What's 🔥 in Enterprise IT/VC #290

Story of survival + success from the Dotcom crash - how Greenplum sold to EMC + eventually IPOed as Pivotal

Looking at my Twitter feeds and texts this week, and VC after VC has offered their version of gloom and doom advice. So rather than rehash the basics which amounts to make cash runway last to infinity, let me share a story of resiliency, a pivot, and a success story from the Dotcom crash and some lessons learned. Here’s the 🧵 and hope this gives founders an opportunity to see that good things can happen if you survive through the worst of times.

Read the 🧵 for the rest!

And just finished reading Amp it Up by Frank Slootman and it’s super short and full of so much advice. If you finish my thread above, you’ll see one of the biggest reasons companies run out of cash is premature scaling before PMF. This is a good sign you have PMF 👇🏼

Reminder to be honest about when to scale your sales - when folks are pulling back could be a good time to get market share but also could be deadly

In other news, join Shai Goldman from Brex and I to discuss the State of the Markets next Tuesday at 12pm ET - it will be a Q&A so come with questions and register here.

Also, my firm, boldstart ventures will be hosting Kelsey Hightower, developer advocate guru for a Q&A on June 2 at 12PM ET. Register here

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Yes, there are lots of dollars floating around that is unfunded but folks don’t realize most of that is spent or reserved and this is something to pay attention to a couple quarters out

keep building - more and more large cos will be slowing down and focusing on only what can deliver near term results

Cohosted a dinner at Permissionless crypto conference with Blockdaemon & Sapphire Ventures - mood was more sombre than FTX but folks still investing, still building and not deterred

Enterprise Tech

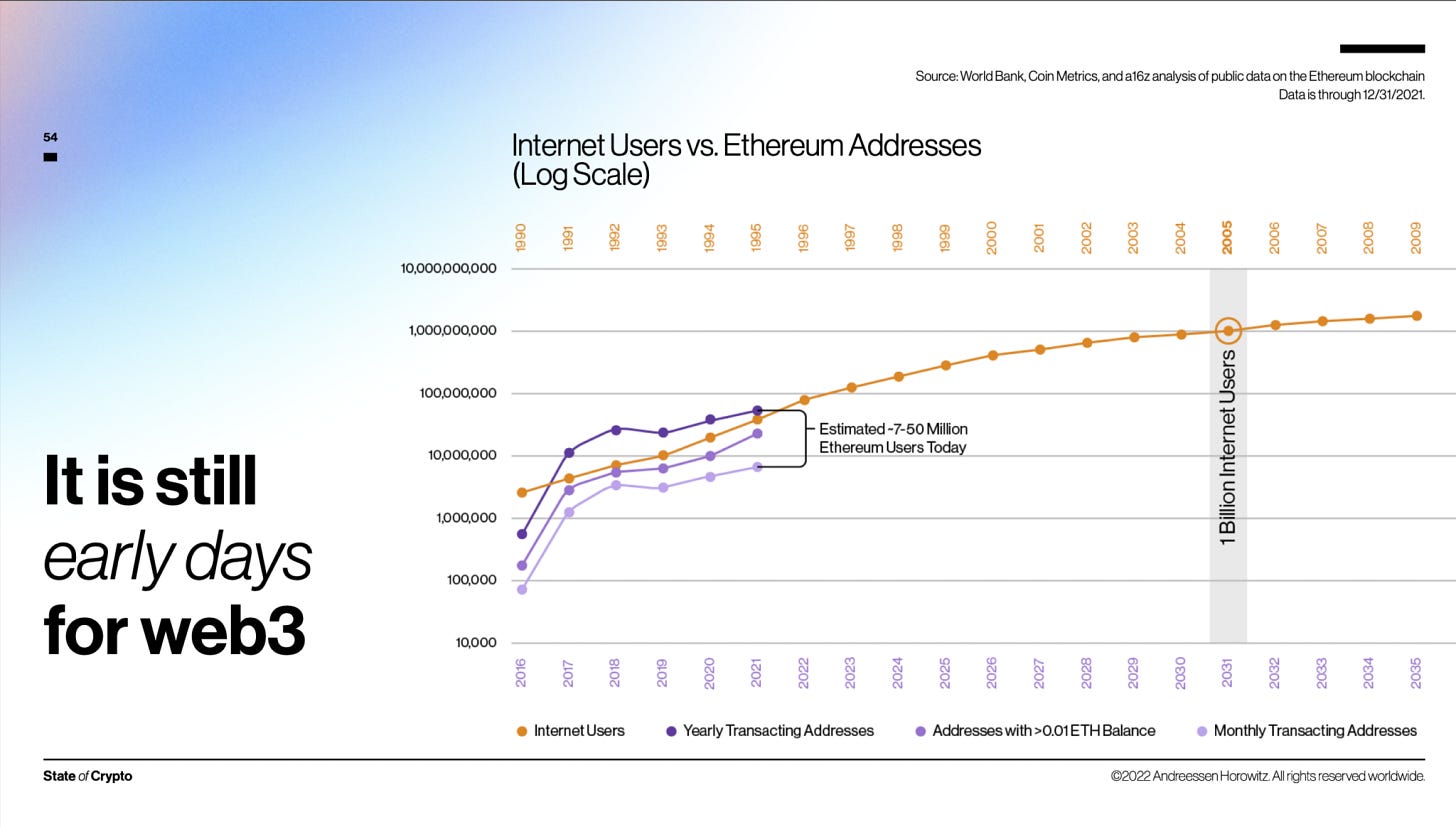

State of Crypto from a16z - must read REPORT

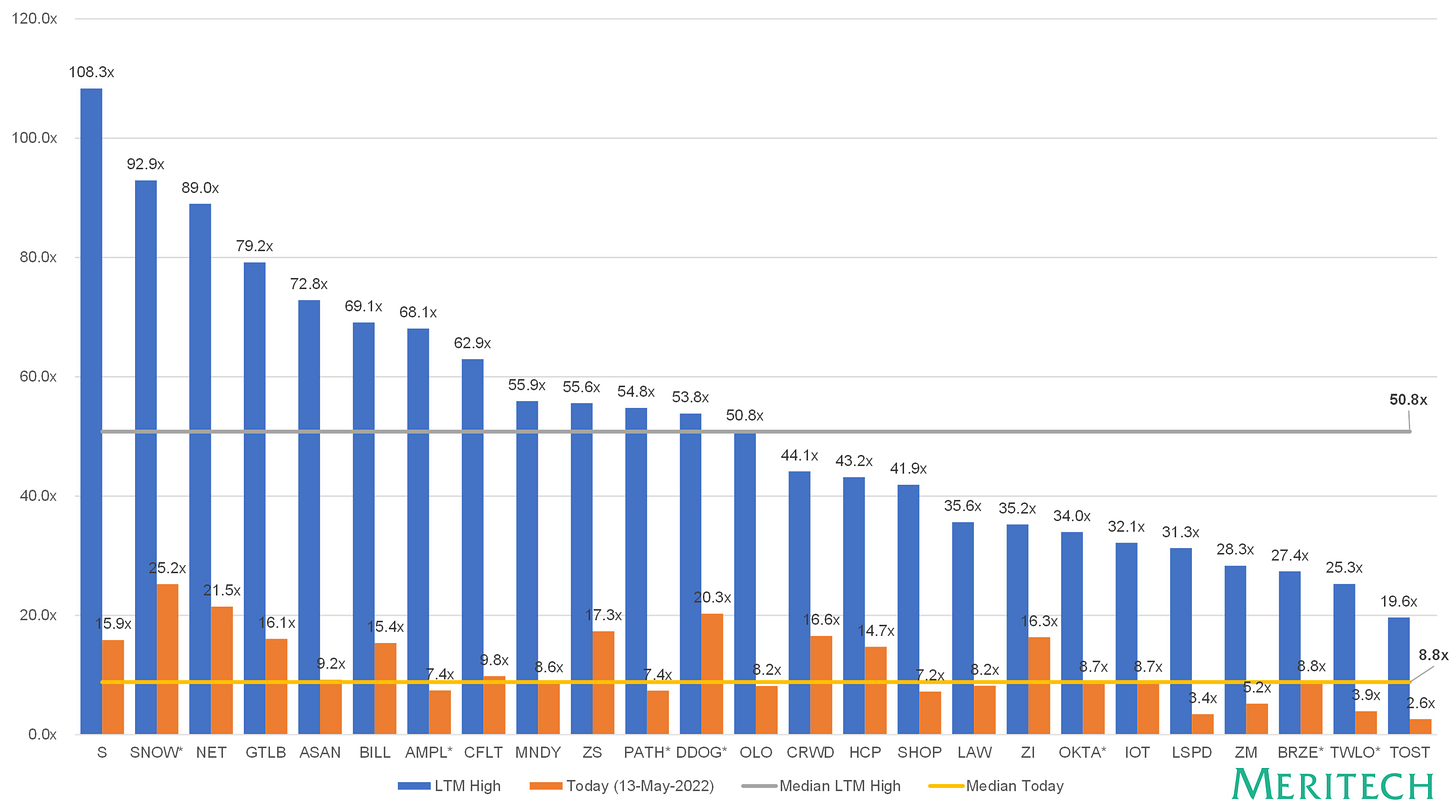

Where are we in terms of multiples, market - great read from Meritech Capital

One of most telling charts - Snowflake NTM multiple went from 92.9X to 25.2X which is still super healthy

🧵 on AirBnB evolving architecture…

👇🏼 pretty awesome attach rates

More web2 coming for crypto infra…

We are going to support the development and deployment of Ethereum by running Proof of Stake validator nodes on our network. For the Ethereum ecosystem, running validator nodes on our network allows us to offer even more geographic decentralization in places like EMEA, LATAM, and APJC while also adding infrastructure decentralization to the network.

On e-commerce spend, huge COVID spike but growth leveling off - what does that mean for infra cos selling into these markets?

Great comments on developer experience and what it means along with folks chiming in on what a great one is

CNBC Disruptor 50 List - Flexport #1 followed by Brex and Blockchain.com appears at #7

🤣