What's 🔥 in Enterprise IT/VC #318

VC investor letters written by ChatGPT 🤯

OK, I couldn’t resist and had to share some of the fun I’ve had with ChatGPT from OpenAI. It’s incredible and you must try it here. Here are a couple investor newsletters I asked it to write for me - one explaining why an enterprise VC fund performance was less than stellar and another on why 2023 will be a better year.

And here’s why it’s a great time to invest and why 2023 will be better.

Try for yourself!

Besides ChatGPT, I found data from Github’s State of the Octoverse 🤯.

Looking at that report also reminded of the need to get behind mega trends early as an early investor. Here’s what I wrote in 2009 about the “Googlization of IT” which is really about how web scale companies paved the path for everyone else when it comes to infrastructure. This was a core mega trend we got behind when we started boldstart in 2010. What I couldn’t see was how quickly companies would adopt the public cloud versus private cloud and of course, one of those big factors was security which blossomed into a massive industry in the last 13 years and still has a lot of room to grow moving forward (read more from that 2009 blog post).

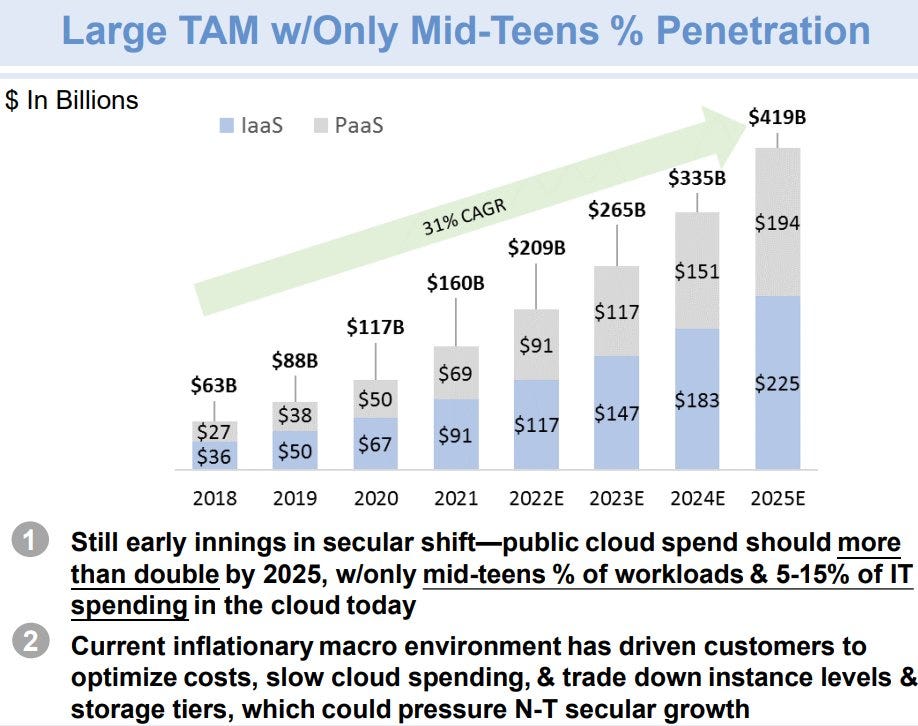

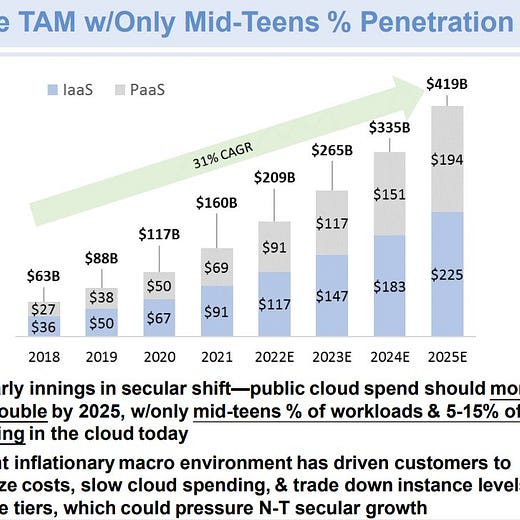

And this mega trend is still in early innings…from JPM report (🎩 MadsCapital)

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

👇🏼 🧵

Inside baseball from Hunter Walk (Homebrew) - Why VCs Explaining “It Was Only 4% Of Our Fund” Is Misleading - Minimization When a High Flying Startup Implodes As MultiBillion Dollar Private Companies Shrivel, What Their Investors Aren’t Saying About These Losses

Enterprise Tech

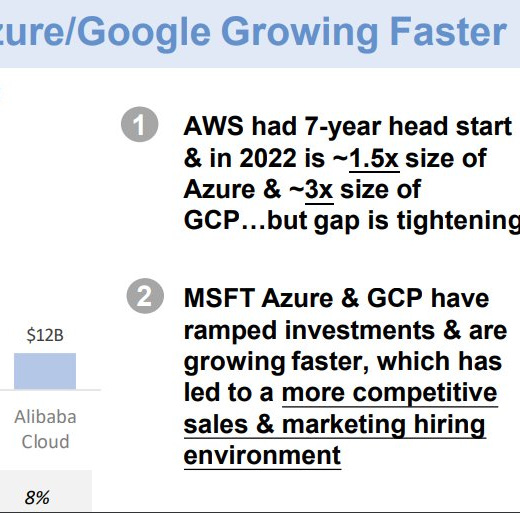

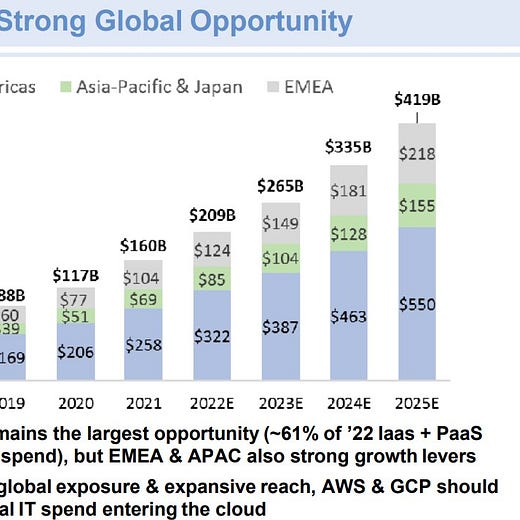

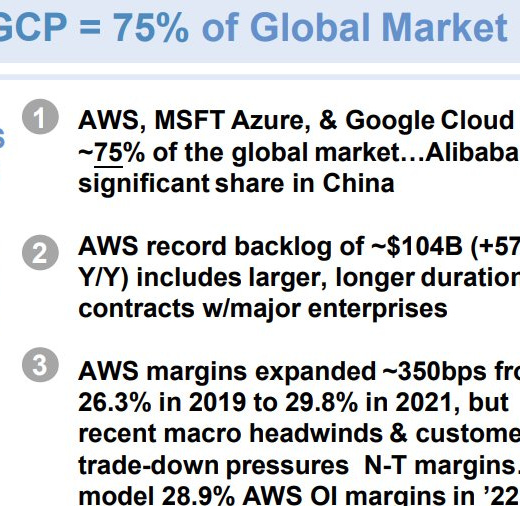

Public cloud update

end of an era but lots of great suggestions in comments

Another cool WASM startup which hit #1 on Hacker News this past week

from Snowflake and Crowdstrike earnings this past week, headwinds getting stronger with weakness in SMBs heading into Q4 - I am seeing the same across the portfolio

from Crowdstrike (CNBC)

“Increased macroeconomic headwinds elongated sales cycles with smaller customers and caused some larger customers to pursue multi-phase subscription start dates, which delays ARR recognition until future quarters,” Kurtz said.

from Snowflake earnings transcript

“I would say the only thing that's really changed this quarter, and it's a very small piece of our overall revenue is the SMB segment. You're really seeing a slowdown in consumption by those customers.

It's not going away, but it's just not growing like it was at the pace of growth. And same with APJ. But the U.S. verticals, large enterprises, doing extremely well.”

The future is here faster than we expected…Russia and Ukraine are fighting the first full-scale drone war (Washington Post)

Dystopian future?

Markets

Stay the course!

Private-Equity Titan David Rubenstein on Crypto’s Future, Inflation, and Deals (Barron’s)

Among the investors you interviewed for your book, what were some common traits that made them successful?

One of the good things they have that I don’t have is the ability to forget their losses. They make mistakes and get over it quickly. They also have an intense, incredible intellectual curiosity. They’re not just reading things that relate to areas of investing. They’re reading everything. You never know what information will be useful to you. And they tend to be doing this because they enjoy it. The people that I’ve interviewed all made a lot of money. They don’t need to be working for a living.