What's 🔥 in Enterprise IT/VC #344

The seed to A fundraising log jam and the importance of Big Mo

This was a big earnings week for enterprise software companies from Crowdstrike to Sentinel One to MongoDB to Salesforce. As is the case for every enterprise software earnings call in 2023, there is no call without discussion of AI. Here’s Marc Benioff’s quote:

"The coming wave of generative AI will be more revolutionary than any technology innovation that's come before in our lifetime, or maybe any lifetime," Benioff told investors, noting that it was "reshaping our world in ways that we've never imagined."

"This AI revolution is just getting started," he added.

Here’s Dev from MongoDB:

"We believe the recent breakthroughs in AI represent the next frontier of software development. The move to embed AI in applications requires a broad and sophisticated set of capabilities while enabling developers to move even faster to create a competitive advantage. We are confident MongoDB's developer data platform is well positioned to benefit from the next wave of AI applications in the years to come."

Despite all of the excitement around AI there still is a Seed to Series A Fundraising log jam.

As an enterprise founder going from seed to A, how do you stand out?

First, there are fewer story rounds these days where investors will throw $15m for little more than an idea unless you’re an AI company started by a researcher from one of top labs.

What that means is every other founder will have to focus on building a highly efficient lean and mean operation. As I’ve always said, going from an idea to product to first sales is your goal but how you get there also matters. It’s all about momentum and showing not only that you have Big Mo on your side starting with shipping product but also as you sign customer 1, what’s behind that.

The best companies are able to tell investors that they need money because they are breaking and can’t keep up with all of the demand and product updates and need to hire some bodies to meet these needs. Investors are looking for these signals, and you need to make it easy for them to find it. Simple ways would be some early but solid customer count growth, usage, expansion and also a quality sales pipeline with early signs of repeatable success. I’d show these numbers in months and also aggregate into quarters since investors think in these time horizons. It also gives your company a longer time domain than days or weeks to show that beautiful 📈.

The “holy shit, I’m breaking moment” shows your potential investors two things; your company is lean and mean, and if they invest they are investing into the beginnings of this 📈.

There is no magic number to get a Series A done, but you will have a much easier time if you have Big Mo on your side. Many folks think of $1m ARR as a threshold, but we must remember that not all $1M ARR companies are built the same.

It’s not the $1m ARR that matters but how you get there and how your company is positioned for repeatability.

When your new investor puts 💰 into your business will it take another 18 months to get another $1m or 6? Is your $1m from a small number of customers sourced through friendlies or more diverse with smaller lands and more expands. IMO, while huge customers are nice, you’re better off having a number of smaller customers with smaller lands and some proof of expansion to truly show the market is there. There is so much more to cover on this topic but for now, just remember momentum matters. If you don’t have it, then find a way to manufacture it. An example could be that you tried a new sales motion or marketing plan or delivered an important feature and since that time look at the velocity. Even if things aren’t going great, you can still try new things to find a way to show and tell that story of 📈.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

How can enterprise founders leverage their board/investors for more sales? Here’s a great post from my Partner Ellen Chisa on how to get more meaningful intros along with a template to build your own

Importance of “feel” when building PLG products from VP Product Figma - Sho Kuwamoto (via Lenny Newsletter)

I am sure there are certain kinds of software where people decide what to purchase based on rational criteria. Design tooling is not like that. When you talk to designers about their preferred tools, they start talking about how things “feel.” It’s almost like talking to a musician about their favorite instrument.

It’s my belief that the feel of software is vital to adoption, especially when you are going for product-led growth. People respond instinctively to how something feels, and you can’t fake it. In fact, I think it might be the most important part of PLG.

Because of this, the “feeling” of the tool is something we tried to get right from the beginning. When we officially launched Figma, we limited ourselves to a core set of features that felt polished and well-designed, instead of cramming in features. We didn’t have components, styles, or even multiplayer in that core set of features. It was just a simple design tool that lived in the browser and felt great.

Lessons learned 🧵 from founder of Codecademy building profitable business to $525M exit and what it means to transition from founder to CEO

Enterprise Tech

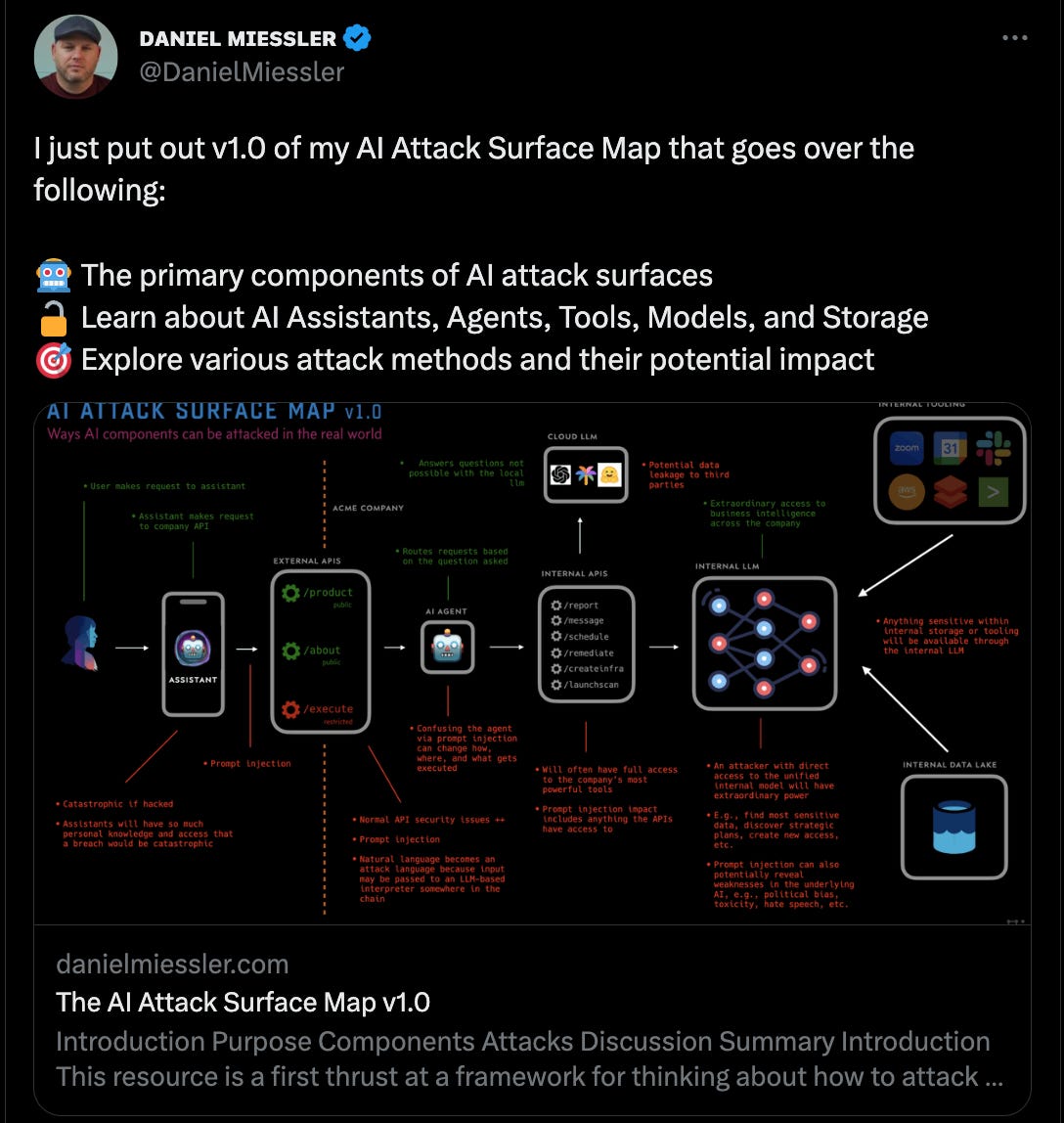

AI Security attack surface map - also additional commentary from Protect AI here

Speaking of the AI Security and privacy, CapeChat just launched! Keep sensitive data private while still using ChatGPT. CapeChat automatically encrypts your documents and redacts any sensitive data. It’s powered by the ChatGPT API, so you get the best language model while preserving your privacy. More on the Product Hunt page.

Want to incorporate the latest LLMs into your product? This is a must read from Phillip Carter from Honeycomb covering what models, thought process for UI, and security risks: All the Hard Stuff Nobody Talks About when Building Products with LLMs (🎩 Shomik Ghosh )

There’s a lot of hype around AI, and in particular, Large Language Models (LLMs). To be blunt, a lot of that hype is just some demo bullshit that would fall over the instant anyone tried to use it for a real task that their job depends on. The reality is far less glamorous: it’s hard to build a real product backed by an LLM.

LLMs have a limit to the amount of input that can accept.

Commercial LLMs like gpt-3.5-turbo and Claude are the best models to use for us right now. Nothing in the open source world comes close. However, this only means they’re the best of available options.We found no tangible improvements in the ability to generate a Honeycomb query when chaining LLM calls together. The book isn’t closed on this concept altogether, but here’s your warning: LangChain won’t solve all your life’s problems.

And we have absolutely no desire to have an LLM-powered agent sit in our infrastructure doing tasks. We’d rather not have an end-user reprogrammable system that creates a rogue agent running in our infrastructure, thank you.

And for what it’s worth, yes, people are already attempting prompt injection in our system today. Almost all of it is silly/harmless, but we’ve seen several people attempt to extract information from other customers out of our system. Thank goodness our LLM calls aren't connected to that kind of stuff.

Crowdstrike announces Charlotte AI, generative AI based security analyst - yes, table stakes for security cos and notice language - human guardrails still needed

We combine the best in technology with the best of human expertise to protect customers and stop breaches. We believe the future of cybersecurity requires tight human-machine collaboration to deal with the speed, volume and advancing sophistication of the adversary. When done correctly, AI can rapidly surface hidden threats, accelerate the decision making of less experienced security analysts and simplify a multitude of complex tasks.

More AI and Security: Cisco Security buys Armorblox in email security space with a bigger vision for AI

Today, we are taking an exciting step forward in executing our plans for an AI-first Security Cloud. We are pleased to announce our intent to acquire Armorblox, a company that has pioneered the use of Large Language Models (LLMs) and natural language understanding in cybersecurity. The first application of Armorblox’s advanced techniques was securing the most significant way enterprise users get routinely attacked – yes, I’m talking about email. Through this acquisition though, we see many exciting broad security use cases and possibilities to unlock.

Leveraging Armorblox’s use of Predictive and Generative AI across our portfolio, we will change the way our customers understand and interact with their security control points. From enhanced attack prediction, to rapid threat detection, to efficient policy enforcement – there are near-limitless ways to improve today’s security experience.

The evolving role of CFOs from Contrary Research

Markets

MongoDB up 20% as it blows out earnings and ups forecast - you guessed it, there’s an AI story

"MongoDB (MDB) began fiscal 2024 with strong first quarter results, highlighted by 40% Atlas revenue growth and the most net new customer additions in over two years. The continued strength in new business activity indicates the mission criticality of the MongoDB developer data platform and underscores that investments in innovation remain a top priority for customers," said Dev Ittycheria, President and Chief Executive Officer of MongoDB.

"We believe the recent breakthroughs in AI represent the next frontier of software development. The move to embed AI in applications requires a broad and sophisticated set of capabilities while enabling developers to move even faster to create a competitive advantage. We are confident MongoDB's developer data platform is well positioned to benefit from the next wave of AI applications in the years to come."

Exclusive: Francisco Partners, TPG end talks to buy New Relic - While tech buyout firms are flush with cash and it’s a great time to buy public cos as valuation multiples are still down, there is one huge factor preventing mass buyouts - debt providers more skittish making loans due to high rates and questions on economy and ability to pay loans

High interest rates have made debt more expensive, while concerns about an economic slowdown have made lenders more risk-averse, especially when it comes to financing technology companies such as New Relic that have strong revenue but limited cash flow.

New Relic has been negotiating with potential acquirers since last year, Reuters has reported, and it's possible that deal talks resume some time in the future, the sources added.

The gap in the deal price expectations between the parties could not be learned. Shares of New Relic dropped 5% to $73.65 in Friday afternoon trading, giving the company a market value of about $5 billion.