What's 🔥 in Enterprise IT/VC #224

💰 won't get you to product market fit faster, the importance of walking before you run

While the funding market for enterprise startups continues to be on 🔥, one discipline many founders will have to practice is patience and restraint. We all want to run fast but sometimes walking first is more important than running.

As Villi Iltchev from Two Sigma points out, many companies are raising well ahead of where they are as a business.

Companies that raise well in advance of where they are as a business remind me of that awkward adolescence phase where you’re in an adult’s body but still are a teenager and don’t really have full control of yourself. 🔑 is there are no shortcuts and a boatload of 💰 too early doesn’t help you accelerate your path to product market fit and if you ramp too quickly, it can accelerate your path to burning that cash quickly.

So how should founders think about managing that large, preemptive round? First, remember you don’t have to spend all that cash right away. Second, be honest with yourself and your business. Set goals that are realistic and bottoms up vs. top down (i.e., 4x ARR YoY vs. based on developer love or users, etc). Assess whether you have product market fit or not. Why, because if the latter, you can start spending on sales and marketing hires but if not, you can spend your way to lots of problems. I can’t tell you how many times I’ve seen founders do simple enterprise math, if I hire X number of sales reps who take X months to ramp and are X% productive on their quota, I can reach $X of ARR. It’s easy to do that math but math is not product ❤️ or having a true, repeatable sales model. Finally, if taking that preemptive round, make sure that there is 100% alignment with the new investor on where you are as a business and the goals as I’ve seen misalignment in the past where the investors want a company to scale way before it’s ready.

Bottom line, be wise and honest and set realistic goals that has your company stretch but also does not demoralize them and cause the team to do unnecessary acts to realize them.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

👇🏼💯 Saying I don’t know is ok and encouraged when I’m meeting with founders but, I also like a quick follow up suggesting how you may come up with those answers or what hypotheses you would run to figure it out

Anatomy of a pivot from Jeff Haynie of Pinpoint ( a portfolio co) - must read for founders who may be stuck - FWIW, I’m excited about the road ahead 😃

It’s hard being honest with yourself.

TL;DR

What we were building wasn’t working. We shut down the old app and have been working on something that will be more useful to more people regardless of what you’re working on or who you’re working with.

What we learned:

A bottoms up go-to-market motion is almost always best for more technical audiences and solutions.

Keep it simple. Our app was too complicated, had too many knobs, and too many options. Users were overwhelmed.

Inspiration…founders, you will get way more Nos than Yeses when raising capital and selling to customers

Amazon’s Leadership Principles…

Customer Obsession: Leaders start with the customer and work backwards. They work vigorously to earn and keep customer trust. Although leaders pay attention to competitors, they obsess over customers.

Ownership: Leaders are owners. They think long term and don’t sacrifice long-term value for short-term results. They act on behalf of the entire company, beyond just their own team. They never say “that’s not my job."

Invent and Simplify: Leaders expect and require innovation and invention from their teams and always find ways to simplify. They are externally aware, look for new ideas from everywhere, and are not limited by “not invented here." As we do new things, we accept that we may be misunderstood for long periods of time.

Enterprise Tech

Datadog leaning more into security and DevSecOps with acquisition of Sqreen in RASP and in-app web firewall (WAF) space (run time application self protection). Expect Datadog to lean in even more in 2021 as it looks to expand beyond its core market of observability (see earnings call transcript from this past week)

Second, we are just getting started in security with our first product launch in 2020. We consider security a very large opportunity with a long runway of planned product development, and we envision the silos between dev, sec and ops breaking down in a similar way to what we have seen between dev and ops. Third, we are investing in the platform and ecosystem. In addition to building up the Datadog Marketplace, we now have strategic partnerships with all of the major cloud vendors.

Calling all developer first founders - the Orbit Model for developer ❤️ is a fantastic framework and application to build and manage your community - more on Github

Measuring love

In the Orbit Model, a member's love is inferred by the quantity, quality, and recency of activities they've completed. In other words, for each member, you want to understand what they've contributed, the relative importance of each contribution, and when the contribution happened.

Start by making a list of all the activities that are important for your community. For example:

Attended our conference

Spoke at a meetup

Opened a pull request on GitHub

Answered a forum question

Speaking of community, Lisa Xu from FirstMark lays out her thinking around why the Community Department is the next big SaaS category

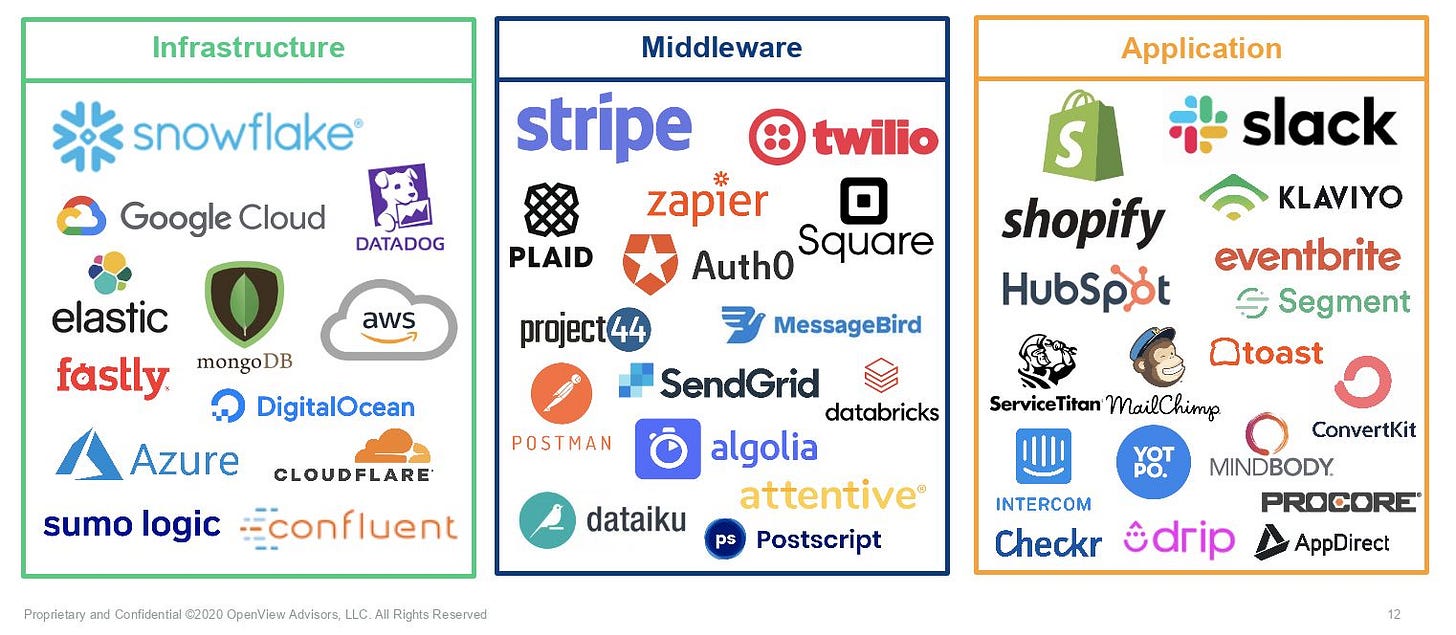

Usage based pricing over seat based pricing - (Kyle Povar, OpenView on Techcrunch)

Some fear that investors will hate usage-based pricing because customers aren’t locked into a subscription. But, investors actually see it as a sign that customers are seeing value from a product and there’s no shelf-ware.

In fact, investors are increasingly rewarding usage-based companies in the market. Usage-based companies are trading at a 50% revenue multiple premium over their peers.

Investors especially love how the usage-based pricing model pairs with the land-and-expand business model. And of the IPOs over the last three years, seven of the nine that had the best net dollar retention all have a usage-based model. Snowflake in particular is off the charts with a 158% net dollar retention.

APIs are big business as Kong raised $100 million at a $1.4 billion valuation led by Tiger

The company began life as Mashape back in 2009 by creating an API marketplace. The company developed Kong, an open source management tool for APIs and microservices in 2015. The product soared in popularity. So the company sold its marketplace business and renamed itself Kong as it focused on building services with Kong at the core.

The company’s flagship product, Kong Konnect, is a connectivity gateway that links APIs to service meshes. Using AI, the platform eases and automates the deployment and management of applications while bolstering security. Among its notable customers, Kong claims GE, Nasdaq, and Samsung.

Key enterprise tech milestones this week include Datadog entering the security space with the purchase of Sqreen, Hubspot passing the $1 billion ARR mark, and CloudBees in the DevOps space passing the $100 million ARR mark and setting its sites for an IPO this year. More below…

CloudBees in the DevOps space surpasses $100 million ARR

“The software delivery market will continue to grow as organizations undergo DevOps transformations and drive greater business value as a result of their efforts,” said Sacha Labourey, chief executive officer and co-founder, CloudBees. “However, you’re never really finished. There are always additional processes to automate and optimize, and demands from business functions for more insight into the overall software delivery flow. Our Software Delivery Management offering accomplishes this by layering a seamless set of services on top of CI/CD automation. We’re excited about the future of the industry, as SDM will make software delivery a more holistic process across the organization, integrating insights and stakeholders in ways that were not possible before.”

Hubspot passes the $1 billion ARR mark selling primarily to SMEs for inbound sales, marketing and customer support

If interested in chaos engineering and incident analysis, then listen to Corey Quinn (AWS) and Nora Jones on Last Week in AWS

Join Corey and Nora as they talk about just what the heck it is that Jeli (a portfolio co) does, how incidents can help organization learn more about themselves, what it was like to work at Jet when it was scaling rapidly, how if everything is an incident than nothing is an incident, why businesses need to define exactly what an incident means to them, what the purpose of chaos engineering is, the unintended positive consequences of chaos engineering, why Nora thinks the word ‘post-mortem’ should be removed from the incident response lexicon, what’s surprised Nora as her role has evolved over her career, and more.

Kubernetes may be on the rise but still not easy…

Markets

Huge week for bitcoin as Tesla buys $1.5 billion worth for corporate treasury and BNY Mellon and Mastercard lay out their bitcoin and cryptocurrency plans

BNY Mellon, which boasts around $2 trillion in assets under management, has announced plans to hold bitcoin and other cryptocurrencies on behalf of its clients.

The move comes amid what the BNY executive heading up its digital assets unit, Mike Demissie, called an "uptick in institutional interest" in the emerging bitcoin and crypto asset class.

"There’s an overall sentiment shift with respect to digital assets," says Demissie, speaking over email ahead of the announcement, adding: "Digital assets are the future."

Softbank Vision Fund bouncing back but more importantly, here’s another amazing slide from their investor presentation