What's 🔥 in Enterprise IT/VC #170

🌥️🌥️🌥️📈

✈️ to Europe this upcoming week to catch up with portfolio companies and to spend more time in the ecosystem. As a trend, I’m seeing more and more interesting companies come from Europe and frankly I ❤️ companies where engineering can scale in less competitive markets while another co-founder moves to the states to ramp up GTM.

Top of mind this past week was cloud growth from AWS and Azure. AWS revenue grew 34% in the quarter over a year ago and ended at $9.95 billion. Azure area 62% to $12.5 billion but that also includes office, etc. What’s key is the growth rate of Azure. While it’s on a smaller base, I do hear the larger enterprises migrating more and more in that direction. Finally IBM’s long time CEO, Ginny Rometty, steps down as Arvind Krishna, head of cloud becomes CEO. From my conversations with IBM, focus in on open stack and multi-cloud, winning back developers, and leveraging Red Hat’s incredible presence. We shall see!

As always, if you like the new format or content, please share and ❤️ above!

Scaling Startups

Speed of deal closing for First Round compressing from 90 days to 9. While I get the competitive market, before entering a long term marriage, both founders and investors need to ensure meaningful time spent with one another.

From my friend Bucky Moore at Kleiner. 💯👇🏼

Being in NYC, the more this message spreads, the better as Mark Zuckerberg says he wouldn’t start a new company in Silicon Valley.

"I think the world is in a different place now," Zuckerberg said. "I think the infrastructure exists for people to do stuff like this in more places."

Furthermore, he said that it's not only easier to go outside Silicon Valley, but that there are now upsides to doing so.

"There's a lot of advantages to building a company that is not in such a monoculture," he said, adding that "Silicon Valley being an all-tech town there's not as much diversity of how people think about things as you'd like, in a lot of ways."

Enterprise Tech

What’s next in cloud revolution? Is it Managed Infrastructure as Code? Read Ohad Maislish from Env0 (full disclosure a portfolio co of boldstart) on what’s next.

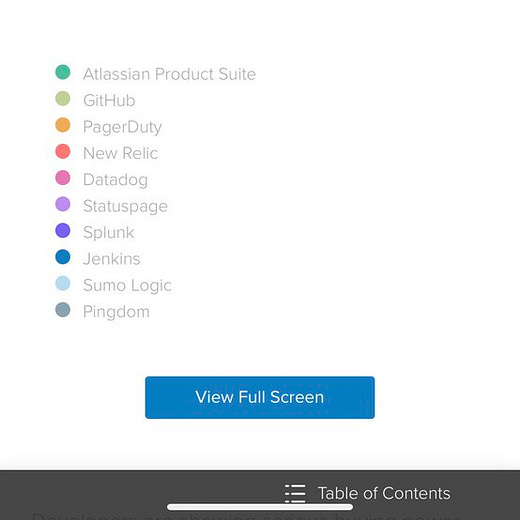

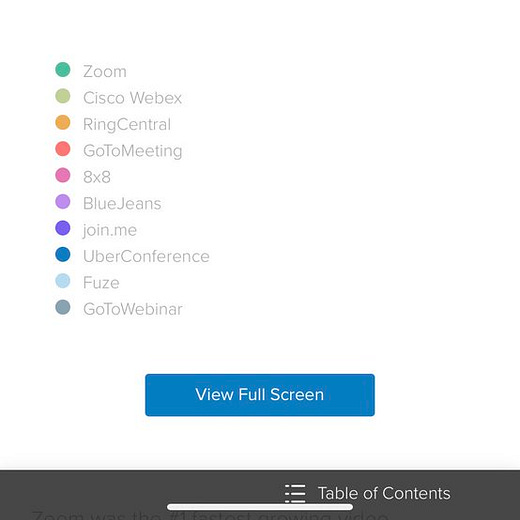

Okta’s Business at Work annual survey is out and under fastest growing apps interesting to see infrastructure services like Snowflake, Opsgenie and Splunk up there. Zoom has been on this list 4 years in a row.

My colleague Shomik Ghosh breaks down further:

Regarding Kevin Kwok’s post on the Arc of Collaboration, Julian Lehr has an interesting one where he believes “Instead of Slack, I believe that email – and more importantly Superhuman – will return to become the center of gravity for productivity.” In particular, “At the moment, Superhuman commands are limited to typical email actions (snooze, send later, etc), but the obvious next step, in my opinion, is to add commands that work across different apps.” His argument is Slack only notifies you but one still needs to get work done.

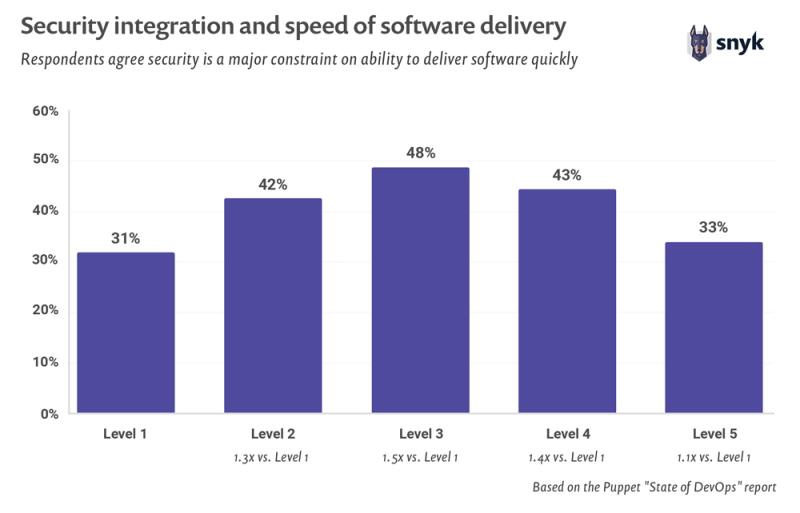

Snyk SecDevOps (in collaboration with Puppet) report is out - one of key stats as per Guy Podjarny (founder of Snyk) - finding the balance between shifting security left and delivering software quickly is a constant struggle

With respect to cloud, here’s a fun exchange I had with Jeff Richards from GGV on twitter

Enterprise companies aren’t immune to layoffs either and when it comes to open source and competing with AWS and Azure it can be quite tough. Rosalie Chan covers the new focus on developer love and cloud offerings as the company had reduced its headcount in sales engineering and sales.

DataStax builds software using Apache Cassandra, a popular open source database that was originally started at Facebook. Internally, some DataStax employees believe the company was too slow to offer versions of its software that were optimized to run on cloud platforms like Amazon Web Services or Microsoft Azure, and that it was struggling to compete with those tech titans, who offer their own database products, four sources said.

While Facebook is not an enterprise company, here is an interesting fact from it’s earnings where expenses grew 52% year over year.

Headcount grew 26% year-over-year to 44,942, and Facebook now has over 1000 engineers working on privacy.

Yes, 1000 engineers working on privacy - astonishing.

Glad to see this is becoming a reality! From Gigabit Magazine on Snyk’s $150mm funding round

In 2018, Ed Sim, founder of investor Boldstart Ventures, said: "Open source software powers most of the Fortune 500 applications today. Securing these open source packages during the development cycle becomes paramount, especially with the movement towards a more agile and continuous release cycle.”

Markets

Microsoft crushes earnings, cloud grows to 62% to $12.5 billion in quarter

AWS similarly outperforms growing at 34% on a much larger base of pure play cloud infra at $9.95 billion

IBM’s CEO Ginny Rometty steps down as Arvind Krishna, head of cloud and the architect of the Red Hat acquisition step up. Multi cloud software and services will pave the way for the new IBM

Prior to IBM adopting its hybrid multi-cloud strategy, the company had a walled-garden approach to cloud computing, largely focusing on its own services. Krishna spearheaded IBM’s shift toward hybrid, prompting the company to work with rival providers rather than compete against them, Rana said. “His openness and ability to work with everybody, from that point, this is very good for IBM.

ServiceNow on a tear as well growing 35% year over year to almost $900 million of subscription revenue