What's 🔥 in Enterprise IT/VC #276

Startups like a fine 🍷, the longer arc of success 💪🏼 for some founders

While all of us love to hear about the 🚀 startups who scale from zero to $50M ARR in record time and build in public, the reality is that it is much different for many other founders and investors. I was reminded of that this week when 2 portfolio companies that we funded on day 1 in 2017 finally emerged from stealth.

First, Clay officially launched and ended up #1 on Product Hunt this past week. I’m super 🔥 up for co-founders Kareem Amin and Nicolae Rusan and the entire team.

Paul Graham likes to say that product velocity is one of the strongest signs of success and my 1b is hiring velocity is closely correlated because you can’t have 1 without a few more killer engineers. While Clay had all of that out of the gate, what they recognized is the product they were building was much more complex than initially anticipated. In addition with a horizontal product like Clay (feels like an Airtable meet Zapier meets Clearbit) in a rapidly maturing market around low code no code, the team felt it was important to nail some initial use cases to truly differentiate themselves from those around them. While many startups like to build in public, Clay took a different route, building and iterating with a targeted community of users, running a series of tests, before nailing their positioning, “spreadsheets that fill themselves.” Huge congrats as the Clay team has a number of happy paying customers and clearly tapped into a huge market need!

Company #2 is Wallaroo which we also funded at company formation. Wallaroo just announced its $25M Series A led by M12 (Microsoft’s VC arm) and existing investors. While founder Vid Jain saw the future, the markets weren’t exactly ready for him. Wallaroo is the easy button to deploy AI models w/ breakthrough performance, ease + scalability. Here’s more from Venturebeat.

And according to Vid in the Wallaroo blog:

I started Wallaroo in 2017 with the mission to build from the ground up a new way to deploy computational algorithms with breakthrough performance, ease, and scalability. I wanted to build for the future—far beyond what existing tools are capable of: to handle any number of models, the complexity of models, and amount of data, and to support computing in any cloud, on-premises, or at the edge—and without having to rip out customer’s existing tools in the process or drown in costs.

In 2018 we closed a $5 million seed round (pre-seed in 2017) and today Wallaroo is helping enterprises across many verticals, from real estate to manufacturing to the U.S. military, with our powerful self-service toolkit, blazingly fast distributed computing engine, advanced observability, and actionable insights to help drive results. They are now able to use machine learning to turn their data into value—and doing so more easily, faster, and at lower cost than ever before. (You can read more about Wallaroo here.)

We got here with just me working my network for customer engagements and no marketing. And what’s more, we found that data scientists and ML engineers truly love the experience of using Wallaroo, while CIOs/CFOs love the productivity and low-cost operation it brings. That sends a big signal that not only is there a large market for our product but that once ML teams are able to actually try it they really get our core value.

Similarly to Clay, Vid had a strong engineering culture and team out of the gate with incredible product velocity. Unlike Clay which is a PLG company, Wallaroo had to brute force its way into a number of Fortune 500 customers, those who had enough models in production and had the scale pain that Vid sought to solve. It reminds me of the old adage that pioneers get arrows in their backs and it’s so hard to create new categories and time early markets. Part of is just surviving and continuing to build and that is what Vid and team did.

Just because you don’t find success immediately, it doesn’t mean you won’t build a massive and successful company. While Clay and Wallaroo are still both early in their respective journeys, their quietness and “behind the scenes” approach doesn’t mean they were dead, but intensely focused on finding that right positioning and messaging.

Finally, every startup journey is different and there are lots of ways to reach the promised land so founders keep building and iterating and remember sometimes it can take longer than you want.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

👇🏼 Founders get these now! Alex Miller’s Sample Seed Handbook…

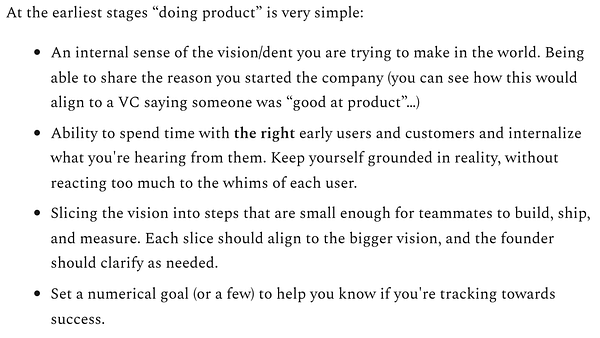

What does it mean for a founder to do product? Read and subscribe to my colleague Ellen Chisa’s substack as she shares her thinking from PM to cofounder/CEO of a dev tools co to VC

On hiring…

1000%

On people…

Enterprise Tech

Wow, Docker on a nice growth trajectory and $50M ARR run rate by focusing on devs and its enterprise spinout Mirantis on a $100M run rate

Let’s go 📈 - H1’22 spending indications positive and Security spending continues to be at the top of the list for the Goldman Sachs IT Spending Survey

Data infra startups on 🔥 as Starburst raised $250M at a $3.35B valuation and Census raised a Series B at a $630M valuation with a reported $2M of ARR

Crypto infra for builders 🤯

Say what? Salesforce tells employees it’s working on NFT cloud service (CNBC)

Speaking of NFTs…and its not just JPEGs

Is Chaos Engineering for real? Gremlin hits the $10M ARR mark with 100 customers

Gil Dibner from Angular Ventures shares his “Enterprise & Deep Tech VC in Europe & Israel 2021” deck - great data driven summary of trends, startups, fundings…

🤣

Markets

Twilio 😲

Cisco made a $20B bid for Splunk according to WSJ