What's 🔥 in Enterprise IT/VC #319

How Open Source founders can go from artistic success to commercial success - lessons from Hashicorp

🤯 If you wonder why interest rates and controlling inflation matters, this chart from my friends at Guggenheim Securities (Rob Bartlett) showing current EV/NTM multiples will pain the picture.

It’s down from an all time high of 48x just a year ago and now it’s at 8.2x for the fastest growing software companies (>40% YoY). Multiples aren’t coming back until inflation gets under control and while the pendulum will swing back to more historical pre-pandemic numbers, don’t expect seeing 48x ever again.

The good news is that against this massive valuation compression, we still have developer and infrastructure software companies executing in this challenging environment. Companies like Gitlab, MongoDB and Hashicorp all beat expectations. Hashicorp, for example, had an amazing quarter growing over 52% to $125M Revenue with 134% Net Dollar Retention. More importantly there are some lessons to be learned from the transcript and investor deck.

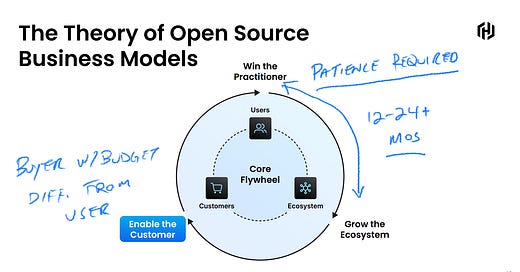

This slide from the Hashicorp Q3 Presentation shows how the OSS flywheel is supposed to work: user first, budget second. Reminder the user and grow the ecosystem elements require significant patience, anywhere from 12-24+ months to get that flywheel moving. When folks fall short is not understanding what the economic buyer needs and that they are different than the user. Yes the budget could be developer engineering but Hashicorp focuses on the new platform eng team and even security budgets.

Done right, this model can drive results like this 👇🏼 - 7 years later, a land of $100k has turned into a multi product sale and 10M of ARR - a 100X increase from 2015!

Here’s more on the current market and the GTM motion from the earnings transcript.

On Current Markets - do more with less

Dave McJannet (CEO)

Armon and I have spent the last few weeks meeting in-person with customers and prospects across North America, Asia Pacific, Europe, and also last week at Amazon re:Invent and I wanted to share some more insights. Regardless of location, all buyers are under increasing scrutiny and pressure to do more with less, a theme I think will continue through next year.

Still huge tailwinds overall for cloud infra

However, despite these pressures, for large organizations worldwide the transition to a cloud infrastructure remains a key strategic investment over the long-term. And because of the ongoing prioritization of cloud, even with economic pressures HashiCorp products continued to be a strategic investment for our customers. Our products are fundamental to running a modern infrastructure estate and conducive to cost control.

As I've said before, organizations worldwide are still very early in cloud adoption. As they continue their transitions to the cloud and multicloud becomes the standard, our products become increasingly valuable because they offer operations, networking and security teams with a consistent operating model that provides a system of record across each layer of their infrastructure stack.

on ROI - net new budget + reduce cost + risk + accelerate time to market

Sure. Thanks for that. I maybe think about that in three ways. I think first and foremost, just to be clear that our customer is the cloud program office by and large inside these companies. And that is actually a net new spend category, right, where they are really just trying to determine what vendors are going to be their partners for this next several decades. So it's very rare that we're displacing something because this is a net new construct.

Yes, I had a security model in the private data center, but now I have cloud. That's a different vendor set. And I would say much like Datadog, it is relatively unpopulated. Number two, when we go into - and that is a unique opportunity for us, and that is why you see the efficacy that you do of our model.

Number two, the value proposition of our products is always around reducing cost, reducing risk and accelerating time to market for new things, take Terraform, for example, are you overspending on your cloud estate, well, constrained Terraform's usage so that you apply policy and governance guardrail before you provision things and that will bring your cost down. So it's a very conducive message to the economic environment we're in, which certainly helps clearly our sales cycles. And that has always been a message and will continue to be a message.

The lag factor in dev tools and infra software vs. cloud spend

Armon Dadgar, co-founder

Yes. I think the other - and this is Armon. Maybe a little additional color I would add is, as we continue to travel and speak with customers, one of the trends that we see over and over is that there is a lag effect between when customers start on their cloud journey and how long it takes them to truly build maturity and start operating at scale, right? I think there's a lot of inertia as we think about it to these infrastructure transitions.

And so I think that once underway, those are pretty robust, as Dave said, I think even though the clouds are sort of slowing down near-term. I think these programs still take a lot of time to build up to maturity. And I think there's a lot of other spend, whether it's in dev test environments or data consumption or things like that, that are a bit more bursty versus core infrastructure and core applications that tend to be a few years behind when customers start their cloud journey.

Be patient, focus on the user, find the economic buying center and budget, land, expand, and never forget your North ⭐ and focus on delivering value for that single user no matter how big you get.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

On negotiating…anything

The SaaS Agreement Toolkit is here from CommonPaper (a portfolio co) - Agreements, guides, and benchmark data to help you sell SaaS faster!

👇🏼 this is exactly what every SaaS founder needs to close deals at the speed of SaaS - get your design partner agreements, NDAs, cloud contracts + more w/ benchmarking data on most standard term Let's go @UseCommonPaper @jakestein @bengarvey Combine w/ enterpriseready.ioWe’re thrilled to announce the 🚀 launch 🚀 of the SaaS Agreement Toolkit, a free resource for founders and operators offering the fastest, most trustworthy way for SaaS companies to create and understand commercial contracts. Check us out on ProductHunt! https://t.co/hXAU7QnFti https://t.co/v3gk9yFY1K

👇🏼 this is exactly what every SaaS founder needs to close deals at the speed of SaaS - get your design partner agreements, NDAs, cloud contracts + more w/ benchmarking data on most standard term Let's go @UseCommonPaper @jakestein @bengarvey Combine w/ enterpriseready.ioWe’re thrilled to announce the 🚀 launch 🚀 of the SaaS Agreement Toolkit, a free resource for founders and operators offering the fastest, most trustworthy way for SaaS companies to create and understand commercial contracts. Check us out on ProductHunt! https://t.co/hXAU7QnFti https://t.co/v3gk9yFY1K CommonPaper @UseCommonPaper

CommonPaper @UseCommonPaper

Enterprise Tech

WASM!!! 14 hot cos from InfoWorld: “From blazing-fast web apps to Python data science in the browser, these programming language and compiler projects offer different twists on the promise of WebAssembly.”

Tomasz dives into the profitability of PLG motions 🧵

Will this be the beginning of encryption everywhere? 🧵

Security sells developer tools - Gitlab (from earnings transcript) no longer DevOps but now a DevSecOps Platform

Matthew Hedberg (RBC Analyst)

Thanks for taking my question. Sid, first of all, I love the change in your tagline from DevOps platform to the DevSecOps platform, something I think we've all sort of heard in checks in terms of how you guys are resonating with security use cases. Can you just talk about, I guess, the significance of that and how you think about even a security-led sale and maybe even adding even more SecOps functionality.

Sid Sijbrandij (Founder/CEO)

Yes. Thanks for that, Matt. Security is getting more and more important. And not only is secured again and more important, people are recognizing security needs to be an integral part of the DevSecOps life cycle. You need to shift security left. And as a DevOps platform, we are leading in the number of features we offer within that security tier. Static and dynamic analysis, container scanning, secret detection, we have the best security offering, and that is resonating in the market.

And this quarter, we also put a focus on Govern because it's not enough to just have all the security functionality. When the auditors walk into your company and say, "Hey, that environment tell me what runs there, who signed off on that code. Did another person sign off on the code? Did you run all the tests?" You need answers. You need documented answers that you did that. And the alternative for GitLab is building that yourself and no company wants to do that, especially not in this economy. So, we're super excited that we not only have the most security technology, we also allow you to prove it that you did all of that.

Another example of how history rhymes - 21 years ago at our prior fund, Andy and I were invested in ActiveBuddy which launched SmarterChild, an intelligent bot on AOL Instant Messenger which had a personality and could answer questions. Net net, the company could not make money, pivoted its conversational tech to FAQs and customer support, changed its name to Colloquis, launched AskComcast which grew to a 7 figure deal and eventually sold to Microsoft. History certainly does rhyme! We are going to see the chat interface as the primary UI for a ton of apps in 2023.

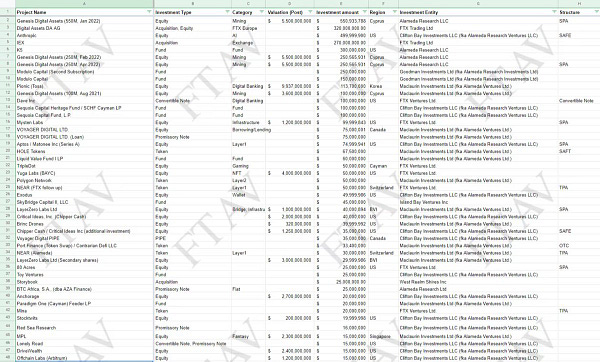

The full Alameda/FTX venture portfolio revealed - I wonder how the bankruptcy courts will auction off these assets - impossible to do 1 by 1

Markets

Lead article in The Economist: Investing in an era of higher interest rates and scarcer capital - Prepare for impatient investors and pain in private markets—but also higher returns”

Welcome to the end of cheap money. Share prices have been through worse, but only rarely have things been as bloody in so many asset markets at once. Investors find themselves in a new world and they need a new set of rules.

The pain has been intense. The s&p 500 index of leading American shares was down by almost a quarter at its lowest point this year, erasing more than $10trn in market value. Government bonds, usually a shelter from stocks, have been blasted: Treasuries are heading for their worst year since 1949. As of mid-October, a portfolio split 60/40 between American equities and Treasuries had fallen more than in any year since 1937. Meanwhile house prices are falling everywhere from Vancouver to Sydney. Bitcoin has crashed. Gold did not glitter. Commodities alone had a good year—and that was in part because of war.