What's 🔥 in Enterprise IT/VC #245

Enterprise infra is sexy!

I was out at a 🥃 cocktail party the other night (yes a party - so nice to do that!) and talking about the public markets with someone who is far from the tech field and the one company they mentioned to me was Datadog.

On the one hand it was pretty cool to hear someone not in tech mention Datadog instead of Doordash or Uber and on the other hand it was kind of scary. For many years, enterprise infrastructure companies toiled away in obscurity quietly providing the picks and shovels for the leading consumer companies and over the last 12 months, the picks and shovels and jeans makers are all having their day in the sun.

Just this week Barron’s wrote a great article about observability:

One of the challenges of modern enterprise computing is keeping track of what’s going on inside your network. Cutting-edge information-technology systems are a messy brew of public clouds, private clouds, old-school data centers, third-party apps, edge computing, and mobile workers. Keeping tabs on what’s working—and what isn’t—is a gigantic challenge. The good news for investors is that the result is an enormous emerging market.

Once blandly known as infrastructure management tools, the market for this stuff now has a sexier, slightly Orwellian name: “observability.”

Morgan Stanley also released research this past week citing the same:

I ❤️ it when the large investment banks get their clients 🔥 up about the opportunity ahead in infrastructure software and the ☁️ - Morgan Stanley’s report from this past week dives deep into observability, operational databases, and security analytics - bottom line - huge growth ahead 📈. As these banks and publications continue educating the market about the amazing world of enterprise infrastructure expect a continued parade of IPOs to hit the market in the coming months and perhaps one day, your non-tech friends at a cocktail party will truly understand what we as infra founders and investors actually do. Well…actually, I hope not as it’s been nice to have that secret all to ourselves 😃.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Startups aren’t easy especially if you’re a solo founder. Try YC’s new founder matching service if looking for a connect.

There is also proof in the data that having a co-founder is important: Of YC's top 100 companies, only four went through the famed accelerator without a co-founder. (Those would be Ryan Petersen's Flexport, Blake Scholl's Boom, Aaron King's Snapdocs and Ryan Chan's UpKeep.)

Many of our best founders at boldstart are also active angel investors - great 🧵 on what folks learn and why they angel invest

👇🏼💯 Many VCs love to fund PhDs but we prefer the Poor, Hungry, Determined ones vs. the doctorates

Must read - Building a data team at a mid-stage startup: a short story (Erik Bernhardsson) - especially huge for PLG and dev first motions - you can’t refine product and work on growth without the metrics

On the importance of patience, especially in the early days and for developer first or PLG models

Enterprise Tech

I ❤️ new SaaS categories and the most recent one is a turnkey platform for PLG journeys from first visit to sales - reminds me a lot of the early days of customer success which Gainsight helped create. This is a category that is currently dominated by BYO leveraging tools like Segment and Pendo. The most recent to launch in the space is TopLyne: go-to-market (GTM) orchestration platform that lets product-led teams connect the dots from user signals (behavioral, demographic, billing, and more) to business outcomes (new sales, upsell opportunities, reduced churn)

We’ve already met 5 others companies in stealth in the last 6 months so this will surely be a hotly contested market to watch in the coming year especially as more and more investment 💰 go to PLG companies like Coda which just raised another $100M at a $1.4B valuation to unify documents and spreadsheets.

👇🏼Yep - the love hate relationship with Slack…lots of lost threads, constant interruptions, there has to be a better way

A reminder of the importance of Net $ Retention…Notice Datadog, Zoom, Twilio at far right

This relationship appears throughout the dataset. For example, the companies in the top half of the NRR distribution show an average EV / Revenue ratio** of ~25x, while those in the bottom half show only ~10x. What’s more, the company with the lowest NRR of the group (New Relic) has the 3rd lowest revenue multiple, while that with the highest NRR (Snowflake – by a lot!) boasts the strongest multiple.

What is good API design? Great comments in 🧵

As I’ve written in the past months, 2021 has been even more insane from a startup and investment activity versus 2nd half of last year and relative to the 25 years I’ve been a VC. I’ve never seen anything like it, and I keep wondering when things will slow down a bit but instead, everything is just accelerating. It’s important for founders and investors to maintain their composure, try to stay disciplined, and yes, also understand what game you are playing and if the rules have changed and where you are willing to adapt or not. In the end, what goes up must come down.

So let’s go to the numbers that were just released this past week.

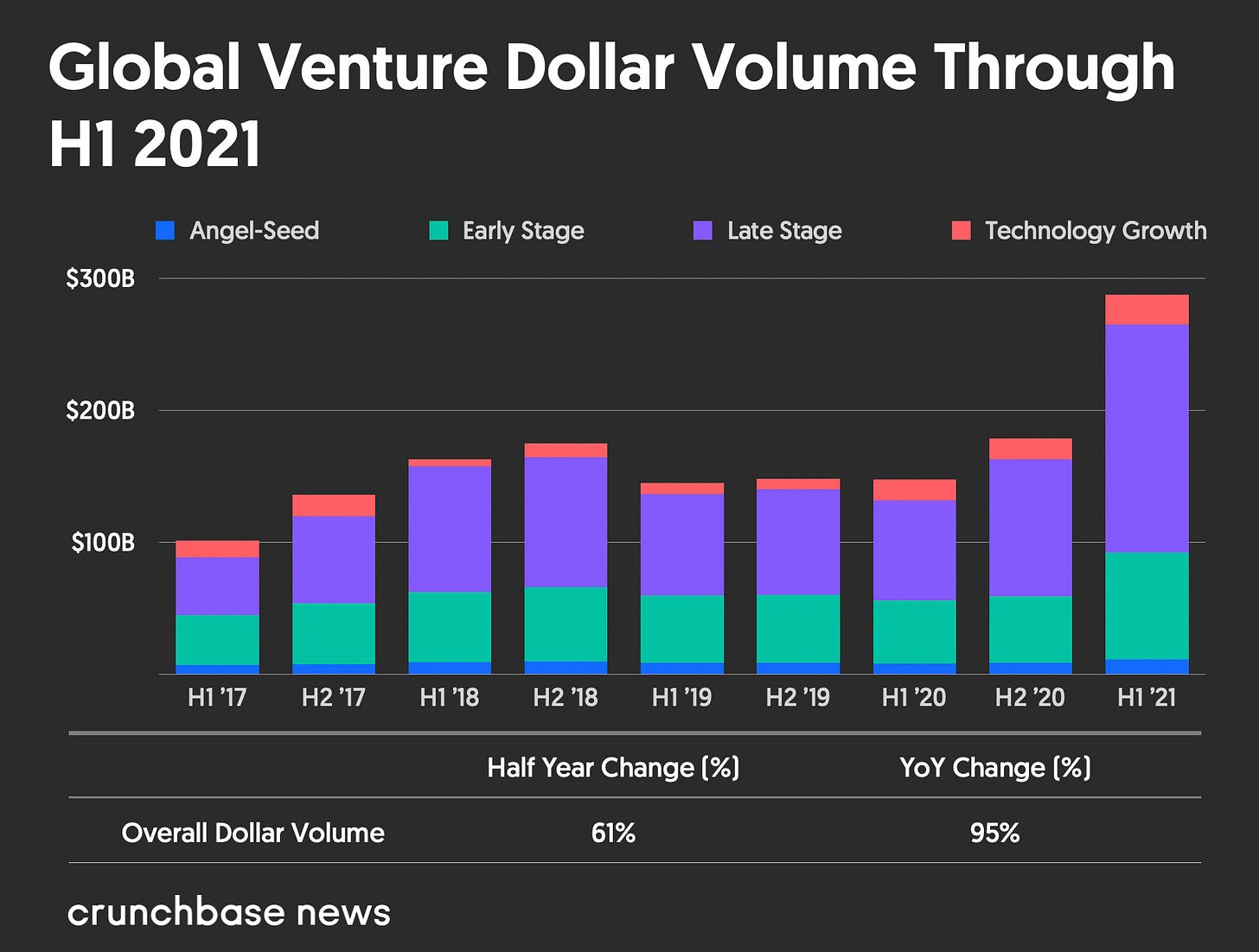

According to Crunchbase News $288B was deployed in the first half of 2021 which is 61% higher than the previous 6 month record for the 2nd half of 2020 and 95% higher versus the same period last year.

While most of this capital is being deployed at the later stages as investors continued to pile on to the winners, it has affected first check, day one investments as well. Over the last 6 months, it seems as if the normal fundraise for a company with 2 strong founders and no product is $5M and in Israel it seems to be $6-8M. Anecdotally, versus same period of last year, the number seemed more like $3-4M. Regardless, because of the continued increase in round size and upward pressure on pricing, everyone now fashions themselves a seed investor. As more and more folks continue to move earlier in the stack, founders please remember to know who you are partnering with, that they are stage appropriate, and that they are the right fit for where you are in your journey.

All I can say it’s a great time to be a founder.

Web3.0 - the decentralized web is starting to happen…

Web3 Adoption Hits Tipping Point

The proliferation of Web3 has been long awaited, but failed to manifest fully because of a need for infrastructure across computation, indexing, data management, hosting, storage, and other vital services. However, after many years of building and continued growth, many Web3 protocols are starting to hit their stride.

💯 Cloud Native Software’s Technical Debt is Growing (The New Stack) - so much opportunity to create newcos to solve these problems…

What we found was that the more modern the application, the faster it would cease to work. Legacy applications would be fine for years but cloud native applications would crash and burn within weeks.

What we need is an open ecosystem for developing and distributing automation for these tedious code maintenance tasks: upgrades, CVE patching, internal API maintenance. It can only be solved by a community through composing more and more complex refactoring operations and validating them on more and more code.

We can start with the same proven building blocks that an IDE provides, but make them shareable and composable, and applicable via different workflows. With these building blocks, API vendors and OSS framework authors can develop and distribute automation for upgrading consumers of their libraries and APIs together with the new versions of their libraries. Security researchers can not only disclose a vulnerability but provide an automated remediation for everyone impacted.

Markets

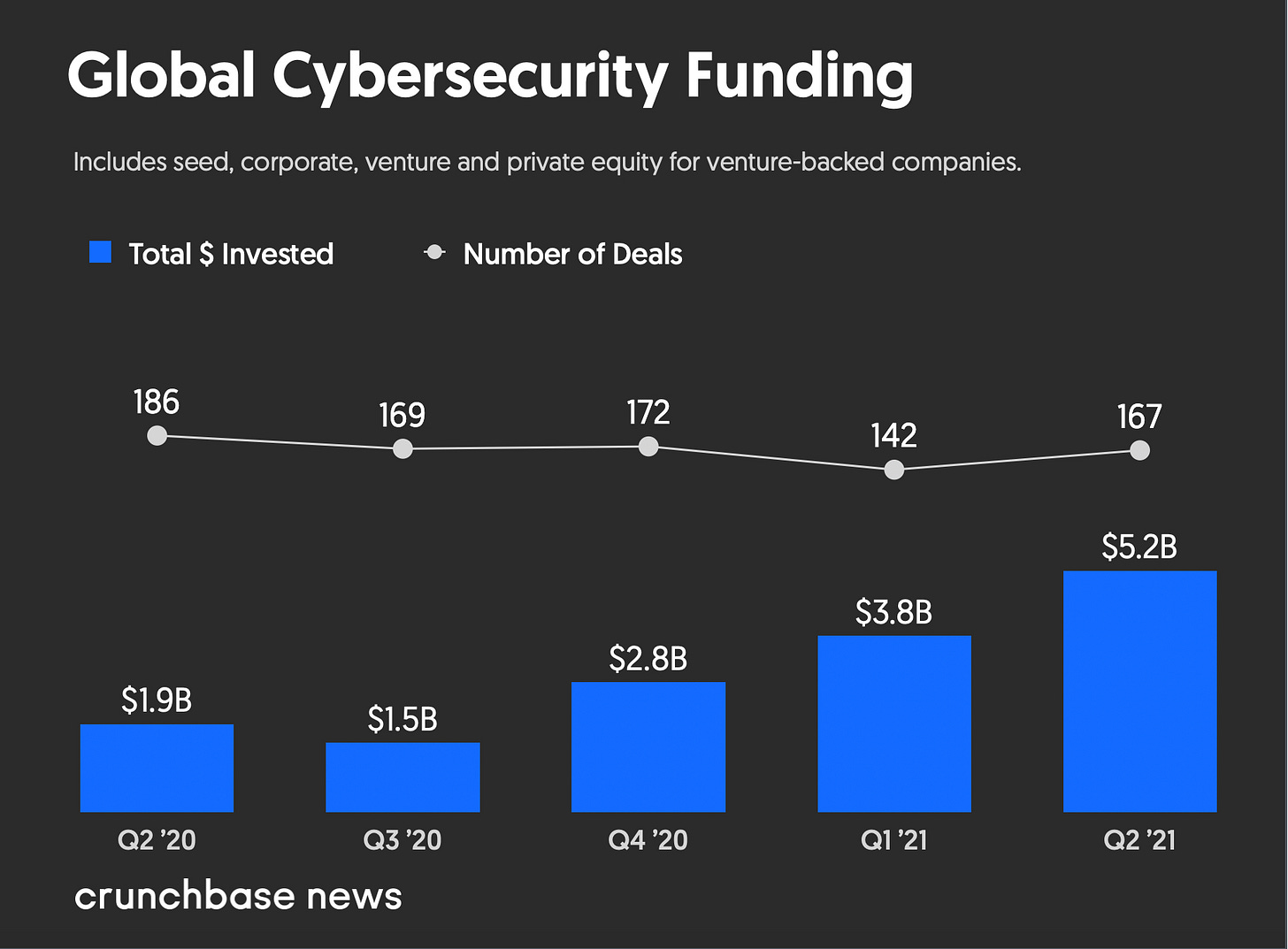

Cyber security on 🔥 as Netskope more than doubles valuation from last round with $300M at $7.5B post-money valuation - SASE market is huge and going after ZScaler, SentinelOne and others

Continued investment in Netskope from premier investors further validates the company's exceptional team, vision, track record of strong global execution, and opportunity to continue its rapid gaining of share in the fast-growing CAGR market which analysts estimate to be a $30 billion total addressable market by 2024, with cloud security CAGR growth estimated to exceed 30% over the next several years. Netskope will continue to aggressively expand both its platform and go-to market amidst its hypergrowth to meet the strong demand for its market-leading Secure Access Service Edge (SASE) architecture.

😲

Reminds me of the dinner I hosted at RSA with CISOs and founders - amazing how the world has changed since 2017 (read recap here on 10 takeaways).