What's 🔥 in Enterprise IT/VC #280

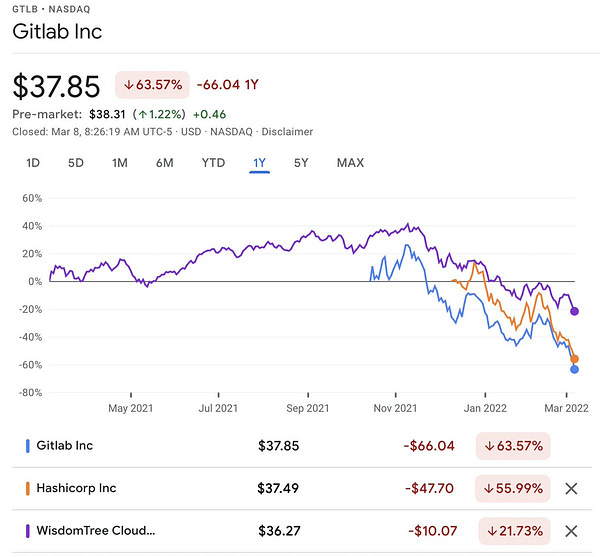

Dev first stocks 📉 but still bullish in LT - MongoDB - from $100M ARR to $1B ARR in 5 years 🤯

🙏🏼 for 🇺🇦 - this week’s focused giving is on Alex Iskold from 2048 Ventures 1k Project to send $1k to directly support a family that has been impacted by the war in Ukraine. If interested, you can donate here.

So this past week I tweeted this out.

Alex Wilhem from TechCrunch expanded on this tweet here:

Jason Lemkin from SaaStr has a great post adding to the 🧵 - “Your VCs Are Worried About Public Multiples. Do You Need To Worry, Too?”

Now that I have your attention, read more in the 🧵 as it’s not the end of the world but more of an expectations resetting on valuations.

Most founders will still believe they are in the 1% where this does not apply to them and who can fault them for it. However, my strong belief is that while this correction is overdone and things will improve once we get through this war, I highly doubt that we will be back to the world of 100x NTM ARR but perhaps we will find a happy medium between 20x and 100x.

The good news is that all all is not lost for developer first and infrastructure companies as a number continue to grow and beat their quarterly revenue targets. Case in point is MongoDB which is continuing to show the power of consumption based pricing as it beat its earnings and jumped over 20% after announcement.

😲 Here are a few quotes from the most recent earnings transcript:

We had another strong quarter of customer growth, ending the quarter with over 33,000 customers. The fourth quarter marked another major milestone as we crossed $1 billion in annualized revenue run rate. Crossing over the $1 billion mark five years after reaching the annualized $100 million mark is clear evidence of the value MongoDB's application data platform offers customers, large and small, all over the world. Our excellent fourth quarter performance was broad-based.

More on the bull case for enterprise 💰 spending:

Businesses across all industries will continue to invest heavily in software as a means to differentiate themselves to seize new opportunities and to respond to new threats. While this has been happening aggressively over the past decade, we are still only in the early stage of this movement. As infrastructure becomes more advanced, with chips getting more powerful, algorithms getting smarter and networks getting faster, the capability for innovation only increases. Powerful software powered by real-time data will empower experiences and business models we cannot even conceive us today.

And MongoDB continuing to refine its GTM motion as it aims to grow from $1B ARR run rate to $2B and more…

Sure. So we've constantly always tried to stay ahead of where the business is in terms of anticipating changes to our go-to-market model. I mean, as you can imagine, in the early days, we had one model, which is a direct sales force really trying to sell to everyone. Then we introduced an inside sales team.

Then we introduced self-serve. Then we've introduced the notion of having focused teams on high-end accounts. We introduced the notion of removing friction from the initial selling process to get customers on our platform more quickly. So we're always refining our go-to-market motion in anticipation of, one, how big this market is, and we try to meet customers where they are versus trying to force them to try to engage with us in one way.

I am as bullish as ever and as I’ve always said, what better time to start a company than now. Super early stage funding has been minimally affected, and if you are in build mode the next 12-18 months, by the time you are out with product, I do believe the world will be much improved.

We @boldstartvc continue to invest at company formation having added 3 new founding teams in the last two weeks to the family and are doubling down as they grow - more below on Upstream (DAO in a box) and more…

Let’s keep 🏗️ and onwards and upwards!

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

As I always say, it’s not the TAM you start with but the TAM you exit with. Best founding teams have an ability to zoom in microscopically to the end user and day in their lives and also zoom out to tell a bigger story of where it can go. But can’t fund a day one startup without the deep and focused product sensibility.

Free trials vs. freemium 🧵

💯 - also why best board members ask questions of founders and let them experiment and learn vs. telling what to do, best founders take that lead with the 10% you give them and learn the other 90% and do it quickly

For the GPs out there - great 🧵 on fundraising for VCs

Denominator effect will be in play but, most of all, LPs get risk-averse really quickly (especially their ICs). I sit in on a few and the discussion is all defense, no offense these last few weeks. You can guess that I’m pushing them to keep investing through the cycle.VC friend last night estimated U.S. endowments & foundations exposed to VC have likely lost “multiple hundred of billions” in private book value so far in 2022, but it will take many months for the marks to hit. They suggested this will greatly impact those raising new funds.

Denominator effect will be in play but, most of all, LPs get risk-averse really quickly (especially their ICs). I sit in on a few and the discussion is all defense, no offense these last few weeks. You can guess that I’m pushing them to keep investing through the cycle.VC friend last night estimated U.S. endowments & foundations exposed to VC have likely lost “multiple hundred of billions” in private book value so far in 2022, but it will take many months for the marks to hit. They suggested this will greatly impact those raising new funds. Semil @semil

Semil @semil

Enterprise Tech

Ready to start your own DAO with a few clicks? 🔥 up about doubling down in existing portfolio co Upstream

Enterprise Tech 30 from Wing Venture is back with a great list and lots of open source, dev first and PLG cos represented including Snyk (a portfolio co). Excited to participate again this year with a great group.

AI Tools Stack from Casber Wang and Aditya Reddy at Sapphire Ventures with port co

“While modularity would inherently bring in more complexity, I’m very excited to see 1) products designed with abstraction + integration in mind that meet end users where they're at from an AI workflow maturity standpoint & 2) modularity bringing flexibility to help customers tweak every last component of their model and model-building workflow to produce the most optimal analyses and systems for their specific needs.”

Stripe enabling crypto for every merchant…game changing

Some 💎💎💎…

Google buys Mandiant for $5.4B - could kick off cybersecurity M&A wave from other big cloud vendors

Wedbush analyst Dan Ives said in a note to investors Tuesday, “With cyber attacks increasing by the day and cyber warfare underway from Russia/state sponsored cyber terrorism organizations, Google is doubling down on its cyber security footprint at the right time with Mandiant and looking to differentiate itself from the likes of behemoths Microsoft and Amazon in the cloud arms race.”

Ives said his firm expects the deal to have a “major ripple impact” across the cybersecurity space.

“Cloud stalwarts Amazon and Microsoft will now be pressured into M&A and further bulk up its cloud platforms,” he said.

“We believe cyber names such as Varonis, Tenable, CyberArk, Qualys, Rapid7, SailPoint, and Ping standout as potential M&A candidates in cyber security (among a handful of private players) given these vendors laser focus on protecting next generation cloud workloads from cyber attacks.”

Acquisition #6 by Snyk is…TopCoat Data, a portfolio co, to uplevel customer facing reporting and analytics. Thrilled for all involved and more on the journey 👇🏼

Acquisition #3 by Blockdaemon - as companies continue to scale, exercising a M&A 💪🏼 becomes a critical component to scaling and expanding TAM

My colleague Shomik does a technical deep dive on “What's Under the Hood of SaaS Companies (Hint: Why Multitenancy Matters)” - The hidden underpinnings of what makes SaaS scale so nicely

Markets

How to 🤔 about multiples 🧵

🤕