What's 🔥 in Enterprise IT/VC #236

Atomic units of value for OSS, seed to A, and partnering for the Long Term

Twilio keeps crushing its numbers - so awesome to see a developer first powerhouse continuing to scale at its size with dollar based net retention at 133% still!

But as I’ve written about in previous newsletters (Anatomy of a Developer First Juggernaut), patience is 🔑 when it comes to building a community and developer first machine. Along those lines, I had a chance to speak with DROdio, founder and CEO of Armory (commercializing Spinnaker), about what atomic units of value founders should think about when building a developer first/OSS base company (hint: not ARR).

One 🔑 thought we discussed is there is no 1 playbook as each project is unique, the developer downloading likely doesn’t have the budget, and finally to think about how one user ❤️ a product and how to go viral and “wall to wall” in an organization. We also covered the temptation of early revenue from enterprises and balancing when to take that bigger deal or not. These are choices that will dictate what your focus is and how you build your business - going enterprise ready may generate early ARR but you will sacrifice features that build more community and individual usage. How does one make that decision? (video here)

In the video above, Ed and I discussed the importance of ensuring that founders identify, track and optimize the most important non-revenue metrics in their business to help investors understand the potential energy growth — especially if you're talking to investors that typically only understand revenue-driven "kinetic energy" metrics. This most atomic unit of value will vary depending on the project, but it almost certainly goes well beyond tracking GitHub stars, which is where many investors hit a wall because they often don't have deep enough context into your specific OSS project's value creation mechanisms to really understand how you're defining the value of that potential energy. Examples might include tracking and optimizing things like:

Number of contributors / contributions to the project (including segmenting them by company size & type, which can be difficult because developers often use personal email addresses on Github)

A value metric that's specific to the project, like "number of deployments powered" or "amount of compute driven" etc.

A mix of multiple metrics that paints an accurate picture of the value being driven by the project

Tied to this discussion is all of the interest for OSS companies from investors and making sure that…

And this happens way too often…

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

Super thoughtful from Merci Grace (ex-Slack PM, ex-Lightspeed)

With all of the founder and VC content out there to tell you what time it is

🤣

Enterprise Tech

More open source databases? Congrats to TimeScaleDB on its $40M B round led by Redpoint. I’ve always been a huge fan of building off the PostgreSQL community when I first invested in Greenplum in the early 2000s which built a petabyte scale data warehouse on top of PostgreSQL. Now you have TimeScaleDB which is building a time series DB on top of PostgreSQL and others like Cockroach and Yugabyte in the distributed cloud SQL space. At end of day, lots of Oracle around and easy to move to PostgreSQL from Oracle. Crazy growth in 4 years - crazy growth in 4 years as leveraging @PostgreSQL community, if done right, can give new DB startups a huge advantage when it comes to building community.

Ever since TimescaleDB first launched 4 years ago, we’ve seen explosive growth, with a vibrant community running over 2 million monthly active databases today. 🙀 6/

Ever since TimescaleDB first launched 4 years ago, we’ve seen explosive growth, with a vibrant community running over 2 million monthly active databases today. 🙀 6/

More on power of PostgreSQL here in an interview from CTO of EnterpriseDB last month:

BN: What benefits does PostgreSQL offer over other databases?

ML: The main benefits are cost and innovation. People come to Postgres for cost but stay with it because it’s innovative, easy to use and runs everywhere.

For enterprises, there are a few features which differentiate Postgres from its competitors. Postgres offers superior performance. It's able to handle enterprise workloads with ease, and continues to build on this, with 50 percent performance improvement in the last four years.

It's capable of growing alongside a business, with multiple technical options for operating at scale. Postgres is built for speed, as its permissive license and broad availability make it straightforward to install and test. It's also supported by a wide array of extensions, plus multiple SQL and NoSQL data models.

I believe the core reason Postgres has become the gold standard is it’s community-driven nature. Open source contributors don't participate in a project to make a profit -- they just want to make Postgres the best possible solution it can be.

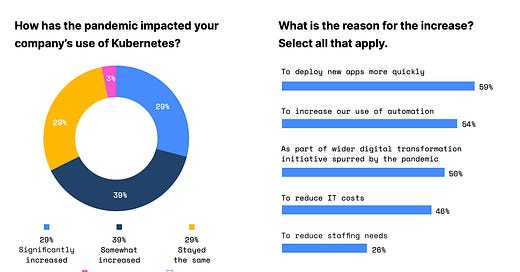

Kubernetes is king and accelerating (Portworx survey) - also nice expansion in containers

Momemtum Cyber Q1 2021 report is out: 🤯 more Cybersecurity 🦄 created in Q1 2021 than all of 2020!!! Great report as it covers multiple expansion in public markets, most venture financings (frankly the size of the report for Q1 alone (122 pages) will give you an idea of how much 💰 is flowing into this market…

and congrats to Snyk and Security Scorecard as two of larger financings in Q1 (both portfolio cos)

Speaking of cybersecurity this is a huge deal…

Ever wanted to know about the Vista playbook for the software companies they acquire? This🧵 nails it

5 investors discuss the future of RPA after UIPath’s IPO (TechCrunch) - enjoyed chatting with Ron Miller and sharing my thoughts on workflow, no code, and more - also got to plug portfolio cos FortressIQ, Clay.run, Catalytic

IBM with another acquisition - Turbonomic for up to $2B - “provides tools to manage application performance (specifically resource management), along with Kubernetes and network performance — part of its bigger strategy to bring more AI into IT ops, or as it calls it, AIOps.”

Someone still needs to solve this 👇🏼

Markets

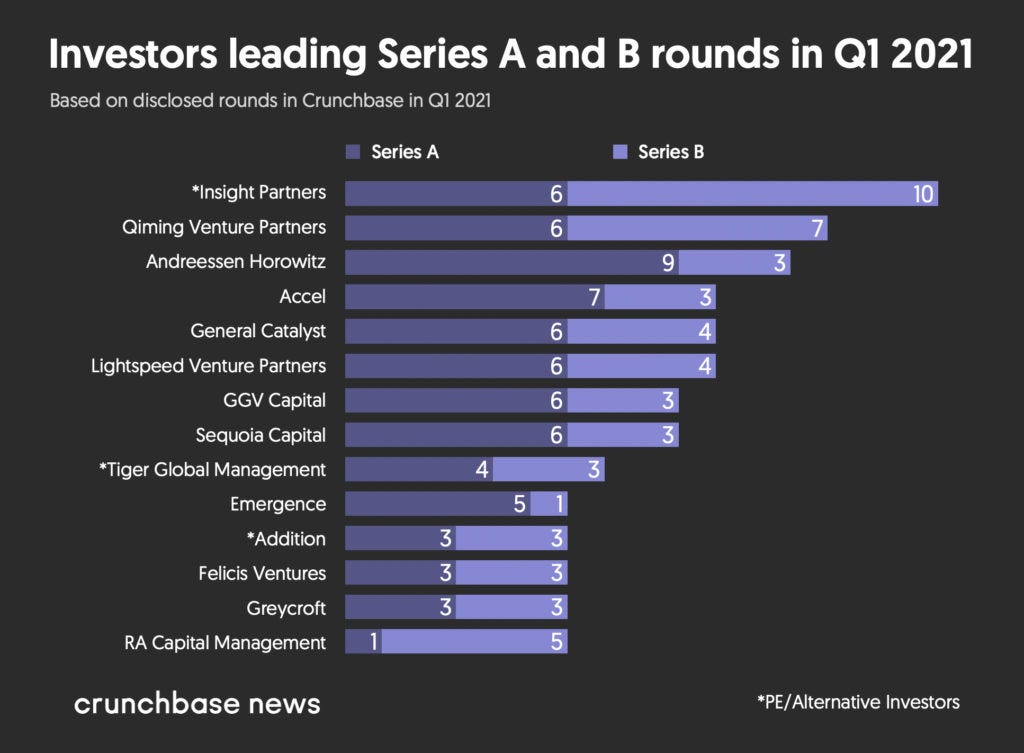

Is Early Stage Investing becoming a growth investor’s game (crunchbase news)? Q1 Data is in and the trend we all know of later stage investors going earlier is reflected in the data as we look at names like Insight, Tiger, and Addition showing up here.

As I’ve always said, there two kinds of investors in this world, courage and conviction and access. The joke is that we hope that our courage/conviction investments eventually do so well that they become an access play. As Ricky Bobby’s dad said in Talledega Nights, “if you’re not first, you’re last.”

SPACs are clearly cooling down in public markets but how about IPOs?

This article interestingly compares each stock to its peak price (as opposed to offering or deSPAC) and concludes this path to public is "waning." Would IPO analysis be any different? $DASH -44% peak, $SNOW -46% peak. $U -42% peak.Spac share prices slump as enthusiasm wanes https://t.co/nGnRNF2QP4

This article interestingly compares each stock to its peak price (as opposed to offering or deSPAC) and concludes this path to public is "waning." Would IPO analysis be any different? $DASH -44% peak, $SNOW -46% peak. $U -42% peak.Spac share prices slump as enthusiasm wanes https://t.co/nGnRNF2QP4 Financial Times @FinancialTimes

Financial Times @FinancialTimesBut Goldman Sachs Global Head of Investment Banking believes otherwise - she’s slightly biased though 😁 (the Information)

Investor demand for these new tech shares will remain strong, predicts Posnett, because advances in the technology that powers enterprise software companies such as Snowflake and Unity and consumer businesses such as Instacart and Roblox mean the suppliers of such tech can develop into bigger companies more quickly.

“When these great tech companies are coming to market right now, either public market or private market investors really want to own them because of that disruption,” she said. “The pace of change has never been so fast.”

But Connolly, who was involved in deals like Coinbase’s and Palantir’s direct listings and Snowflake’s IPO, expects such imbalances in supply and demand to clear out in the coming months, with strong investor demand for tech stocks strengthening the IPO market in the long run.