What's 🔥 in Enterprise IT/VC #213

Halt and Catch Fire and The Doherty Threshold, 400ms to 100ms rule, speed as a feature

Happy Thanksgiving 🦃 to those who celebrate, and for those who don’t, I find the beginning of the holiday season as a time to reflect on what I’m grateful for, what happened during the year, and how I’m thinking about 2021. I hope that all of you find time in your busy schedules to do the same.

The holiday season is also a great time to catch up on Netflix and other shows and while watching Halt and Catch Fire ( Madmen meets PC entrepreneurs), I could not stop thinking about the Doherty Principle, coined in 1982 by Walter Doherty, an IBM Researcher, about the importance of speed in all that we do on the computer. Check out this clip below where Joe MacMillan waxes poetic on the value of 400ms or interactions of under 1/2 a second which in turn leads to users being glued to that

machine for hours. When doing some digging, I found that Doherty’s paper was written in 1982 and this episode was from June of 2014. Speed has always been an important factor for building computer systems and Paul Bucheit, inventor of Gmail, turbocharged this idea with his 100ms rule, a speed which interactions feel instantaneous. Rahul Vohra, founder of Superhuman (a portfolio co), reenergized this thinking with his positioning based on a “blazingly fast” email experience where everything is less than 100ms.

Going back to the Doherty Principle, Jim Elliot, a former IBMer and now mainframe consultant, best summarizes the original paper here.

When a computer and its users interact at a pace that ensures that neither has to wait on the other, productivity soars, the cost of the work done on the computer tumbles, employees get more satisfaction from their work, and its quality tends to improve. Few online computer systems are this well balanced; few executives are aware that such a balance is economically and technically feasible.

If you’re thinking about speed as one of your first class product principles, then make sure you have everything wired from the start to track and measure every interaction that matters. In the early days, knowing that speed was a key product North 🌠, Superhuman built much of its own instrumentation into the product. This engineering blog post from the team captures what they measured and how.

While simple to say let’s build for speed, it’s much more difficult in reality. Building product, creating new ways of interaction like Command-K, and really thinking about what not to include and what to remove, are all tough repeated decisions one has to make. When it all comes together the best SaaS products truly feel like magic; the speed, the intuitiveness, the interactions all blend to create an amazing user experience.

Although in SaaS there are few technical moats, I truly believe those who optimize and build for speed can create one. And it’s not just saying you will do it, but one must wire the “need for speed” into your culture from day one, live it, measure it, and continually make all of those difficult product decisions to do less versus more.

🙏🏼 again for reading and please share with your friends and colleagues!

Scaling Startups

Lots of discussions on analytics and instrumentation for PLG companies this past week and this thread from Lenny is great as you can’t be true PLG unless you wire up the data

and here’s an older post from Boris Jezic of Census Data sharing his view of what the modern stack is - yes, there are so many choices out there!

👇🏼💯

🤔 A thoughtful essay from Paul Graham on independent minded thinkers vs. conventional ones, and how to be great you not only have to do things that are right but also new.

You see this pattern with startup founders too. You don't want to start a startup to do something that everyone agrees is a good idea, or there will already be other companies doing it. You have to do something that sounds to most other people like a bad idea, but that you know isn't — like writing software for a tiny computer used by a few thousand hobbyists, or starting a site to let people rent airbeds on strangers' floors.

Paul then goes on to say it’s not just nature but you can also nurture being independent minded.

Another place where the independent- and conventional-minded are thrown together is in successful startups. The founders and early employees are almost always independent-minded; otherwise the startup wouldn't be successful. But conventional-minded people greatly outnumber independent-minded ones, so as the company grows, the original spirit of independent-mindedness is inevitably diluted. This causes all kinds of problems besides the obvious one that the company starts to suck. One of the strangest is that the founders find themselves able to speak more freely with founders of other companies than with their own employees. [3]

Well said! Click through for comments as well. For that matter I’d also add that given so many companies are in stealth, it’s also hard to really know if funds have invested in any competitors through firm or scouts so need to be wary of that as well.

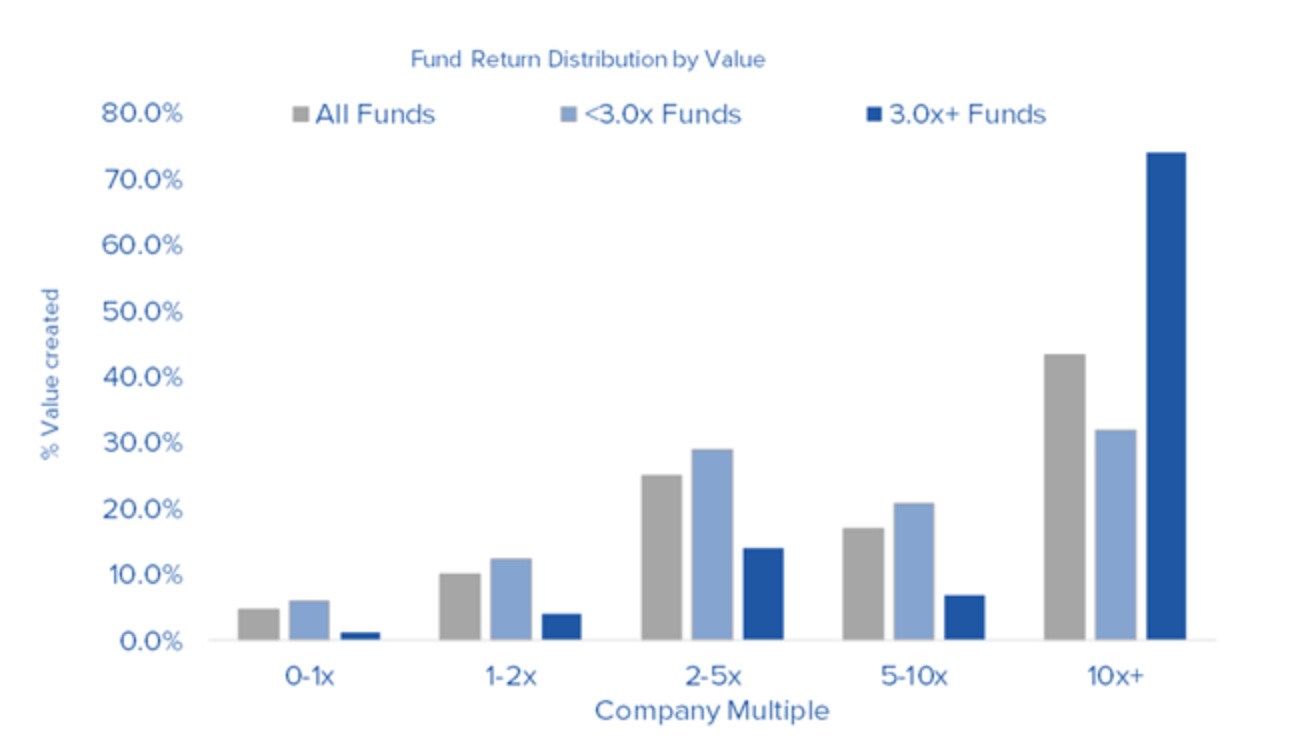

We all know VC is a hits driven business and this data from 322 funds from VenCap (oper8r substack) shows how important those 10x + returners are for the top performers. In fact, more than 70% of all value created by these 3x net funds are from the 10x-ers.

If you choose to raise VC and by the way, not everyone should, remember this is what we’re looking for in each and every investment - the opportunity to be 10x or more. How you get there is another story and one I’ve written about many times. For us on day one, it always starts with technical product obsessed founders who go deep on a narrow problem with the ability to tell a story on how it could expand over time.

Enterprise Tech

2 years of learnings from migrating to kubernetes and the tech stack that went with it from Grafana, Tekton, Consu, Vault Open Policy Agent, and Skaffold. Getting set up was hard enough but operationalizing is even harder. 🎩 DevOps Weekly

Our learning is that operating Kubernetes is complex. There are a lot of moving parts. And learning how to operate Kubernetes is most likely not core to your business. Offload as much as possible to cloud service providers (EKS, GKE, AKS). There is no value in doing this yourself.

Kubernetes is so complex that even if you are using a managed service, upgrades are not going to be straight forward.

Even when using a managed Kubernetes service, invest early in infrastructure-as-code setup to make disaster recovery and upgrade process relatively less painful in the future and be able to recover fast in face of disasters.

All of this is a reason to check out what Spectro Cloud is doing (a portfolio co).

Great post from James Governor at RedMonk on the Developer Experience Gap and the need for New Code or Glue Code. Yes, there is still tons of opportunity for companies to address this huge problem.

My colleague Stephen recently wrote an excellent and well-received post about the Developer Experience Gap – the chasm separating modern promises of developer productivity with the reality of stitching environments together by hand. There are so many powerful tools and platforms out there – we keep calling it a Golden Age for developers – but choice and fragmentation, and a lack of focus on the end to end experience, are holding us back as an industry. Pipelines remain a challenge to build and maintain.

❤️ this from Shopify on how they compete with Amazon, wait for it, developers, developers, developers. Also a key thought as everyone is rushing to build a platform; you’re not a true platform unless your participants are making lots of 💰💰💰 by being on your platform.

Another week and another outage - this time AWS went down and affected tons of folks from Hashicorp to Adobe to Coinbase to port co Env0 - you guessed it, time for resiliency engineering, shifting left breaking and testing with devs before production - check out Steadybit

Great thread from my colleague Shomik on minimalism and simplicity in product design as put in use by AWS

Every Fortune 500 is a tech co which means they need engineers. Goldman Sachs initially wanted to be the Google of Finance many years ago and now it seems it’s the AWS of Finance (more from The Information)

In an interview last week, Goldman’s Argenti downplayed the number of former AWS colleagues who had joined the company recently.

“We’ve hired literally thousands of engineers since the beginning of the year. And so if you look at how many of those came from AWS, it’s actually a small number. We also hire people from other tech companies—lots of them,” Argenti said.

Here’s a recent slide from a Goldman presentation a couple of weeks ago on their tech stack - cloud and APIs…

Interesting: Amazon Sidewalk - back door way to build neighborhood based networks over 900 MHz

Sidewalk basically creates a special, separate network, hosted by so-called Sidewalk Bridge devices. That includes certain Echo and Ring models. What distinguishes them from your regular WiFi connection is that proximate Sidewalk devices can collaborate, even if they’re not necessarily your own.

Your neighbors’ Ring camera, for example, could join a local Sidewalk network. The advantage, Amazon says, is that even if your internet connection goes down, things like your Ring security system may still potentially be able to get online using a neighbor’s bandwidth. It also improves range, since Sidewalk devices can in theory fill in gaps in WiFi coverage.

Looking for some reading material over the holidays and want to geek out? Check out the DevOps reading list here to get you up to speed!

More data from Forrester Research on 5G and edge computing in warehouses, manufacturing

Forrester sees immediate value in private 5G — a network dedicated to a specific business or locale like a warehouse, shipyard, or factory. Private 5G is here now, and we expect it to fuel edge computing in 2021. Business infrastructure such as warehouse robots and factory machine tools enabled by the internet of things need local processing and low-latency networks; edge computing and 5G serve these, respectively. 2021 will be the inflection for 5G, but it will be private, not public.

🤣

Markets

Had to mention this although all of you know already - Salesforce in rumors to buy Slack. Salesforce Chatter never took off and if this happens will be interesting to see how companies like Google and Zoom respond - could be a new game of musical chairs in the M&A space for collaboration cos. Post-close, we should also see how and if Slack gets wired directly more into the Salesforce platform or just left as a standalone. As you know, I’m a big believer that native collaboration will be built into every application and also requires many of the OG SaaS providers to rethink their architecture for this.

Bitcoin rally all about Square Cash App and Paypal as written by Pantera Capital. Yes, I’ve been holding for awhile and will continue to do so

In last month’s investor letter we discussed that after 30 months of operation, Square’s Cash App is estimated to be buying around 40% of all newly-issued bitcoin.

PayPal just launched their new service that enables customers to buy, sell, and hold cryptocurrency directly from their PayPal accounts. It’s already having a huge impact.

The bitcoin community is proud to have grown to 100 million users over twelve years. PayPal has 300 million active users. As we’ve argued — and will argue more fully in our December investor letter — this rally is much more sustainable than 2017. One of the main differences is the ease of investing in bitcoin now — via PayPal, Cash App, Robinhood, etc.

And as it neared its all time high in 2017, it crashed 3,000 to 16,857 on Thursday.