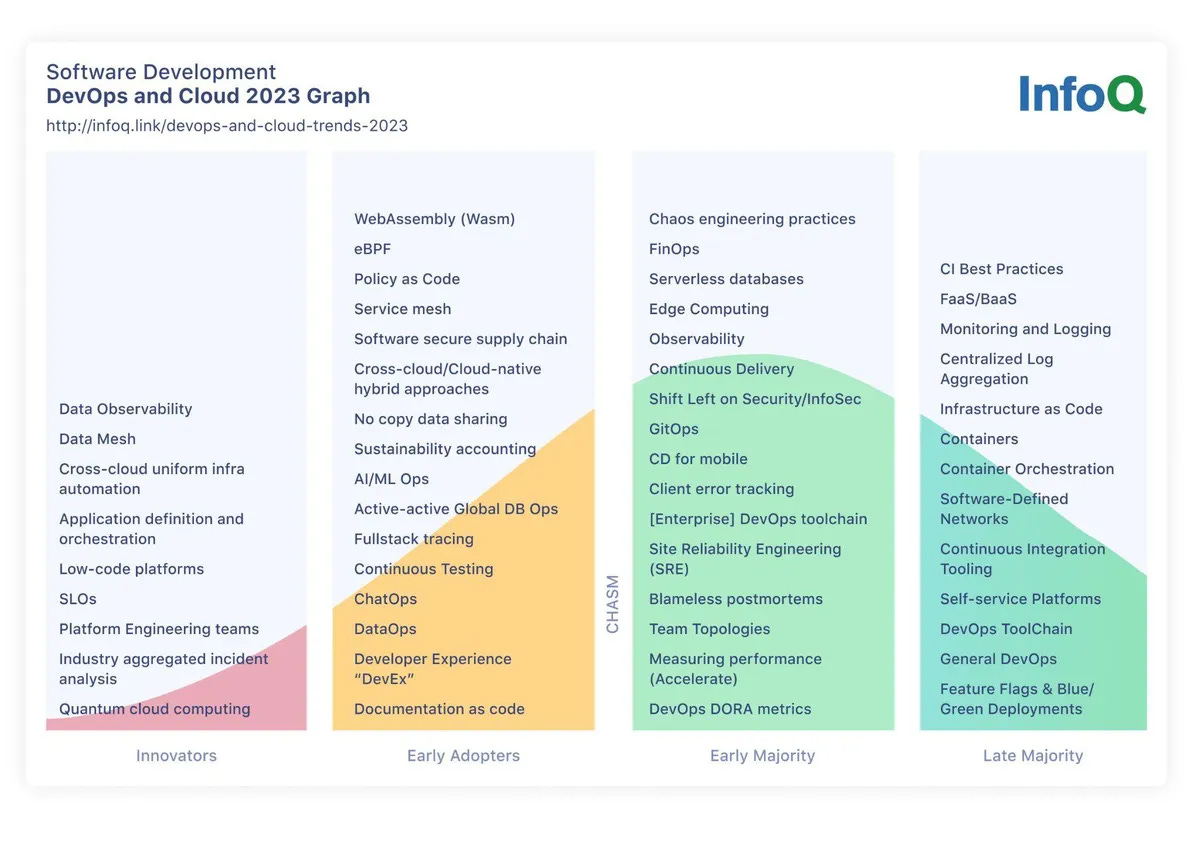

I always look forward to this from InfoQ: DevOps and Cloud InfoQ Trends Report – July 2023 - WASM on the rise and “is delivering on the promise toward achieving "write once, run anywhere" in the cloud, offering reusability and interoperability across different languages and platforms” - also more on AIOps and ClickOps (h/t Daniel Bryant)

For the fifth year, the State of the API is the world's largest and most comprehensive survey and report on APIs. More than 40,000 developers and API professionals have shared their thoughts on development priorities, their API tools, and where they see APIs going. This year covers API Monetization and Generative AI

🤯 - Must watch from Fable - “Announcing our paper on Generative TV & Showrunner Agents! Create episodes of TV shows with a prompt - SHOW-1 will write, animate, direct, voice, edit for you. We used South Park FOR RESEARCH ONLY - we won't be releasing ability to make your own South Park episodes -not our IP!”

Here’s more from Jim Fan (NVIDIA) on how this was done.

Markets

What will it take for a company to IPO? From Jamin Ball last week

I went back and looked at the last ~6 years of data on software IPOs to answer the question “what does it take to go public?” I looked at 3 key metrics: LTM Revenue, Revenue Growth and LTM FCF Margins. Here are the median stats for a set of ~50 software IPOs from 2018 to today. This can also act as a guide for younger startups who have ambitions to go public one day (these should be your goals).

Median LTM Revenue: $198M

Median Quarterly YoY Growth Rate: 49% (this is the revenue in the most recent quarter before IPO compared to the quarterly revenue 1 year prior)

Median Net New ARR added in IPO Quarter: $22M

Median FCF Margin: (11%)

And below are the charts for each. My guess is there are quite a few private companies who have IPO scale (ie >$200m LTM revenue).

Nicely done. Post should be titled “Oh, Jim”