What's 🔥 in Enterprise IT/VC #342

Our first NEW AI investment...Kustomer 2.0, post-Meta spin out

I remain consistent from my end of year forecast that AI is amazing, it’s a technology, and it will be embedded in every application where it makes sense. From my 2023 predictions post - What’s 🔥 #322 on 12/31/22.

And here’s Paul Graham from this past week - it’s a 🧵 you should read.

So along those lines, we made our first NEW AI investment - in Kustomer 2.0! Yes, it’s not what you think of as an AI company since it’s actually a leader in customer experience and support software. It’s not a LLM or an AI infra startup or a ground zero founder building a new AI app. It’s also our second time investing in Kustomer and co-founders Brad Birnbaum and Jeremy Suriel. The huge difference is that one rarely gets to invest in a company on day one, sell it, and then invest in the spin out which is what is happening here. Here’s my post sharing the original journey from day one to exit.

What gets me even more excited is that Kustomer 2.0 is starting with a massive customer base built on a rapidly scaling data platform hosting lots of different data sets which is the perfect platform to infuse with AI. In fact that is just what the team has being doing. Here’s Brad Birnbaum, co-founder and CEO announcing Kustomer spinning out from Meta as an independent company again.

For our customers, here’s what you can expect. We plan to hit the ground running, investing in new talent and technologies to expand our product offerings. First, businesses will see modernization and simplification of the Kustomer interface, resulting in faster, easier-to-use tools. Next, we will double down on the automations our customers rely on today, infusing the latest AI technologies throughout our product and bringing new generative AI advancements utilizing the customer data platform. From there, we will continue to advance our customer CRM capabilities to fuel the next generation of personal, contextual experiences. We are confident in our vision to scale as an industry leader and we look forward to fully embracing our startup superpowers to bring innovative customer service solutions to market faster than ever before.

Our journey with Meta has been amazing and we are proud of the work we accomplished together to transform how businesses support their customers. Our partnership has resulted in expanding our international offerings, broadening our capabilities with artificial intelligence and deepening our integration with Meta’s modern communication channels (Instagram, WhatsApp, Messenger).

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

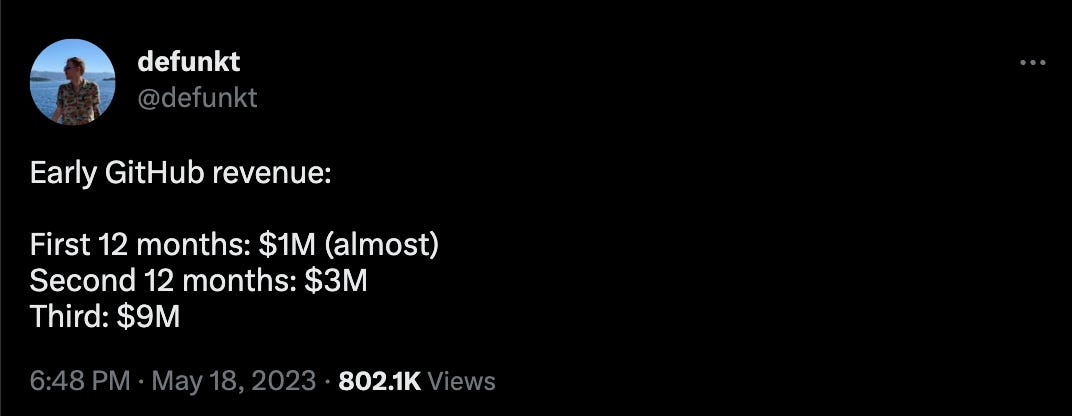

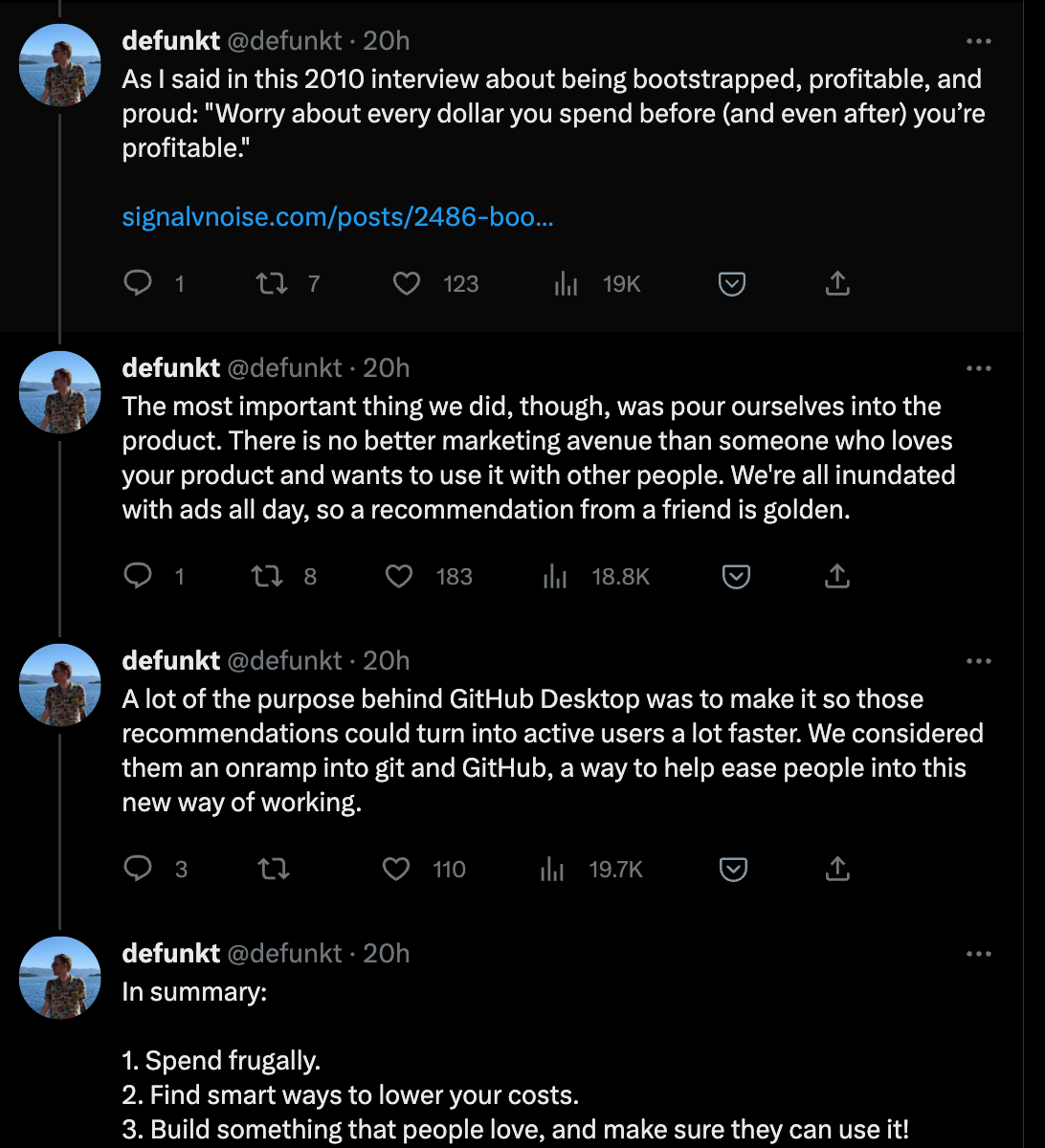

The way developer startups used to be built when they were super unsexy and how they should be built today as well. Must read 🧵 on Github’s early days from one of the co-founders Chris Wanstrath who was also CEO.

Speaking of hiring, reminder from Marc Randolph at Netflix - my two cents - hire slow, fire fast.

Enterprise Tech

Enterprise Tech 30 by Wing VC is out - congrats to portfolio co Snyk, #5 in Giga category behind cos like OpenAI, Stripe, and Databricks. Some key takeaways…

GenAI commands VC attention

33% of ET30 2023 companies are generative AI-native (the companies’ origins are rooted in GenAI tech). An additional 13% are generative AI-launch—meaning they recently launched significant GenAI features or products.

Just 3% of ET30 companies in 2021 were generative AI.

PLG dominates (again)

The product-led growth model’s steady takeover continued this year. 75% (30 of 40) of 2023 ET30 companies employ a significant product-led growth model, and the trend has marched steadily upward since 2019

Speaking of AI, sw-yx just shared its AI hackathon stack and wow it’s crowded, esp. in AI infra and tooling - great for founders, hard to tell who will from startup side (🎩

)Just how good can China get at generative AI? (The Economist)

This leads those in the know to conclude that China is two or three years behind America in building foundation models. There are three reasons for this underperformance. The first concerns data. A centralised autocracy should be able to marshal lots of it—the government was, for instance, able to hand over troves of surveillance information on Chinese citizens to firms such as SenseTime or Megvii that, with the help of China’s leading computer-vision labs, then used it to develop top-notch facial-recognition systems.

That advantage has proved less formidable in the context of generative ais, because foundation models are trained on the voluminous unstructured data of the web. American model-builders benefit from the fact that 56% of all websites are in English, whereas just 1.5% are written in Chinese, according to data from w3Techs, an internet-research site. As Yiqin Fu of Stanford University points out, the Chinese interact with the internet primarily through mobile super-apps like WeChat and Weibo. These are “walled gardens”, so much of their content is not indexed on search engines. This makes that content harder for ai models to suck up. Lack of data may explain why Wu Dao 2.0, a model unveiled in 2021 by the Beijing Academy of Artificial Intelligence, a state-backed outfit, failed to make a splash despite its possibly being computationally more complex than gpt-4.

Cloud data management and security space heating up as Polar Security (raised $8.5M) sold for $60M to IBM (TechCrunch)

What’s happening with backstage, the open platform for building developer portals by Spotify

Enterprise founders, get your standard partnership agreement from CommonPaper now

Markets

Pay attention - what world looks like before zero interest rates

New Relic, one of first observability companies, rumored to be taken over at 6x to 7.6x CY23 Sales

New Relic (NYSE:NEWR) may be worth $88-$100 a share in a possible takeover after a report that the company is in discussions with private equity firms Francisco Partners and TPG about a more than $5 billion takeover, according to a Truist analyst.

The software company could even see a $110 a share , or a multiple of 7.6x CY23 sales, if a premium were paid for "product stickiness," Truist analyst Joel Fishbein, who has a hold rating and $65 price target on NEWR, wrote in a note on Wednesday.

"However, given the conversations we have had around PE firms not being as comfortable with consumption model businesses (and NEWR’s historical top line volatility), we see a likelihood of a slight discount, and a 6x CY23 sales multiple would lead us to an $88 share price," Fishbein wrote.