What's 🔥 in Enterprise IT/VC #260

🙏🏼 5 years of What's 🔥!!! IT Spending 💰 forecasted to grow 📈 at fastest rate in over 10 years!

As I’m writing this from 30k feet enroute to Miami for some meetings with enterprise founders, yes, enterprise founders, I wanted to take this time to 🙏🏼 all of you for reading, listening, and sharing your thoughts with me on the What’s 🔥 journey. Today marks a huge milestone as issue #260 represents 5 years of weekly rants and emails! On the one hand 5 years seems like quite a long time, and on the other hand, it feels like it has just flown by.

As I reflect on the last 5 years, what stands out the most to me is that we’ve moved from a world where developer tooling and infrastructure software was a backwater, unsexy area to invest to one that is driving massive value where terms like DevOps are regularly tossed around on CNBC. Just 5-6 years ago, New Relic was one of the gold standards of DevOps public companies with a market cap north of $2B and now it’s only worth $5B as companies like Datadog at $40B+ and Gitlab at $15B plus have accelerated past New Relic as the new leaders. Given how much has changed since I hit send on the first What’s 🔥, I’m super excited about the what the next 5 years will look like!

While valuations are 📈 for all enterprise software companies, the good news is that the fundamentals underlying this are also 📈 as IT spending...cybersecurity, BI/Data, and cloud spend is forecasted to continue to rise in 2022 and beyond.

In fact, according to a Gartner report released this past week, IT budgets in 2022 are expected to rise at a faster rate than they have in more than 10 years! (WSJ)

Here are the actual Gartner numbers on spend.

As you can see, it’s all about enterprise software and in particular spending on infrastructure. (ZDNet)

Enterprise software saw the biggest increase in spending for 2022 compared to 2021, while device spending fell precipitously after a big 2021. According to Gartner, the 11.5% growth predicted for 2022 is driven by "infrastructure software spending spending continuing to outpace application software spending," according to Gartner.

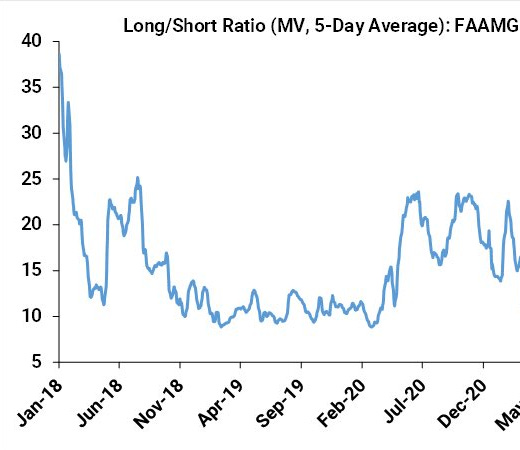

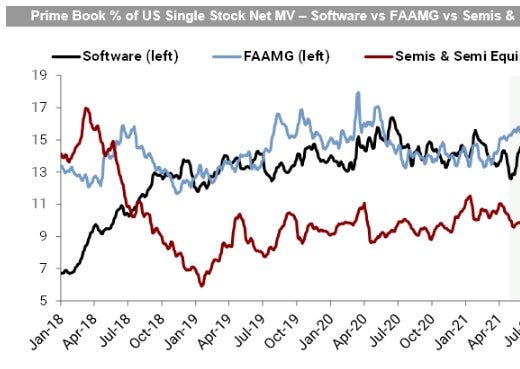

Here’s a look at the public markets as you can see 💰 shift into enterprise software the last 5 years and away from consumer FAAMG.

Let’s hope this spending binge continues so it can continue to support these valuations and sky high growth rates. As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

Must read from Michael Eisenberg (Aleph) - Michael and I go way back to 1999 when we were on a board together in Israel - solid advice for founders when choosing their partner. I fear that with the speed of dealmaking we are losing this…

Summary of Working Backwards (startup lessons from Amazon)

I highly recommend these annual get togethers for whole companies that are distributed and more frequent IRL for the teams. Yes this was discussed at the board level and many of our companies get way more value out of these bonding experiences than the actual $ cost. Full video here

Enterprise Tech

🔥 up for latest offering from Cape Privacy (a portfolio co) as it now helps companies run ML models on encrypted data without decrypting it in Snowflake!

Privacy market on 🔥 with TripleBlind raising $24M for privacy preserving data sharing and Skyflow raising $45M for data privacy API

Must read 🧵 on the supply chain backlog from the founder of Flexport

If you’re interested in what makes up the DAO stack (web 3), here it is

😲

OSS leading to web 3

In-depth look at how Google runs its Site Reliability Engineering (SRE) teams

“It was only logical that this year’s DevOps Enterprise Summit would want to invite Google SRE leadership to break down how it works at Google. After all, with more than 2 billion lines of code, Google’s production environment is one of the most complex integrated systems… ever. Its interconnectivity and uptime sets the standard for DORA metrics, but also create challenges at a planet scale. It literally wrote the books on site reliability engineering.”

This is so good 👇🏼