What's 🔥 in Enterprise IT/VC #331

The fear of running out runway vs. stepping on the gas - don't miss your window of opportunity

I am seeing signs of positivity in VC and founder land. Checkbooks are opening up again for Series A and beyond rounds as there was lots of activity in the portfolio this week that resulted in some signed term sheets and/or closings of rounds - Woo hoo!

It was also a big week for Israeli cybersecurity as you will read in the the Enterprise Tech section below. Wiz in the cloud security space raised at a $10B valuation and an outlier multiple, Axis Security in SASE (secure access edge market) sold for $500M for what I hear is also a “strategic” value (i.e., meaning not grounded in any existing ARR but for tech), and rumors that NoName in API security space could be bought. BTW, don’t be surprised if Cisco’s name pops up on the radar as I hear they are hunting, especially as they are sitting on lots of cash.

Switching gears, I’ve talked to a number of founders who are obsessed with runway and rightly so…but IMO, perhaps at the expense of capturing opportunities that are sitting right in front of them. I get it, and I understand the fear of going from 24 mos to 20 mos runway, especially in an uncertain economic environment.

But ask yourself one question, if I could go faster, what would I do, and what results could I expect?

I’ve found that simple question can unlock a ton of insight. Some founders will say there is nothing an extra dollar of spend would do to unlock more value. Others that I’ve spoken with will come back and tell me they’ve actually been holding back and are chomping at the bit to do more, to run faster, but fear running out of cash. Perhaps an extra engineer or two can help you ship those features 3 mos faster to unlock a blocker to sales. Perhaps a sales engineer can help close more deals and let that engineer or you, the founder, get back to your other options. Yes, cash runway matters, but don’t use that as your only goalpost as this is also a great time to step on the gas when others are also pulling back.

This is also a great opportunity to take an insider led up-round vs. down round to top off the cash. Perhaps you can run faster if you had 6 more mos of runway in a simple, fast, and clean process from existing investors. The tradeoff will be if taking the additional dilution now will allow you to create much more value by going faster today versus waiting and going slower. Either way, be honest with yourself and ask if you are holding your self back due to fear and missing out on market opportunities.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Enterprise Tech

All about developer portals for the sprawl of microservices and potential benefits along with some of the players

Here’s a deeper dive and great to see Martina from portfolio co Roadie and one of engineers building out initial version of Backstage contribute to this analysis

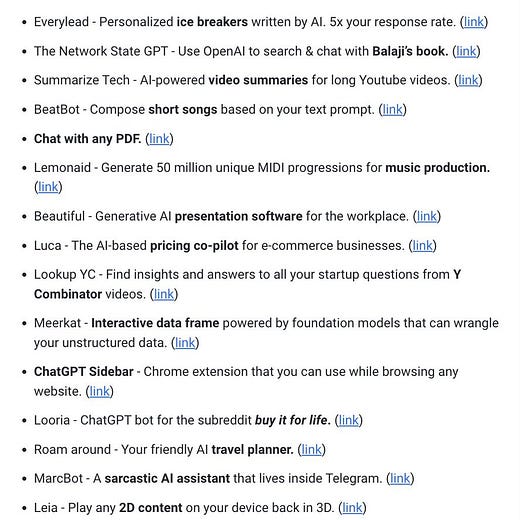

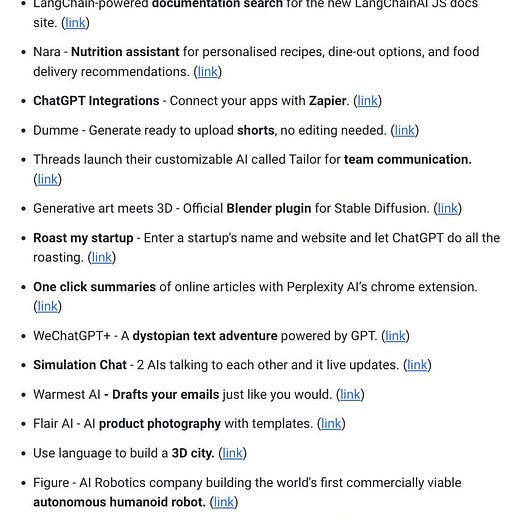

They keep coming…avalanche of ChatGPT related cos

💯

Cloud security and Israeli cyber on 🔥 as Wiz raises $300M at $10B valuation from Lightspeed and Greenoaks

The demand for Wiz's product is evident in customer validation from more than 35% of Fortune 100 companies, including BMW and Morgan Stanley, as well as other leading companies such as Salesforce, Slack, Colgate, and Blackstone, demonstrating that Wiz's approach to cybersecurity is the future of the industry. Additionally, earlier this month, G2, the world's largest software marketplace, awarded Wiz Best Security Product for 2023.

Wiz has expanded its cloud security platform (CSPM & CNAPP) during 2022, adding modules for Container and Kubernetes security, Data Security Posture Management (DSPM), and Cloud Detection and Response (CDR), enabling organizations to further consolidate their cloud security program to a single platform that is truly built for cloud.

Israeli API security co “Noname Security in negotiations to be acquired for hundreds of millions of dollars” - last round was $135M Series C at $1B valuation

The Israeli cybersecurity unicorn has developed a platform that analyzes configuration, traffic, and code to identify the broadest set of API vulnerabilities

While Israeli Axis Security in SASE (secure access edge market) is sold for a rumored $500M to HPE

Axis Security was founded in 2018, employs 134 people and has raised $100 million in outside funding, according to LinkedIn. The company was co-founded by Dor Knafo and Shuky Chen - who both joined Symantec through its acquisition of browser isolation startup Fireglass - and by Gil Azrielant, who served as a team leader in the intelligence unit of the Israel Defense Forces. All Axis staff will join HPE.

Calcalist reported that HPE has agreed to pay $500 million to purchase Axis Security. An HPE spokesperson tells ISMG that $500 million is "substantially higher than the actual figure" but declined to disclose the deal price.

Great read from Contrary on Cloud Security market - IMO, will be interesting next 12-18 mos as you have build (developers) vs. runtime (security) - which entry point wins? How to bridge gaps? Old school incumbents like Palo Alto or new entrants? Stay tuned!

Lessons learned building on top of LLMs

Coinbase Ventures map on web3 security

Markets

Orlando Bravo on Rule of 40 and back to basics - tradeoffs between growth and efficiency - not a very good metric! Listen in…the more profitable you are in software with 90% gross margins, the faster you should grow, you have less layers of management, you have better span of control, focus more on your core competencies, build simpler use cases…

Snowflake - headwinds coming in 2023 after 3 years of >70% growth, forecast is for 40% growth in 2024 down from previous guidance of 47% - the beauty of consumption in up markets but tough on way down