What's 🔥 in Enterprise IT/VC #252

❄️ and Salesforce earnings 😲 - eventually you have to grow into your valuations and performance matters

It seems that every week, What’s 🔥 is chock full of massive financing rounds for private enterprise companies. Behind all of these funding announcements, however, is the need for founders to keep delivering on growth. And while we all worry about the massive uptick of valuations and growth expectations, I do find comfort in looking at the bellwether public companies announcing their earnings and continuing to deliver on results.

This week is a reminder of why 💰 continues to pour into enterprise startups. When public companies like Salesforce and Snowflake continue to crush it in the public markets at their respective scales, it shows there is still tons of upside when it comes to IT spending from large enterprises.

First up is Salesforce - 😲 look at those numbers at their scale - absolutely incredible - the platform sales seems to be working as it continues to go after Microsoft.

Here’s a tweet from Brett Taylor, #2 to Marc Benioff at Salesforce.

The real power of Salesforce platform is bringing all of these capabilities together into a Customer 360, a single source of truth for your customers. Our industry strategy is enabling our customers to get started with an end-to-end Customer 360 faster than ever before, tailored to the specific needs of every industry. Our Industry Cloud saw 58% year-over-year growth in annual recurring revenue. We had especially strong performance in the public sector, in our Health Cloud business and financial services. In fact, 4 of our top 10 deals in the second quarter came from the public sector.

Taylor added that Slack can show similar bundling power. He said: "Slack comes up in every single one of my customer conversations."

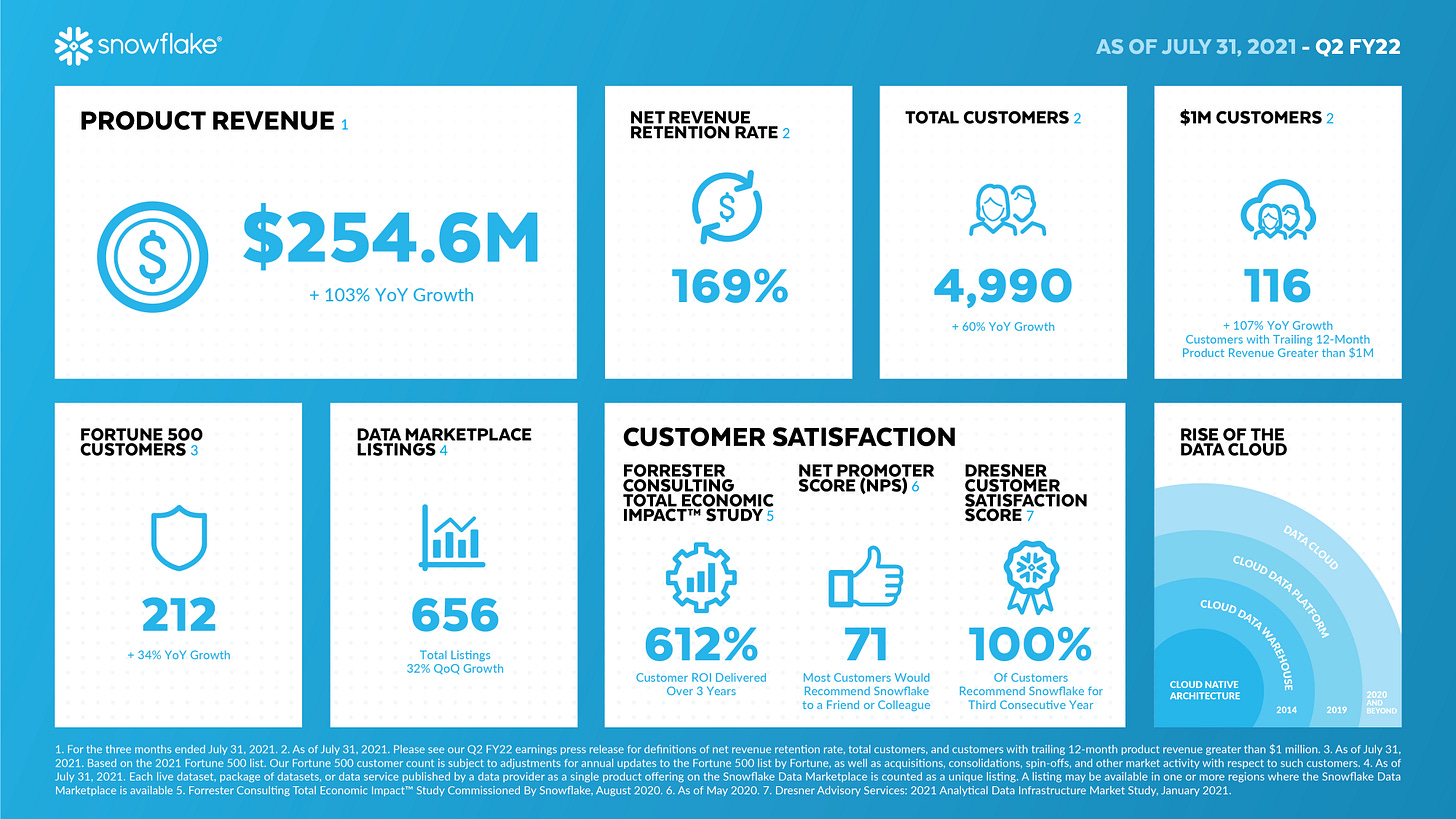

Next up is Snowflake - all I can say is 🤯! More here from their Q2 release:

And if you want to know the big idea for Snowflake, here is what’s in store for the future:

Strategically, Snowflake is emerging as a highly secure, compliant, global and efficient data network in the infrastructure across the major public cloud domains. The combination of world-class data workload execution with cloud application development, cross-cloud operations, data and data application marketplaces as well as planned monetization is what makes Snowflake stand out.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

🤣

As I’ve said before, one of hardest challenges for founders is the ability to zoom in myopically on the product and the end user and how to make their daily life 10x better with your product than without. However, we also can’t fund unless founders are able to zoom out to tell us what is possible!

Speaking of user focus 👇🏼 - must read 🧵

Importance of employee growth from Travis leading product security at Databricks 🧵

If it’s too good to be true, then…in a world of rapid fundraisings, this is super sad to see: Feds charge tech founder Manish Lachwani with fraud

Palo Alto-based HeadSpin raised over $100 million from such veteran firms as Tiger Global, Google Ventures, EQT Ventures and Battery Ventures.

💯👇🏼 Prep accordingly

Sign of the Apocalypse - Overemployed? 🎩 @LeUnicornHunter

Overemployed is a community of professionals looking to work two remote jobs, earn extra income, and achieve financial freedom. Be free from office politics and layoffs. Instead, negotiate a severance and invest in your life.

Great list of books for team leaders from Shreyas Doshi (Stripe) 🧵

Enterprise Tech

Enterprise on 🔥: seed valuations on the rise along with every other round - data from Pitchbook

🤯 Another huge win for OSS as Grafana Labs Raises $220M at a $3B valuation “to Accelerate Global Adoption and Development of Open Source Visualization and Observability Platform”

The “actually useful” free forever tier of Grafana Cloud provides the industry’s most generous no-cost observability stack, and with the funding round, Grafana Labs is adding 50GB of traces to the 50GB of logs, 10,000 series of Prometheus metrics, and 3 Grafana dashboard users that come with the free offering. Both Grafana Cloud and the on-premises Grafana Enterprise Stack offering include access to free and commercial plugins, such as Elasticsearch, Jira, Datadog, Splunk, AppDynamics, Oracle, MongoDB, Snowflake, ServiceNow, and more.

“In just a few years, Grafana Labs has grown from a single open source project into a comprehensive platform that is widely used across the Fortune 500 and Forbes Global 2000, helping companies make better decisions based on actionable data,” said Eschenbach. “I see a lot of similarities between the growth at Grafana Labs and the early years at VMware: focusing on solving problems for developers, and scaling those solutions across the enterprise. We’re eager to partner with Grafana Labs and look forward to working with Raj and team to continue building world-class observability products.”

Sales engagement as a space is on 🔥 - SalesLoft at over $100M ARR with >50% growth - those numbers on growth side though is not as high as many others which is why its still listing $1B valuation in early 2021…

SalesLoft, provider of the most complete Sales Engagement platform that includes Cadence, Conversations, and Deals today announced that during the prior quarter it far exceeded its financial plan, surpassing $100 million in annual recurring revenue, and growing 50% annually.

The revenue achievement is the latest in a series of accomplishments for the sales engagement leader, which has grown recurring revenue nearly 40% since reporting a valuation exceeding $1 billion in early 2021. The company also announced that Calendly founder and CEO Tope Awotona has joined its Board of Directors.

🦄 startups built off of Google Chrome 🧵

Cloud vs. BYO data center debate continues

Snowflake to go after Datadog???

From the archives - ASP Model to SaaS

Elastic Search expanding cloud and developer first security with acquisition of Cmd and Build.security (dev first authorization built on top of OPA)

from the build blog:

While authentication has been largely solved by the likes of Okta, Duo or Auth0, development teams around the world still struggle to build and manage authorization for their applications and services. The rapid progression to microservices architecture exacerbates this problem for developers looking to secure “who has access to what” in their systems, and in what context.

At the same time, we came across the Open Policy Agent project (AKA “OPA”), a recently graduated project in the CNCF, that delivered the promise of a unified policy language and decision engine, wh

Markets

Forgerock, in identity software space (competes with Okta) files to go public

Mission from S-1

Our vision is a world where you never log in again.

We help make the digital economy possible. ForgeRock supports billions of identities to help people simply and safely access the connected world—from shopping and banking to accessing company networks to get their work done. We make this possible through a unified and extensive identity platform to enable enterprises to provide exceptional digital user experiences without compromising security and privacy. This allows enterprises to deepen their relationships with customers and increase the productivity of their workforce and partners, while at the same time providing better security and regulatory compliance.

and from Bloomberg

ForgeRock could seek to be valued in an IPO at $3 billion to $4 billion, or possibly higher, Bloomberg News reported in May.

The company had a net loss of $20 million of the first six months of the year, down from $36 million in same period in 2020. Meanwhile, its revenue for that period climbed to $85 million from $55 million, according to the filing.

Freshworks filed to go public in customer support/engagement space (Reuters)

The Salesforce.com Inc (CRM.N) rival revealed it had earned $168.9 million in revenue for the six months ended June 30 this year in a regulatory filing, up from $110.5 million in the same period last year.

Net loss came in at $9.8 million for the same period, down nearly 83% from a year earlier.

Remember Elastic? One of the first public OSS cos?

SPACs were all the rage in 2021 but not anymore…Axios

SPAC enthusiasm is slowing, as evidenced by rising redemption rates.

Between the lines: “Redemption rates are very much a barometer of market sentiment,” explains SPAC Research founder Ben Kwasnick.