What's 🔥 in Enterprise IT/VC #288

Stay calm and carry on, growth at all costs is over, the prudent ones can keep building 🏗️

VC tweet after tweet this week is about the world ending now. My only advice is to stay calm. Focus on what you can control and not on what you can’t.

I’ve lived through some 🎥 like this before, and trust me, every movie is different.

While this correction sucks and is painful, I also do hope some of the insanity out there will end - specifically the idea that growth at all costs is the only thing that matters. Call me old fashioned, but I’ve always tried to preach fundamentals, balanced growth, and here are a couple practical ways to think about it.

Seed startups - only spend on product/eng - do not prematurely scale until you have product market fit - no change should be necessary in an up or down market if that is how you’ve built your business. If you need more runway, get it fast via extension from existing investors.

Late stage growth startups - keep spending on growth if the sales efficiency and CAC is there. Yes, the overall multiples for your business have changed, but you can’t control it. If you are hell bent on spending more and more💰, take a look at a simple ratio - $ spent for each new $ of ARR and make sure that improves YoY. If you’ve been sensible all along, then you shouldn’t have to tweak too much as you’ve already laid out your 3 plans, upside, base, and lower plans. Pulling in profitability in this market for the late stage companies will be more rewarded in the future.

Tweeners - folks who raised massive preemptive A or B rounds, be honest with yourself and ask if you have true PMF. I can’t tell you how many times I’ve seen founders raise boatloads of 💰 and with the high expectations prematurely scale their sales teams when they still don’t know who the target user or buyer is from the right target company. Insane - YES! But it happens more often than not. For these cos, this is where the truth hurts - hunker down, cut burn quickly and buy more time.

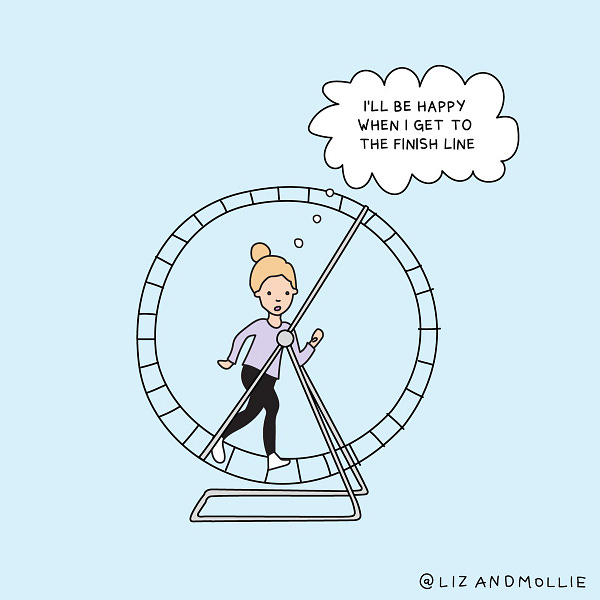

If you have been thinking like this all along, particularly for companies in buckets 1 and 2, you should be quite calm and ready to keep hiring talent as the companies who didn’t build prudently are going to feel some major pain. Remember, the highs should never be too high as you should be thinking on how things can turn badly in an instant. The lows should never be too low because frankly startups are F$%!ING HARD, especially for new categories so folks need to keep the faith. Your investors should also know when to cheer (when things are shitty), to challenge (when things are going 🚀), and to chill (sometimes founders need to figure things out on their own).

Once you get through this, remember to keep a balance approach at all times and you’ll be ready for what’s next. IMO, this too shall pass but may take a few quarters.

IT Spending continues to 📈, move to ☁️ has more room to grow, and we are so early in crypto with 🌊 of 💰 waiting to pour in and burning needs for better security, infrastructure, and tooling to support. Founders keep building 🏗️ but prudently.

As always, 🙏🏼 for reading and please share with your friends and colleagues. Also, Happy Mother’s Day to all the wonderful mothers in our lives!

Scaling Startups

Masterful and well said 🧵

Sadly layoffs but for those who have built prudently, it’s time to keep hiring

While not enterprise, such a great comeback story 🧵 and some great lessons like simplify your business

Enjoy the journey

Enterprise Tech

OSS and new category for developer first infra access for the win - Teleport raised $110M Series C at $1.1B 🦄 valuation led by Bessemer. Notice in blog post that Teleport started with a GitHub project in 2016! Long arc of success and quite similar to port co Smallstep which also has been around 6 years and just announced its $26M raise last week…infra, esp. new categories takes time

Today, there is no doubt in my mind that an Infrastructure Access platform is absolutely a new market category. Soon, every organization that builds cloud software will have to have one. Our own customers, including the most advanced tech companies born and raised in Silicon Valley, agree with this. Secure, consolidated access is critical, but it also needs to be easy to use. That's exactly what Doordash loves about Teleport.

Speed is key to our business. But so is security. The Teleport Access Plane allows our engineers to securely access the infrastructure they need to do their jobs without getting in the way of productivity. Everybody wins.

~ Luke Christopherson, Software Engineer Doordash

This round signifies the importance of this market trend, and elevates the awareness and urgency of moving away from perimeter-based security and static secret-based credentials. The growing frequency of data breaches suggests that the time is right.

Another OSS and security 🦄! CRV and Insight led…

Reminder for open source/PLG founders

TradFi to DeFi - 🌊 of 💰 waiting to pour into crypto - proud day 1 investor

💪🏼 huge congrats @shawn_douglass @Gongt2 @Amberdataio 🔑 Building block + leading crypto data platform for granular + historical RT fundamental on-chain, DeFi + market data investors like @Nasdaq @coinbase @Nexo @Citi + other TradFi Proud day 1 investor @BoldstartvcAmberdata raises $30M to chase the “unlimited opportunity” of bringing traditional finance into web3 https://t.co/VuaC9Ovgdp by @jacqmelinek

💪🏼 huge congrats @shawn_douglass @Gongt2 @Amberdataio 🔑 Building block + leading crypto data platform for granular + historical RT fundamental on-chain, DeFi + market data investors like @Nasdaq @coinbase @Nexo @Citi + other TradFi Proud day 1 investor @BoldstartvcAmberdata raises $30M to chase the “unlimited opportunity” of bringing traditional finance into web3 https://t.co/VuaC9Ovgdp by @jacqmelinek TechCrunch @TechCrunch

TechCrunch @TechCrunchAmberdata is the only digital asset data provider offering granular historical and real-time fundamental (on-chain), DeFi and market data, eliminating the need to source and integrate data from multiple vendors. Leading financial institutions choose Amberdata as their trusted digital asset data partner to eliminate the infrastructure setup, integration challenges and maintenance headaches to access digital asset data, reducing cost and time to market for entering the asset class.

“Nasdaq is pleased to support Amberdata as they deliver comprehensive, high-quality digital asset market data and blockchain analytics to the investment community,” said Benjamin Blueweiss of Nasdaq Ventures. “With digital assets and decentralized financial services gaining adoption, we are excited about future opportunities to partner with Amberdata to bring unique insights to a broader set of stakeholders.” (more here)

👇🏼 state of software today…comments quite interesting

Dropbox PLG model…

Stack ranking web3 ecosystems

Great 🧵 on security issues in crypto

power of DAOs

Markets

Where we are on multiples

So true!