What's 🔥 in Enterprise IT/VC #244

Reminder of what matters in the early days of an OSS project

For investors and founders 🤔 about what matters in the early days of an Open Source Project, you must watch the video from Brendan Burns, co-founder of Kubernetes on how he helped build the community and scale it.

In summary, when optimizing early metrics:

It’s not about git🌠

Issues - show people care about your stuff and use it, also can understand quality of project

PRs (Pull Requests) queue is opposite - shows interest, do people actually care enough to contribute - strong sense for health of project in early days

Create momentum, look alive and respond super fast

Why? Because…

Super fast engagement and responsive matters, in your IRC, Slack, chat, issues…instant gratification on engagement so they don’t wander off…lots of other choices - you have 2 hours before they go to another project…Really good docs, responsiveness is Issues Queues, retain the people you attract.

Also Look Alive - Great hack - early days in IRC channel, started piping all of continuous integration results in IRC channel so there was something there -create activity, look alive - eventually over time turned it off as organic activity in channel from people took off. Momentum and velocity matters. Reminds me of a founder we backed who was able to not only be super responsive in the 2 hour window but also turn some of the devs filing issues to contributors - that is voodoo magic!

And later on Brendan shares what it’s like when you go from early to 🚀 - no longer need to attract users but now know who they are. How to sustain the 🏒.

Release metrics - weekly, solid product roadmap

Community health so vital and hard to measure - lots of people with competing interests

Design for scale and formalize everything

Governance and decision making

These are many of the characteristics we found in the Testcontainers.org OSS project and why we were 🔥 up to partner with Sergei Egorov and Richard North, who started a company, Atomic Jar, to support the project they helped create and maintain.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Bonus:

Scaling Startups

As much as folks want to believe that venture investing will be data driven and founders will opt for the highest valuations, best deal terms, and quickest to close, there will still always be a world where deep relationships matter.

Michael Grinich, founder of WorkOS, shared a 🧵 responding to a recent Information story on the legendary Benchmark Capital and how it was not selected as the lead investor.

When getting started on day one, remember hands on keyboard is what matters - product, product, product

Don’t be cute when it comes to describing what your company does

Future of marketing - great 🧵 and comments - hard to rise above noise, people don’t want to feel like a piece of data, community important, authenticity, storytelling…

It’s not where you start but where you finish…

How does hybrid work work? Dustin from Asana shares his thoughts

And a 🧵 on how Okta will handle hybrid with an emphasis on team collaboration when in office and focus on productivity when remote

Enterprise Tech

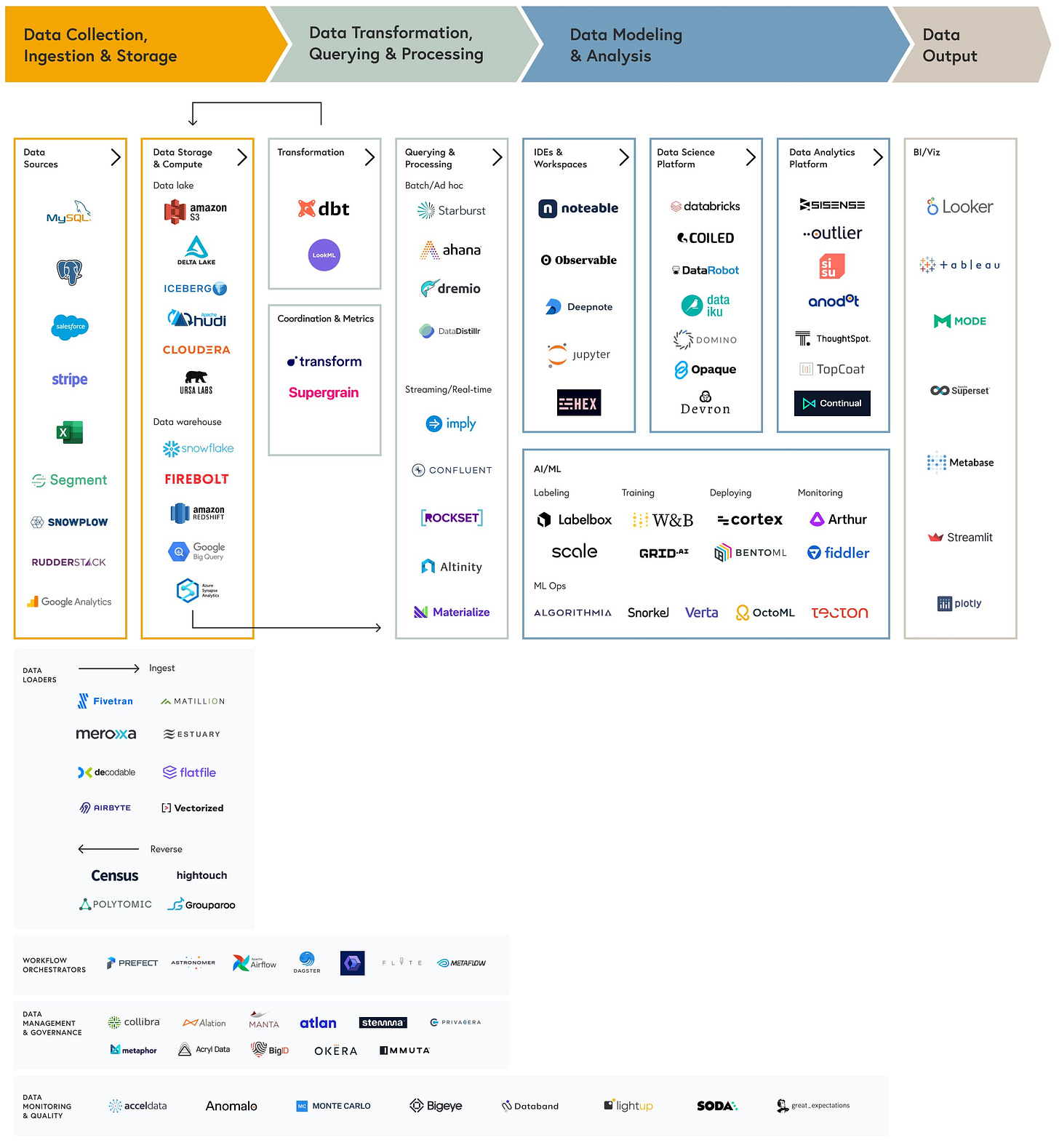

Bessemer’s Data Infrastructure Roadmap is out:

The modern cloud data stack is undergoing massive construction and the future of software will be defined by the accessibility and use of data.

But one category missing is this great list of companies who are building products to compute on encrypted data - nice shoutout to @CapePrivacy (a portfolio co)

There are a long list of companies working in this space, and it is growing every week. We list just some of the companies here; giving some context as to the technology they use (MPC and FHE) and the where possible the vertical markets or horizontal applications which they focus. Some of the bigger companies have efforts in multiple domains. There are many companies we have missed below, if you know one please let us know.

Speaking of data - dbt is the kubernetes of data - from humble beginnings, how an open source player 5 years later now worth $1.5B

When Drew and I had initially released dbt we spun up a Slack channel, and that tiny little group of humans ended up being the only (work-related) social interaction I had in those early days. The first few dozen of us just chatted in #general, no threads, zero moderation. Chaos!

(NB: If you go back in the Slack history far enough you can still see it all. I probably used to swear too much 😬)

Fast forward ~5 years and this community:

Has co-invented the practice of analytics engineering

Has supported the professional development of over 15,000 humans

Includes diverse members from around the globe who work for companies of all sizes

Even though dbt is today far more mature than it was, it still embodies the same principles: analytics as software, authored by anyone who knows SQL. The community’s principles have stayed just as consistent: friendliness, inclusiveness, and a deep commitment to paying it forward.

And super important on why raise again so quickly - independence from the big 3 cloud providers….

Here’s something we know: dbt drives a tremendous amount of usage across several of the major cloud data platforms. That makes dbt and its community very strategic for these platforms. There are currently ~5,500 companies using dbt and this metric is tracking towards ~10,000 by the end of the year. This usage drives, in our estimates, billions of dollars of spend to the major platforms.

The constant battle for developer first companies - users and find budget or budget and find users…read 🧵

Startups 🏃🏼♀️faster than large cos and 👇🏼 is why the cybersecurity market will continue to grow super fast…

and it will only get worse “Hackers are investing in each other’s operations—just like VCs invest in startups”

What AWS Tells Us About Heroku 2.0 - Another beauty from RedMonk, this time Stephen O’Grady, “does developer experience trump breadth of offerings and how AWS has been closing the gap”

And yet, for all that it got right, the Heroku self-contained developer experience never took over the world. The AWS DIY-from-primitives model did. Even granting that AWS had an eleven month headstart chronologically, the story of why IaaS triumphed over PaaS is long, complicated and will vary depending on who’s telling it. And, it must be said, is far from complete.

In the aggregate at RedMonk, we’ve seen more discussion of Heroku over the last year or two than the previous decade combined. There are many reasons for this, but most come down to the basics of the Developer Experience Gap: the more pieces that have to be wired together, the more difficult an environment is to stand up, operate and debug. Primitives were the preferred approach when there were fewer of them. In a world where there are hundreds if not thousands of services to pick from, this experience begins to break down and abstractions begin to look increasingly attractive.

Yes, GraphQL is real…🎩 @shomikghosh

😲 Talkdesk could be joining private $10B 🦄 club (The Information)

The filing shows the company plans to raise up to $210 million at a share Series D price that is 3.2 times higher than its Series C round. Talkdesk said in July it was valued at more than $3 billion from the Series C round. The proposed valuation is more than 50 times Talkdesk’s annual recurring revenue (the revenue it expects to generate in the next 12 months), according to a person with direct knowledge of its business.

Markets

Reminder that growth at over 100% YoY and Net $ Retention over 130% for best in class public software cos

Cybersecurity is on🔥 - SentinelOne soars in IPO to a market cap of over $10B and ends day as largest cybersecurity IPO in history (CNBC)

Shares of cybersecurity company SentinelOne closed up more than 20% in its market debut Wednesday on the New York Stock Exchange, going public under the ticket symbol “S.” Shares closed at $42.50, giving the company a market capitalization of more than $10 billion.

SentinelOne priced 35 million shares at $35 apiece on Tuesday, above its initial $31 to $32 target range. The company raised $1.2 billion at an implied valuation of $8.9 billion, surpassing CrowdStrike’s $6.7 billion market debut in 2019, and a previous era’s cyber defense IPO big winner, McAfee, to become the highest-valued cybersecurity IPO in history, according to data from CB Insights.