What's 🔥 in Enterprise IT/VC #301

On hiring pre-product market fit and focusing on the job to be done now

At the beginning of a startup’s life, the only thing that matters is shipping a product that a user(s) cannot live without. This also means only hiring talent that can help you ship the right product faster. Everything else is a distraction. When we fund technical founders, many in the CEO job for the first time, the biggest mistake that can be made is hiring super experienced candidates too early. Talia from Bessemer nailed it in this tweet.

During the last couple of years, the idea of hiring candidates suited for the next stage or two of a company’s growth happened way too often since many founders thought they were well ahead in their business because of all of the capital they raised. However, we have to remember the amount of capital you raise is divorced from your true stage of customer growth. The end result is the premature scaling of many companies and the need to dramatically cut burn and extend runway.

So how do you this as an early stage founder?

Only hire what you need to build the right product for right user - we will not fund a day one founder without knowing what that initial engineering + design team may look like, how long founders think it will take to get an initial version shipped, and knowing who the first 5+ critical hires will be

Only hire people who help realize the mission above and don’t hire too many people as that can also slow you down

Founders must own product, own initial customer conversations, design partners and conversion - you cannot outsource this! You know the user pain the most and if you can’t teach and sell, how is someone else going to?

Until you get to product market fit, backfill other areas of learning like closing first sales contract with advisors/existing investors but once again, with the founder driving these conversations.

Take a monthly check on how you spend your time in big buckets: product, hiring, fundraising, marketing, ops and if any bucket not related to product gets extremely out of balance, you may need to hire someone

Write a detailed job description and specs, focus on the job to be done and not title

Focus on talent who can roll up sleeves, who want to get work done and believe in the mission, versus hiring folks who want to hire others (managers)

Be careful of the big name, stretch candidate. More often than not, opt for the PhD (poor, hungry and determined) candidate who can do the job today and perhaps grow into the role. Give them a shot, but also be clear that there is a possibility you may hire above that person. The potential hire who is confident in his/her abilities will seek this challenge and opportunity versus look for guarantees.

Don’t hire VPs too early as VPs bring more people…leading to scaling too quickly

This is not a science but more of an art. Get to product market fit before hiring go-to-market folks too early. When it comes to GTM hiring for PLG/infra companies, our friend Martin Gontovnikas (aka Gonto), head of GTM at Auth0, strongly suggests bringing on DevRel as hire #1 to evangelize, write content, spread the word and over time pair with a growth marketer to help convert top of funnel into leads. More to come in future issues as Gonto just held a world class workshop for many of our boldstart founders.

🙏🏼 as always and please share with your friends and colleagues.

Scaling Startups

Great advice for founders - 2 caveats - find the believers and I don’t like using the word thesis, esp. for day 1 investing. I prefer “theme” or general bucket or direction like developer first as founders are the ones who help us see the future!

Sign of the times…

Spot on, no matter if a bottoms up PLG or top down product

Reminder about what’s important in life

Enterprise Tech

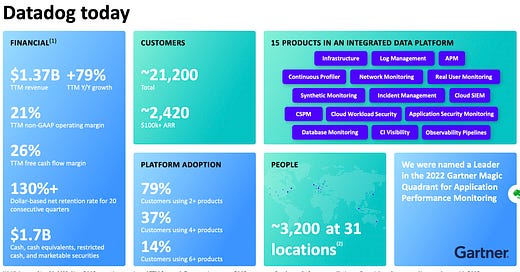

Datadog beat Q2 but upward guidance for remainder of year less bullish - some interesting commentary on spending from large customers and SMBs below…

In Q2, revenue was $406 million, an increase of 74% year over year and above the high end of our guidance range.

We had about 21,200 customers, up from about 16,400 in the year-ago quarter. We ended the quarter with about 2,420 customers with ARR of $100,000 or more, up from 1,570 in the year-ago quarter. These customers generated about 85% of our ARR. We generated free cash flow of $60 million and a free cash flow margin of 15%.

And our dollar-based net retention rate continues to be over 130% as customers increased their usage and adopted more products. Now moving on to this quarter's business drivers. In Q2, while we overall saw strong customer growth dynamics, we have seen some variability in growth among our customers. We saw our larger spending customers continue to grow but at a rate that was lower than historical levels.

This effect was more pronounced in certain industries, particularly in consumer discretionary, which includes e-commerce and food and delivery customers and affected more specifically on products with a strong volume-based component such as log management and APM suite. Note that we did not see this with our SMB and lower spending customers who continued growing with us as they have in the past. While these node growth data points and the current micro climate are leading us to be prudent with our short-term outlook, we remain very bullish about our opportunity and confident in our execution as we continue to see positive trends underpinning our business. First, the number of hosts and containers being monitored by our customers is growing steadily, which points to continued momentum of cloud migration and digital transformation projects.

But..😲 (slide deck here)

Databricks >$1B ARR run rate 🤯 - from WSJ VC

Databricks Inc. says it has topped $1 billion in annualized revenue, a milestone that comes as the nine-year-old data analytics company looks to acquire other tech startups to drive growth.

Co-founder and Chief Executive Ali Ghodsi said he has no immediate plans for a public market debut or to raise another round of investor funding, adding that the San Francisco-based company has enough cash to see it through a prolonged recession.

Databricks, which has a private-market value of $38 billion

Browser isolation security battle in full swing as Talon Cybersecurity just raised a whopping $100M Series A led by Evolution Equity with Crowdstrike participating - the other main competitor is Island which recently raised a $115M Series B at a $1.3B valuation with Insight, Sequoia and Stripes as the main backers

Cloud security space is on 🔥 and rumors of Crowdstrike to buy a cloud security co for $2B - many think it is Orca which competes with others like Wiz, Palo Alto, Laceworks and others

CrowdStrike (Nasdaq: CRWD), one of the biggest cybersecurity companies in the US, is setting up a large Israeli R&D center based on a huge acquisition. The name of the Israeli company is set to be announced. Sources close to the matter have told "Globes" that CrowdStrike has been in talks to buy one or more Israeli companies. Several sources, who preferred not to be named, told "Globes" that CrowdStrike's acquisitions in Israel could be for as much as $2 billion.

💪🏼 huge for Coinbase and crypto as institutional adoption continues to grow despite the market meltdown

There are many ways to develop software and google docs is still a core part of workflow 🤔

Atlassian earnings strong as is guidance for remainder of year - super bullish on developer spending

Scott Farquhar and Mike Cannon-Brookes, Atlassian’s dual CEOs, gave upbeat commentary on the company’s prospects in the current economy in a letter to investors.

“We’ve observed over the years that developers tend to be the last roles companies scale back on,” they wrote. “We believe this will continue to prove true, especially for the overwhelming number of organizations undergoing digital transformation. Second, whilst our products punch above their weight in terms of value, Atlassian is a relatively small line item in overall IT budgets and likely not where customers look to reduce costs.”

Hashicorp State of Cloud is out - lots of data on multicloud, cloud security..

Pendulum always swings back - now trending for AI/ML models to be run on-prem for multiple reasons including cost to train a model, model latency esp. on edge, and security/privacy

“This happened after my time at Walmart. They went from having everything on-prem, to everything in the cloud when I was there. And now I think there's more of an equilibrium where they are now investing again in their hybrid infrastructure — on-prem infrastructure combined with the cloud,” Raghavendra told Protocol. “If you have the capability, it may make sense to stand up your own [co-location data center] and run those workloads in your own colo, because the costs of running it in the cloud does get quite expensive at certain scale.”

“It’s a cost that a lot of companies are now looking at saying, can I bring my training in-house so that I have more control on the cost of training, because if you let engineers train on a bank of GPUs in a public cloud service, it can get very expensive, very quickly.”

Another day, another massive bridge hack in crypto , $190M vaporized and stolen- sadly the vulnerability was called out in a security audit but explained away by Nomad

Super excited for VaultDao from Upstream (a boldstart portfolio co) -

will help you secure your NFTs easily especially if hardware + hot wallets aren't doing the job or too hard to use

I’m excited to share that @joinupstream is opening up early access to our newest product, Vault DAO 🔐 You can check it out here: upstreamapp.com/vault Quick thread on where we’re going with this.

I’m excited to share that @joinupstream is opening up early access to our newest product, Vault DAO 🔐 You can check it out here: upstreamapp.com/vault Quick thread on where we’re going with this.

Markets

After huge recovery in July, Top 10 multiples are creeping back over 20x NTM Rev

Other ways to build - Great to see companies who don’t need the cash do a tender offer for employees…at a $10B valuation 😲…in this market