What's 🔥 in Enterprise IT/VC #278

🙏🏼 🇺🇦...🤔 on your first sales hire...continued

Top of mind for me this week is 🇺🇦 with whom I stand in solidarity.

As I checked in with many founders, we, like many investors, had some companies with teams or individuals in Ukraine. I’m pleased to know that everyone of these companies offered relo packages well in advance to help move individuals and families before the conflict started. Unfortunately, it’s not that easy to move families and many did not take up offers to leave…until the war started and to which point it was difficult to get many out, particularly the men. Let’s 🙏🏼 for a swift ending to this war.

Repeated Question - when to hire a VP Sales, esp. for a developer first startup getting lots of downloads and closing its first handful of enterprise customers

from Founder:

FYI, we’ve been talking to lots of sales and product folks and triangulating on a hiring (and overall) strategy. Everyone we’ve talked to so far has said to *not* hire the super senior VP-level product (or sales) person first, and to instead find someone younger and smart and hungry that currently has a director title, drop them into an IC role to start, hit the ground running & have them help build a little team. Details vary, but that’s the gist.

My response:

XXX that is always the question and my advice is to hire a "head of" who can be an IC but also build and manage the first 3-4 reps…knowing that they may be scaled over

then every once in a blue moon, you get someone like “SPECIAL PERSON”. She was not junior but a VP Sales, worked her way up with a bottoms up model (yours may be different - let's discuss) and scaled XYZ from $0-10m ARR…and loves rolling up sleeves and building out the intial motion and getting her hands dirty

She joined as VP Sales and has been layered above twice! but she is still a vp, vp of growth now and owns some solid equity so is happy

XYZ Search found that special person for us - XYZ who specializes in dev tools GTM - you should chat to him because if you can find that special person who can roll up sleeves but scale to $10m, then WOW

In short, I agree 💯 with not hiring folks who are too senior but depending on your and your investor networks, you may be able to tap into a handful of folks who love getting their hands dirty at earliest stages and can scale more than just 12 mos. That is far and few between, like finding your next 🐲 but if you can, then it is well worth it. 95% of the time, I’d go with a couple reps to start or a head of, up and comer, who loves to close deals and will work fine solo but can bring in the first couple reps.

As always, 🙏🏼 for reading and please share with friends and colleagues.

Scaling Startups

💯

On 🛹 development

From @jamesclear

Writer Ralph Waldo Emerson on making each day a masterpiece:

"Finish every day and be done with it. For manners and for wise living it is a vice to remember. You have done what you could; some blunders and absurdities no doubt crept in; forget them as soon as you can. Tomorrow is a new day; you shall begin it well and serenely, and with too high a spirit to be cumbered with your old nonsense. This day for all that is good and fair. It is too dear, with its hopes and invitations, to waste a moment on the rotten yesterdays."

Source: Letter to his daughter Ellen, reprinted in The Letters of Ralph Waldo Emerson

Great 🧵 to understand speed of deployment of funds, time diversity of funds…

Insight Partners on doing more Series A rounds even with a new $20B fund (TechCrunch) - and yes, this is the mega trend we have been experiencing the last 6 mos as many of the so called growth funds deploy more and more capital on “vision” bets…

Does it make sense to you when a company’s valuation doubles or even triples within months as it raises these often preemptive rounds soon after announcing a round? Has something fundamentally changed?

The reality is that oftentimes, it hasn’t, and it’s one of the reasons why we’ve gotten probably more comfortable taking Series A bets. The valuation spread between Series A and Series B rounds can be 3x or 4x or 5x, but the amount of incremental data really isn’t, so you’re still taking a fundamental market bet.

Is it market that you like? Is it a big addressable market? Is it a great management team? If those things are true, maybe you should be prepared to take that bet at a slightly earlier point in time.

Enterprise Tech

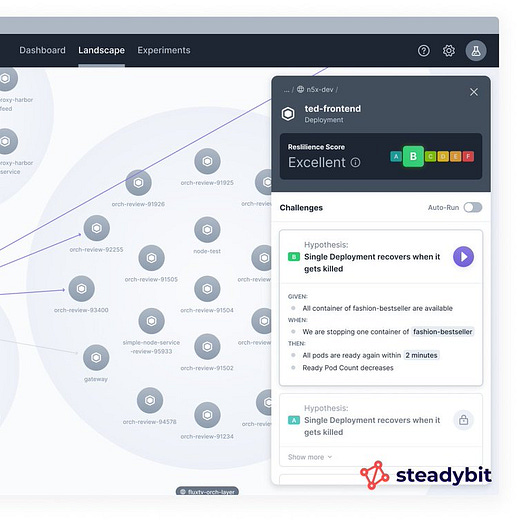

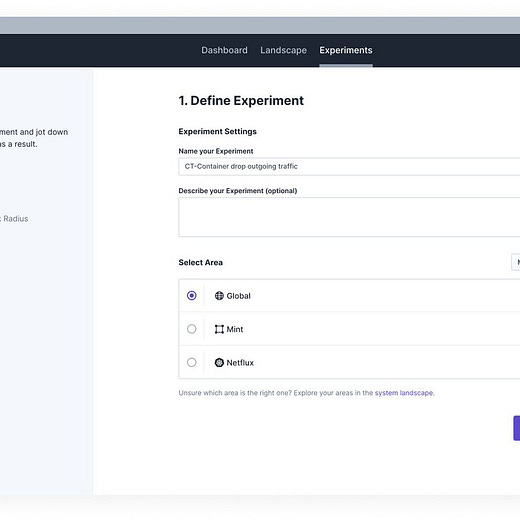

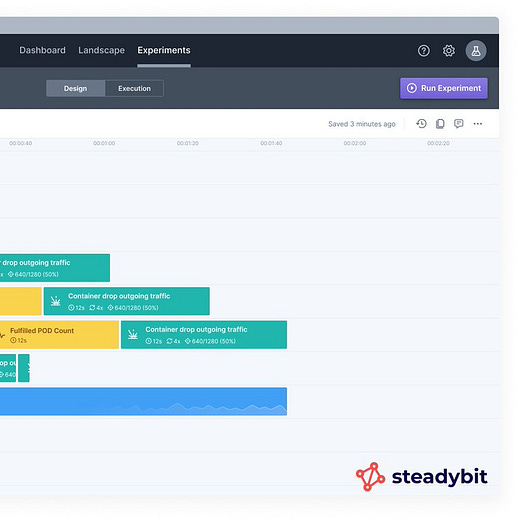

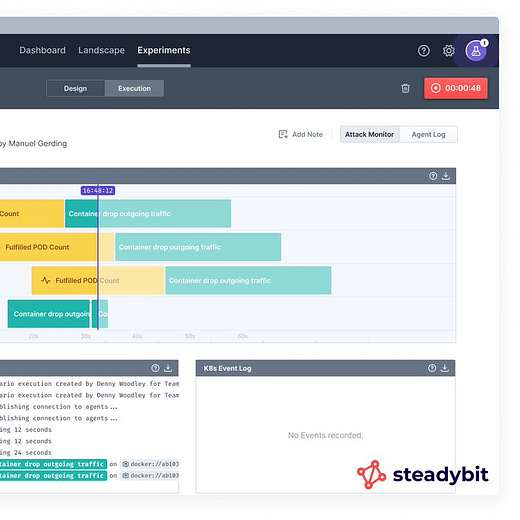

Shift ⬅️ security and resilience/chaos engineering - excited about two new products in beta from the @boldstart portfolio - TRY NOW

First up is Steadybit - chaos/resilience engineering shift ⬅️Next is Jit Security MVS (Minimum Viable Security) launches

OSS for the win! Congrats to my friends Ajay and Mike at TimescaleDB on their $110 million Series C at a $1+ billion valuation which was led by Tiger Global - see the numbers below - incredible growth built on top of PostgreSQL

and another OSS data infra company dbt labs raises $222M at a $4.2B valuation

Shomik waxing poetic on “attach rates” - what they are and why so important and how it ties to my mantra of “It’s not the TAM you start with, but the TAM you exit with”

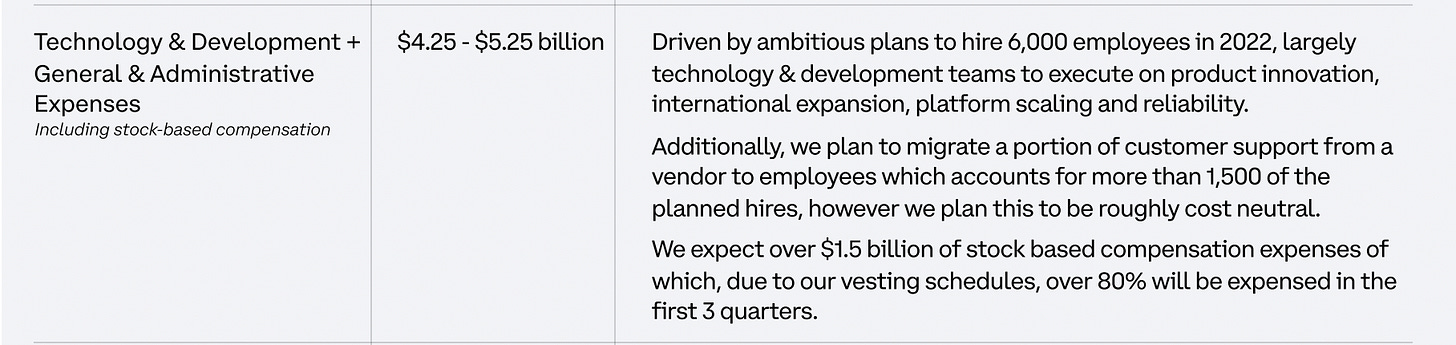

Lots of room to invest in crypto infrastructure and scaling - just take a look at what Coinbase is expecting to do in 2022 (as per Coinbase Annual Letter which is a great primer on what’s ahead for crypto markets in 2022)

In addition, Coinbase taking a page out of the developer playbook - win the ❤️ and 🧠 of developers, to win the enterprise…this will be an interesting 2022 for sure!

Web3 GTM as per a16z - 🤔 sounds like open source community metrics 😄

“The more critical metrics to track, therefore, are areas such as number of unique token holders; community engagement frequency and sentiment; and developer activity. Additionally, since protocols are composable — able to be programmed to interact with and build on each other — another key metric here is integrations. Number of and type of integrations track how and where the protocol is used in other applications, such as wallets, exchanges, and products. “

Gross margins matter and how Peter Reinhardt from Segment attacked one of its biggest cost centers and increased gross margin by 20 points in 1 year - infra 🧵

for developer first/OSS founders, headline numbers of starts and aggregates are now what is going to make or break your project, it’s understanding your users…🧵 - thanks @josephjacks from OSS Capital

Absolutely terrible stuff on the cyber front with Russia…as you can imagine lots of companies here are scrambling to buy ever more security software…read 🧵

Markets

Multiples back to where they started pre-COVID 🤯

Warren Buffet’s Annual Shareholder letter just released today

The digestible Ukraine explainer you've been waiting for (Morning Brew)

And I hope this does not come to pass 🙏🏼

”UK Prime Minister Boris Johnson has said this would be the biggest war in Europe since WWII. But there have been other European conflicts since, so what makes this one so much more significant?Well for one thing, it’s the sheer size of the players. Yugoslavia’s horrific 1990s civil war—the worst European conflict since WWII—took place in a disintegrating country of 23.5 million people. Ukraine has more than 40 million people and, mind you, one of the combatants is a nuclear power.

Second, a central idea of post-war Europe is that you don’t redraw European boundaries by force, because that always ends very badly. And yet here is Russia, a major world power, doing just that. So Russia’s challenge isn’t only to a specific country (Ukraine) but to a whole order.

Third, there’s obviously a huge economic dimension here. We’re talking about a war involving a country—Russia—that is Europe’s largest source of natural gas and is a major global oil exporter. No European war has involved anything close to this level of economic and financial risk to Europe since 1945.”