What's 🔥 in Enterprise IT/VC #334

Q1 round volumes significantly 📉 but keep the faith, true believers needed more than ever - how 2 rounds got done in last 30 days

It’s ugly out there, but let me share 2 stories of portfolio companies that did raise rounds in the last 30 days.

First up is dope.security. While we’re mostly focused day one investing in new categories in cybersecurity, there are a select few founders like Kunal who know an industry so well that we’ll go after incumbents with a bold approach. In this case, dope.security has created the fly direct, secure web gateway (SWG) with a consumer like experience that puts the intelligence back on the edge vs. the cloud resulting in a 4x faster and more secure approach than existing solutions from Forcepoint, Symantec and others.

We initially partnered with Kunal and team in June of 2021 when just an idea and announced the seed round upon shipping the alpha in September of 2022. Here’s more on why we invested originally.

While follow on rounds post-seed are difficult to get done in this environment, it’s even harder to get a round done >$10M since the world has changed dramatically. One of the 🔑 to getting a $15M+ round in this environment is to not only find a true believer in your vision, having some wins on the board in terms of customers, but also spending quality time with your future partner.

In this case, Sangeen notes in his LinkedIn post

After almost a year of conversations, GV (Google Ventures) is excited to finally partner with Kunal Agarwal and the dope.security team as they reshape the Secure Web Gateway market!

As I’ve always said, the world got too transactional the last few years, and I’m pumped to see the pendulum swing back to relationship oriented investing.

Next up is Dylib.so, a developer tools company focused on accelerating the adoption of WASM into production. We initially partnered with Steve, Zach and Ben in October 2022, and all I can say is this team ships fast with the launch of Extism (an open source universal plug in system) and Modsurfer (analyzes code + dependencies of WASM binaries). On the heels of early traction and excitement around WASM, we were 💪🏼 to double down on our initial investment with Felicis in a $6.6M seed round.

Once again, Dylib.so found true believers who did not need to understand the opportunity and risks ahead for WASM but who were bought in on the need for developer tools to accelerate the adoption of WASM.

So despite the doom and gloom on the stats from Tomasz, keep building and shipping, get some wins, and find the true believers which doesn’t require talking to dozens of firms.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

Another example of cleaning up excess of last few years - these are painful times for some employees, esp at FAANG cos who will have to accept a lower compensation

I highly encourage you to read 🧵 and comments

👇🏼 for any developer first founder ready to start a company, come talk to us at boldstart - Anna will share her product superpowers from early days of Snyk to scale

Enterprise Tech

Battery State of Cloud Q1 is out - here are some key findings from the deck - “TL;DR, even amid the challenges the tech industry continues to navigate, the Q1 2023 survey results should come as good news for enterprise-tech startups.”

RIP Gordon Moore, co-founder of Intel - what a legend and visionary

👀 last part of tweet got cut off…Pretty clear that without leveraging AI, most dev productivity cos will get crushed...

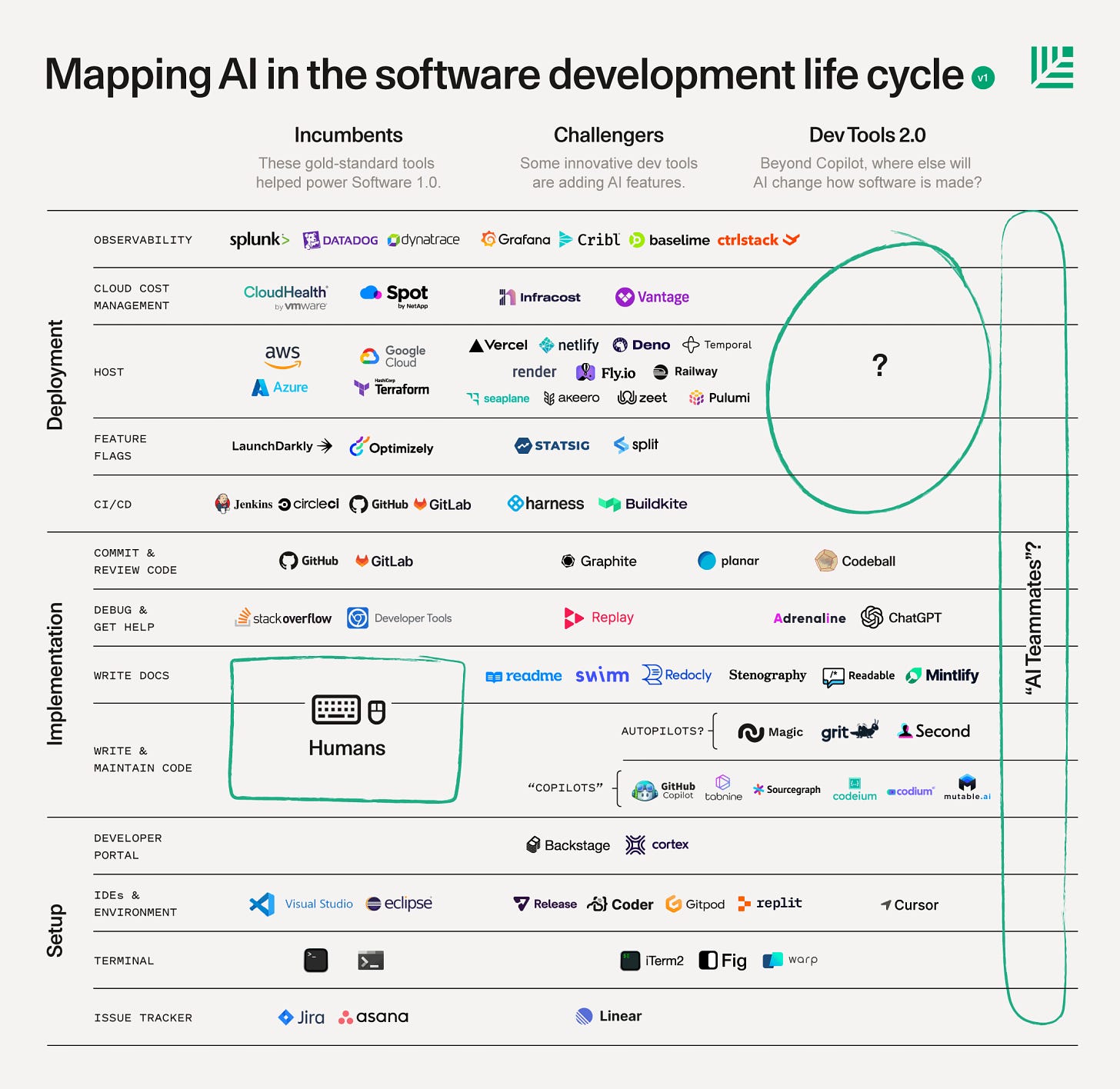

Along those lines here’s Sequoia’s market map on developer tools on the AI opportunity - IMO I still believe many of the incumbents like Github will still win but a select few will create new categories

ChatGPT plugin marketplace is out and wait until these are all connected together into workflows with an output from one task becoming an input to the next 🤯 🧵

What are the security ramifications of OpenAI - privacy concerns? This one is just an bug in OSS but folks are thinking through the ramifications of proprietary data being used to train models - “OpenAI Shut Down ChatGPT to Fix Bug Exposing User Chat Titles” Bloomberg

OpenAI temporarily shut down its popular ChatGPT service on Monday morning after receiving reports of a bug that allowed some users to see the titles of other users’ chat histories.

An OpenAI spokesperson told Bloomberg that the titles were visible in the user-history sidebar that typically appears on the left side of the ChatGPT webpage. The chatbot was temporarily disabled after the company heard these reports, the spokesperson said. The substance of the other users’ conversations was not visible.

Adobe and Canva both announced expanded AI offerings this week

Markets

👇🏼 must watch documentary Age of Easy Money (PBS|Frontline) - yes, folks its over, and this will enlighten you to all things Fed and how much power it wields and why/how it has made some of the decisions in the last few years - 🎩 my partner etdurbin