What's 🔥 in Enterprise IT/VC #243

A Confluent of events with 🔥⚡and ❄️ shows why Data Space on 🔥

If you’re wondering why 💰 continues to pour into the data infrastructure space, this week is a wonderful reason why.

Confluent had a massive IPO raising over $800M and ending the day at over a $11B market cap, Snowflake shared an ambition plan to get to over $10B of revenue, and upstart Firebolt, a next gen Snowflake raised a $127M Series A.

If you’re interested in the Confluent story, there is no better place to start than founder Jay Kreps 🧵 on the journey to IPO.

Going from OSS to ☁️ was huge but also consumed whole company…

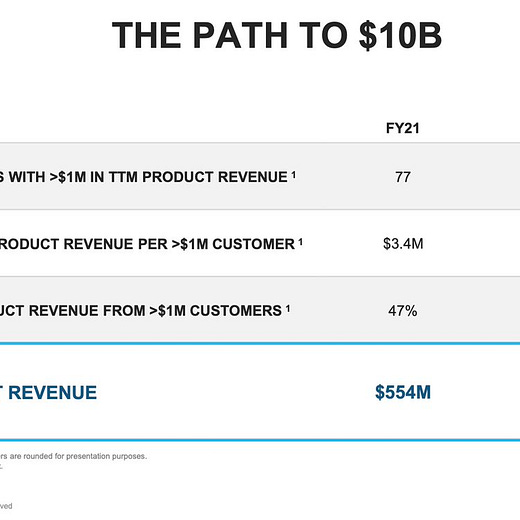

Next up, read Snowflake’s recent Investor Day Deck as you have to ❤️ the ambition and confidence of ❄️ as it lays out a plan to get to $10B of product revenue when they are at $554M today. There are lots of areas of future investment which I’m sure will attract tons of VC 💰 in the coming year.

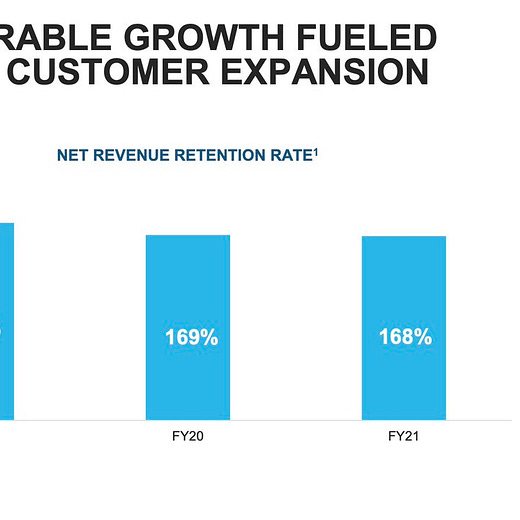

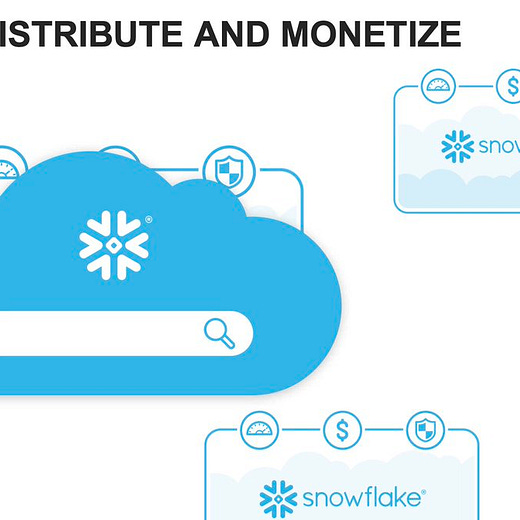

Two 🔑s to continued growth will be in continuing to land and expand and add more products. The next big thing at Snowflake is the concept of the data cloud which is all about data sharing as you can see from the graph below.

Area #2 for the future is a step towards one day, perhaps, entering the transactional data space, yes transactions and not just analytics. From a recent Deutsche Bank Research Report (June 11):

Hybrid transactional analytical processing

We think Snowflake could move into hybrid transactional analytical processing. Here, transactional processing and querying occurs in the same data store. This enables decision making can occur on the fly rather than as a separate activity post factum.

We think Snowflake could launch functionality to support processing for workloads that fall between a data warehouse and transactional database e.g. those that involve a significant analytical component, few INSERTs/ UPDATEs/SELECTs functions and do not require sub second response times. This opens up the ability for Snowflake to capture some OLTP spend longer-term, a market we size at $29B in 2020 growing to $71B by 2028

Given this context, it’s no surprise that Firebolt raised a massive $127M Series A round this past week as it has been pegged as a Snowflake killer with a focus on speed and a way better developer first experience.

Firebolt is taking on more established cloud players such as Snowflake Inc. as well as traditional on-premises data warehouses, which are a combination of hardware and software that unify data from multiple sources and execute queries on it.

Firebolt’s cloud data warehouse is designed for extremely rapid analysis of large data sets. The company reckons it can provide subsecond performance for queries carried out on terabytes or even petabytes of information, thanks to its ability to crunch data up to 182 times faster than alternative data warehouse services.

The company explains that its fast performance is derived from a number of internally developed technologies that power its cloud data warehouse. They include a customized, cost-based optimizer that tweaks Structured Query Language queries its users enter to improve their speed. It also uses a technique called sparse indexing to reduce the amount of unnecessary data that queries retrieve, thereby eliminating superfluous computations.

Another advantage of the Firebolt platform is that the company says it’s built specifically with developers in mind. It allows 100% programmatic control of the platform via application programming interfaces and software development kits, which makes it much easier to create rich data applications based on it, the company asserts.

Bonus from this week is OSS database company Couchbase’s recent S-1 filing and Neo4J’s $325M Series F funding for its graph database.

According to Gartner, "By 2025, graph technologies will be used in 80% of data and analytics innovations, up from 10% in 2021, facilitating rapid decision making across the enterprise.” Source: Gartner, Top Trends in Data and Analytics for 2021, Rita Sallam et al., 16 Feb 2021.

As I like to say there a few certainties in life, death, taxes, and the growth of data.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Must read 🧵 on Notion playbook…patience required 😃

Speaking of PLG…

How to 🤔 about joining your next startup - great 🧵 from Andreas Klinger

It takes a village to raise a startup and all founders should consider using this👇🏼

Designing for Flow - why Superhuman ( a portfolio co) users are so engaged

1. Make the next action obvious

Hesitation is the flow killer.

When somebody uses your product, their next action should always be obvious — and it should be obvious how to do it. Make functions visible, and limit alternative actions.

Example: When you archive an email in Superhuman, you immediately see the next one. There is minimal room for decision fatigue: you simply process one email at a time. This creates flow. When you archive an email in Gmail, you go back to the inbox. You now have to decide what to do next, and you have to do this every single time. This destroys flow.

Enterprise Tech

👇🏼🦄🦄🦄

PLG also on 🔥 as Figma raises $200M at over $10B valuation 🤯 - more on Figma’s story here in a prior newsletter. And if you’re wondering how Figma will spend the capital: “Field also said he is looking to acquire both strategic assets and talent.”

Huge 👏🏼 to Atomic Jar, a new portfolio company…more here on why we invested

Lest we forget about the opportunity ahead for us in the next 10 years!

Infrastructure as Code Automation is just getting started as Env0 (a portfolio co) raised $17M led by M12, Microsoft’s VC Arm…

Check out “Software Snack Bites”, substack from my colleague Shomik Ghosh as he interviews Adam Gross, PLG for developer first cos extraordinaire and ex-CEO Heroku and VP Sales & Marketing at Salesforce + Dropbox - here’s a 💎 which resonates so well for me!

3 Modes of Selling: Oracle Model, Salesforce Model, End User Adopted. Oracle Model - relationship selling. Salesforce Model - teams are using the product and getting collaborative multi-player value. End User Adopted - individual users adopt the product and spread the product around the customer.

Successful Product Led Growth companies have all three of these models working together at scale. Need to move the customer along these 3 models. The timing behind when you engage in each motion is important. Need to make sure balancing each when serving individual users but also prioritizing features for the enterprise. More on this topic can be found in this excellent hour long talk by Adam here.

Can’t wait for this…

Markets

Not all SaaS stocks go to the 🌝 on their IPO - Sprinklr Raises $266M in Downsized US IPO - bottom line, growth matters - top line revenue was $387M vs $324M a year ago, significant scale but slow growth of 19.4%

Sprinklr, a customer experience software maker, raised $266 million after pricing its U.S. initial public offering below a marketed range and cutting the number of shares sold.

The company priced 16.6 million shares on Tuesday at $16 each after marketing 19 million shares for $18 to $20 apiece, according to a statement.

At $16 a share, Sprinklr has a market value of about $4 billion based on the outstanding shares listed in its filings with the U.S. Securities and Exchange Commission.

Four Silicon Valley VC firms notched billion-dollar IPO wins on Thursday (CNBC)