What's 🔥 in Enterprise IT/VC #237

We live in all SaaS world but why on-prem rising and what's modern on-prem?

I remember 10 years ago when enterprise founders would meet with the largest companies and many were still not ready for SaaS and the ☁️. The smart founders would continue to push the envelope to find the early adopters who were willing to go for the more efficient model and avoid doing anything on-prem at all. Despite the fact that SaaS rules, there is still tons of software out there that is 100% on-prem and this week AWS released AWS SaaS Boost as an open source reference environment to help software vendors (ISVs) easily and quickly migrate their existing on-prem solutions to a SaaS delivery model.

AWS SaaS Boost is a ready-to-use open source reference environment that helps you as an Independent Software Vendor (ISVs) accelerate your move to Software-as-a-Service (SaaS). From small specialized software businesses to large global solution providers, AWS SaaS Boost helps you accelerate moving your applications to AWS with minimal modifications. Build, provision, and manage your SaaS environment with greater confidence based on AWS best practices and proven patterns from hundreds of successful SaaS companies.

AWS SaaS Boost takes on the heavy lifting of launching your SaaS offering by guiding software builders through the migration and operational processes, making your move to SaaS as frictionless as possible. It provides you with ready-to-use core elements such as deployment automation, analytics and dashboards, billing, and metering.

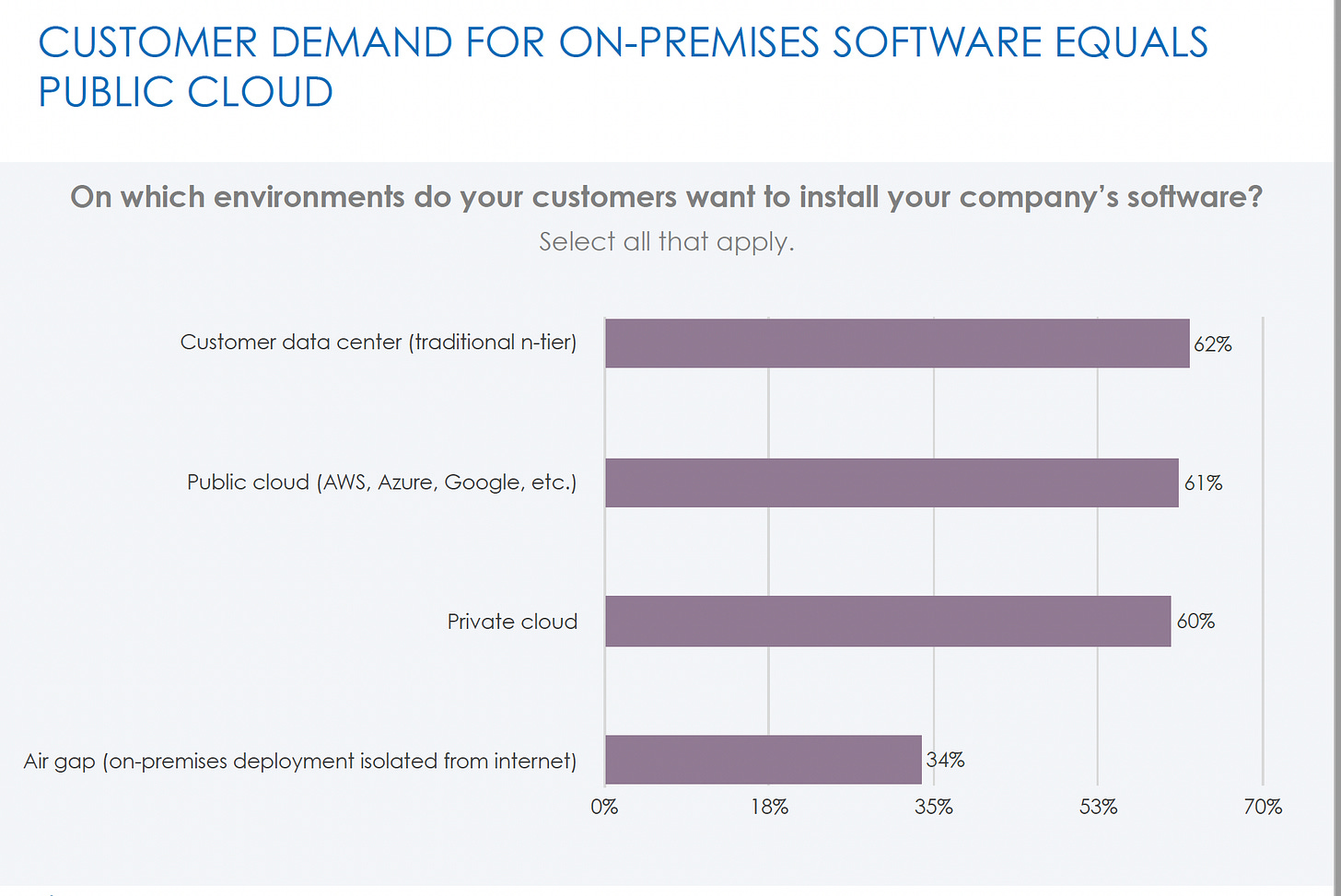

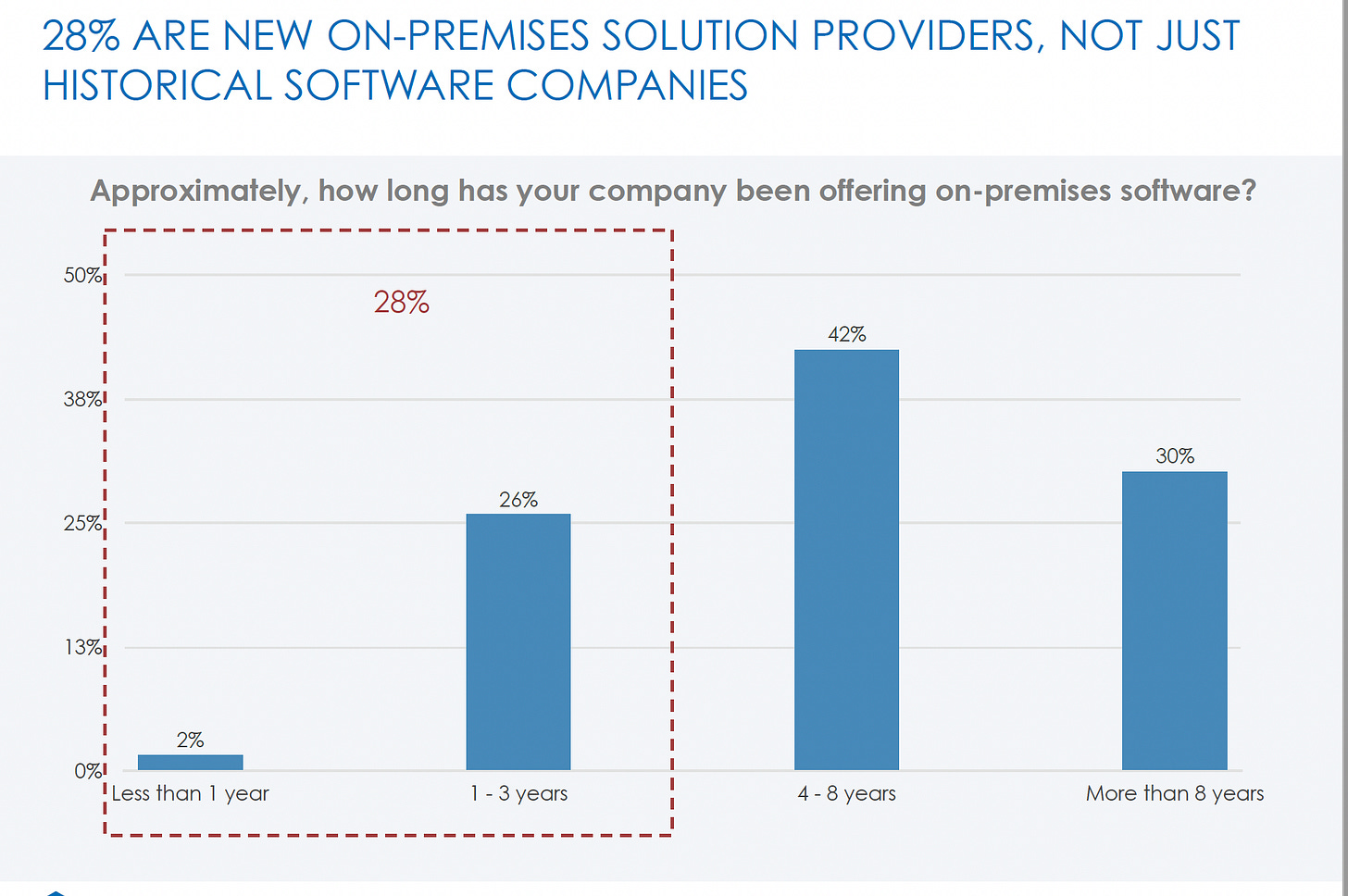

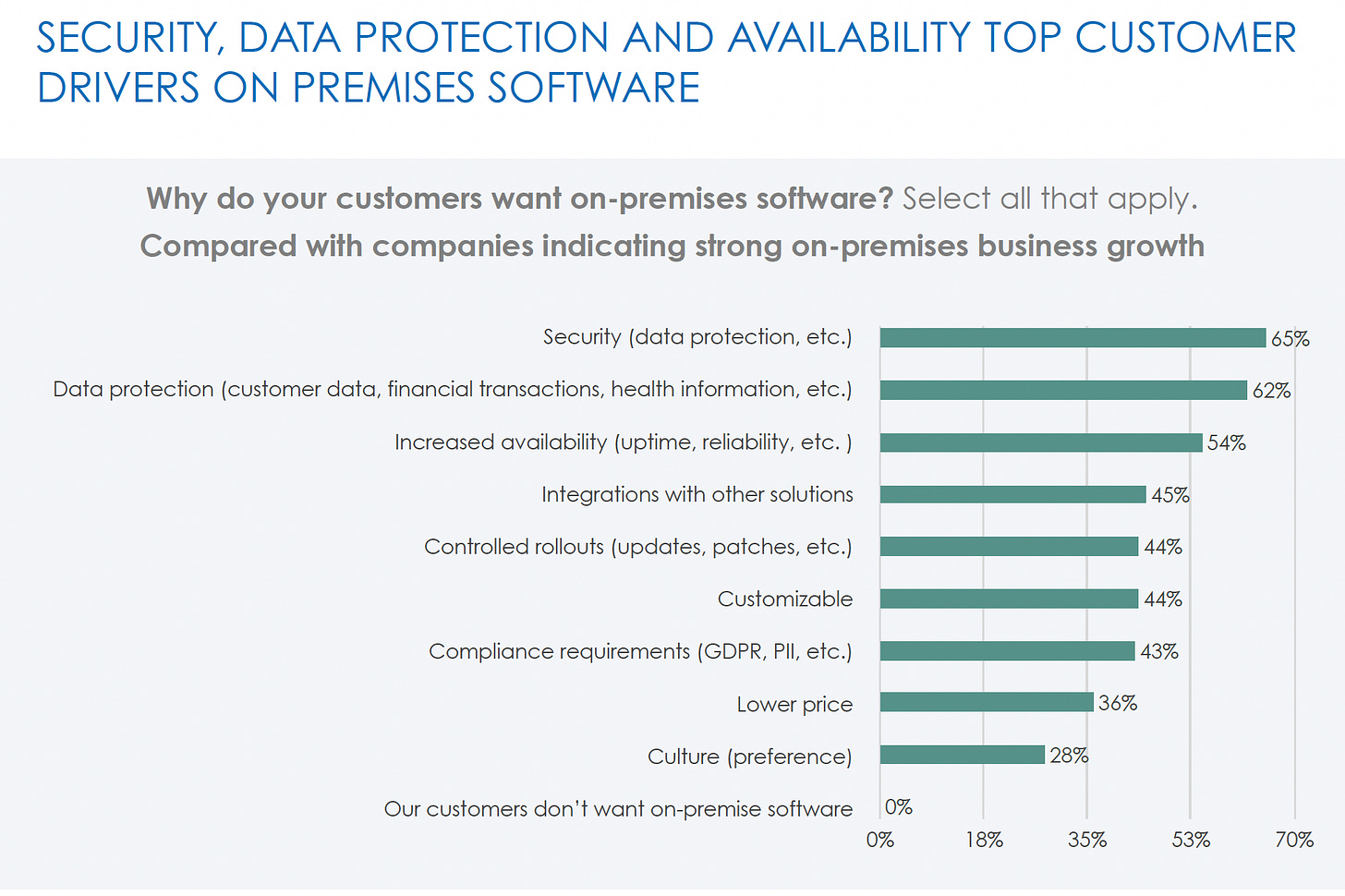

So if SaaS has won, why is the demand for on-prem software rising? (see report from Replicated with Dimensional Research surveying over 400 professionals who work at commercial enterprise software vendors)

And how should startups handle the dreaded, “I’ll buy your software if you deliver it on-prem” request? Should they keep saying “No” to the large enterprise customers or is there another more modern way? Let’s dive deeper.

If you see from the above chart, most vendors selling software on-prem still need at least a week or more to deploy their solution meaning high cost of doing business. In addition, as a company scales and grows, they end up having to manage hundreds or thousands of ❄️ meaning each on-prem solution is custom for each customer. This is why most SaaS vendors will say NO to anything on-prem as it is so much more scalable and easier to write once and deploy to the cloud versus install, help maintain, and troubleshoot lots of on-prem installations all with bespoke environments.

That is until Kubernetes and Replicated came around to help “unlock the opportunity for modern on-prem software allowing vendors to deliver and manage Kubernetes apps anywhere.” 50 of the Fortune 100 already consume software from vendors who deliver their on-prem version via Replicated. You can find more here on their open source project, kots (kubernetes off the shelf) on how you can deliver a kubernetes application for enterprise installation as a modern on-prem app that comes will all of the enterprise ready bells and whistles like SSO, RBAC, audit logs, change management, etc.

Software vendors with a Kubernetes application can package their app as a Kubernetes-off-The-Shelf (KOTS) software for distribution to enterprise customers as a modern on-prem, private instance. The packaging process leverages several KOTS components (some optional, some required). For context, Replicated KOTS is made of several purpose built, open source components, but should be thought of in two distinct (but highly integrated) categories.

Using Replicated, an independent software vendor can still maintain one code base and not several custom versions depending on each customer, thus removing the high cost in delivering and installing software on prem and managing and maintaining different software versions over time. The net result is that rather than shipping the data to the app, Replicated ships the app to the data . Truly though, the debate about SaaS vs. on-prem really should not be one as it’s all just cloud native leveraging Kubernetes. Keep an eye out for this over time as security, data protection, and privacy drive more “on-prem” growth in the years to come.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

What are some characteristics we look for when funding newly created companies? Can founders hit the ground running on day one? Many of the best start their companies because they need capital to hire the backlog of folks willing to join right away - understanding how the founders met them, the quality of the future hires, and how they think about hiring is a huge look into the future.

💯 instincts matter

Great 🧵 on how Zapier got started, one user at a time, forums, etc…

Enterprise Tech

White House signs Executive Order to improve our Nation’s Cybersecurity - expect much more focus on security focused on the “software supply chain” from vendor risk analysis like Security Scorecard (a portfolio co) to third party API analysis - more 💰 will be flowing into cyber security startups

New player in DevOps space as ServiceNow acquires observability platform Lightstep - this is the beginning of many more acquisitions from ServiceNow and great for developer first companies as another large player on the scene

ServiceNow isn't worried about Lightstep's competition. The company is aiming to bolster DevOps engineers' ability to build, deploy, run and monitor cloud-native apps. CJ Desai, chief product officer for ServiceNow, told ZDNet the goal is to "transform software development like we transformed IT."

Desai said the appeal of Lightstep is that it offers visibility into the full software stack without bouncing between platforms. ServiceNow will combine its AIOps and IT workflow automation tools to "seamlessly connect insight with action across all the tools, people, and processes involved in delivering digital customer experiences," said Desai. "With this acquisition, observability is no longer restricted to just DevOps."

CircleCi raises $100M as DevOps continues to be on 🔥 - more from TechCrunch and also my colleague Shomik Ghosh who led one of the earlier rounds while at his prior firm. As I like to say, it’s not the TAM you start with but the one you exit with and in CircleCI’s case, the market grew super fast and they executed like crazy.

Huge congrats to CircleCI on their $100M Series F led by Greenspring Associates at a $1.7B valuation!!

CircleCI's story is one of perseverance and great leadership. Through multiple early funding rounds, investors asked questions about size of the market, whether a standalone CI/CD company would exist, and worried that competitors would crush Circle by offering base level CI for free.

Through it all, the leadership team led by Jim Rose kept an intense focus on the north star of user engagement and developer experience. This led to a re-platform in 2017, pricing change to usage-based pricing, and much more that would sometimes anger users immediately even though it was in their best interest long term.

This funding round is a testament to the team's focus and mission to bring the best CI/CD experience to developers!Fantastic read on consumption-based pricing with Mike Scarpelli, CFO of Snowflake and current Snyk board member - from Anoushka Vaswani (Lightspeed)

Anoushka: How has this pricing model impacted Snowflake from a team and organizational structure?

Mike: It changes your compensation plan for sales reps. You can’t pay everything on new deals. You have to pay on consumption. Every one of our reps has a big consumption quota. We fundamentally want our reps to be involved in customer success.

We don’t believe companies should have a separate customer success function. The first thing we did when Frank joined Snowflake was we blew up was the customer success function. You are either going to do support, sales or professional services. Customer success is not accountable for anything.

You may hear some pushback from your salespeople and you will also have some portion of your salesforce focused on landing new accounts. However, a bigger percent of your commission dollars are going to be tied to consumption.

In the SaaS world, your FP&A group can develop a forecast in a silo in isolation from salespeople. The days of FP&A doing forecasting in this manner are gone. Our revenue and FP&A team is aligned with sales and our sales reps. The group has a regular cadence review of our top 50 to 100 customers. Our FP&A group spends a lot of time with salespeople to understand every element of our large accounts and the trends happening with consumption.

Who knew - Paypal only has 20% of compute in cloud with plans to migrate all of its compute over time - still so much more 💰 to spend - Google Cloud for the win

PayPal in 2017 moved software development and testing to Google Cloud and last year moved some payment processing for the Western U.S. from its own computer infrastructure to the cloud-service provider, although it declined to provide specifics. The company said about 20% of its processing volume last year was handled in the cloud.

Snyk (a portfolio co) buys FossID to expand developer first security to C/C++ and here’s one reason why (more on the NewStack)

Markets

Datadog last week on Q1 earnings - continues to perform at a high rate with 51% YoY growth in ARR, new logo ARR, usage growth, and net expansion >130%

To summarize Q1, at a high level, revenue was $199 million, an increase of 51% year over year and above the high end of our guidance range. We ended the quarter with 1,437 customers with an ARR of $100,000 or more, up from 960 last year. These customers generate over 75% of our ARR. We have about 15,200 customers, up from about 11,500 in the year-ago quarter.

This means we added about 1,000 customers in the quarter, making it another strong quarter of adds and consistent with the last few quarters. We also continue to be capital-efficient with free cash flow of $44 million. And finally, our dollar-based net retention rate continues to be over 130% as customers increase their usage and adapted our newer products. In addition to that, the positive business trends from recent quarters have continued in Q1.

And this is what is a huge driver, not just usage but attach rate of selling additional products

Additionally, 25% of customers are using four or more products, which is up from only 12% a year ago. And we also have hundreds of customers using six or more of our nine generally available products. But it's still early. We think this is an interesting proof point that shows the continued sell opportunity in our customer base.

Always great to see what Digital Ocean is doing as a public company as their core market is serving developers and SMBs - revenue up 29% to $94M, new customer accounts up 7%, net dollar retention was 107% up from 100% last year, and ARPU increased by 20% - serving individuals and SMBs so hard but great to see the progress

Second, net dollar retention, or NDR, is an important driver of the quality and sustainability of our growth. And we are focused on improving it from recent years in the 100% area. In Q1, NDR was 107%, a 600 basis point improvement over Q1 last year. This metric is a strong indicator of the quality of our service to our customers and their willingness to stay and expand with us. We remain focused on specific initiatives to improve fulfillment of customer needs on our platform and believe they will deliver improving NDR as we progress through 2021.

Third, revenue per customer or ARPU, is an indicator of our ability to drive growth within our customer base. And is reliant both in our ability to continue to add new products and capabilities to our platform, as well as our success in adding larger SMBs through our nascent sales effort.

Cloud multiples continue downward trend

😲