What's 🔥 in Enterprise IT/VC #157

Ed Sim's weekly readings and notes on VC, software, and scaling startups

Greetings from London. Top of news is the continued discussion here and in the states on the dichotomy between public and private enterprise valuations. Public markets seem to have much different viewpoints than private investors as companies like Slack are coming back to earth. Question is if we still have a good long run ahead or will this public market correction filter down to the private markets despite all of the growth funds chasing the largest TAMs (total addressable markets) and paying forward. I’ll be sure to keep tracking this over the upcoming newsletters.

Finally, if you like the new format or content, please share and ❤️ above!

Scaling Startups

Results from my Twitter poll. The majority chose for the seed-funded startup to focus on new product versus the other choices. Great suggestion as that is exactly what Forestry.io chose to do when launching TinaCMS with great fanfare to the open source and developer community. It’s not an easy decision to make as it can be “betting the company” on what’s next but for the founders it was quite clear.

In fun and wise department, Andy Weissman from Union Square Ventures shares “Everything about Venture Capital…you can learn from music lyrics”

Well said - many first time founders I know believe hustle and doing everything is the best way to grow and don’t focus enough on bringing the best talent and learning to let go.

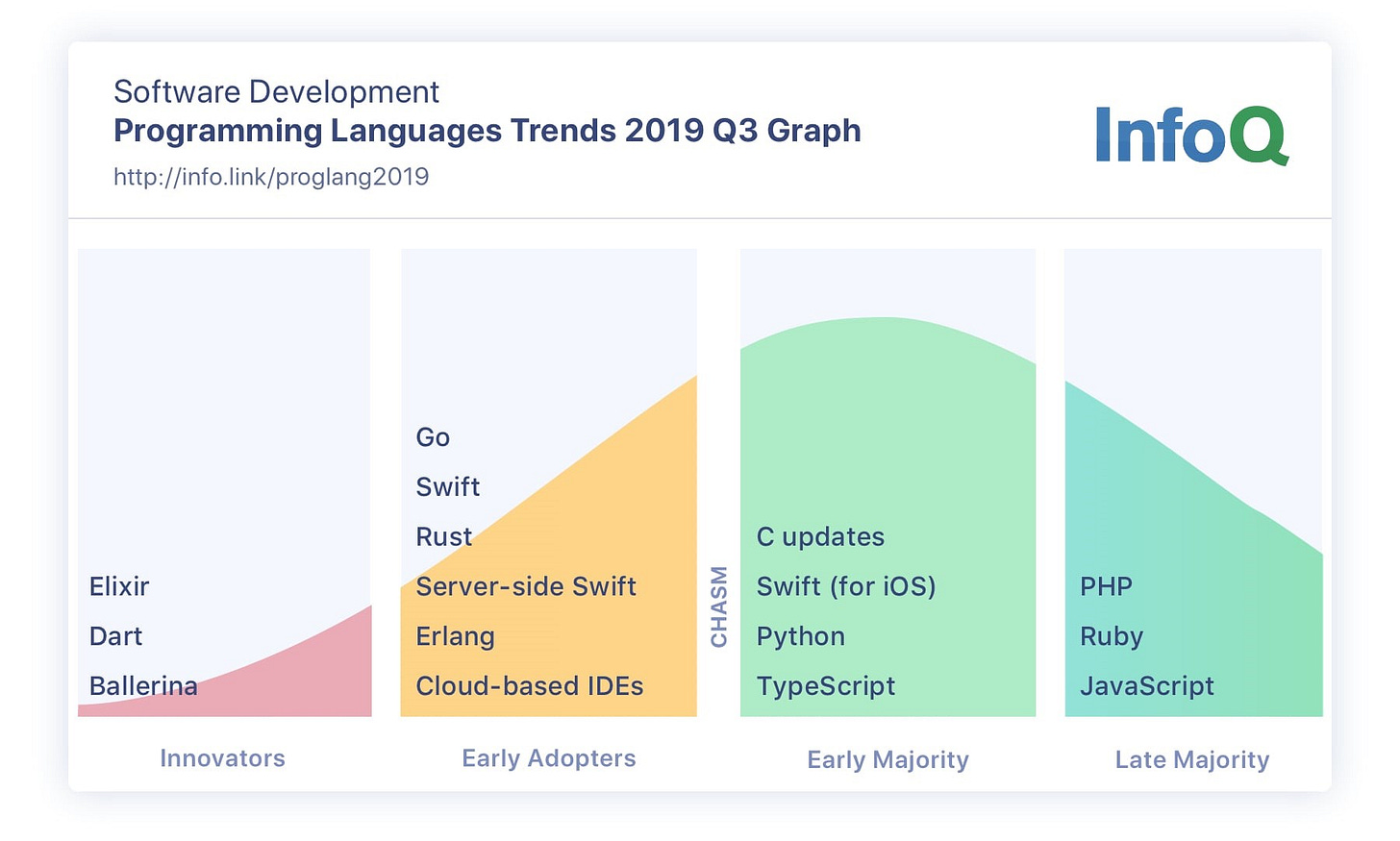

4. Rust and Elixir programming languages on the rise. Rust, in particular, is one to pay attention to with “by its uptake within the infrastructure and networking data plane space — for example, Habitat and Linkerd 2.0. The language is also emerging as a natural partner for WebAssembly, which is helping drive awareness. In addition we note that Facebook has chosen to implement its Libra cryptocurrency using Rust.”

5. More on Gartner Top 10 trends from Peter High of Metis Strategy

Enterprise Tech

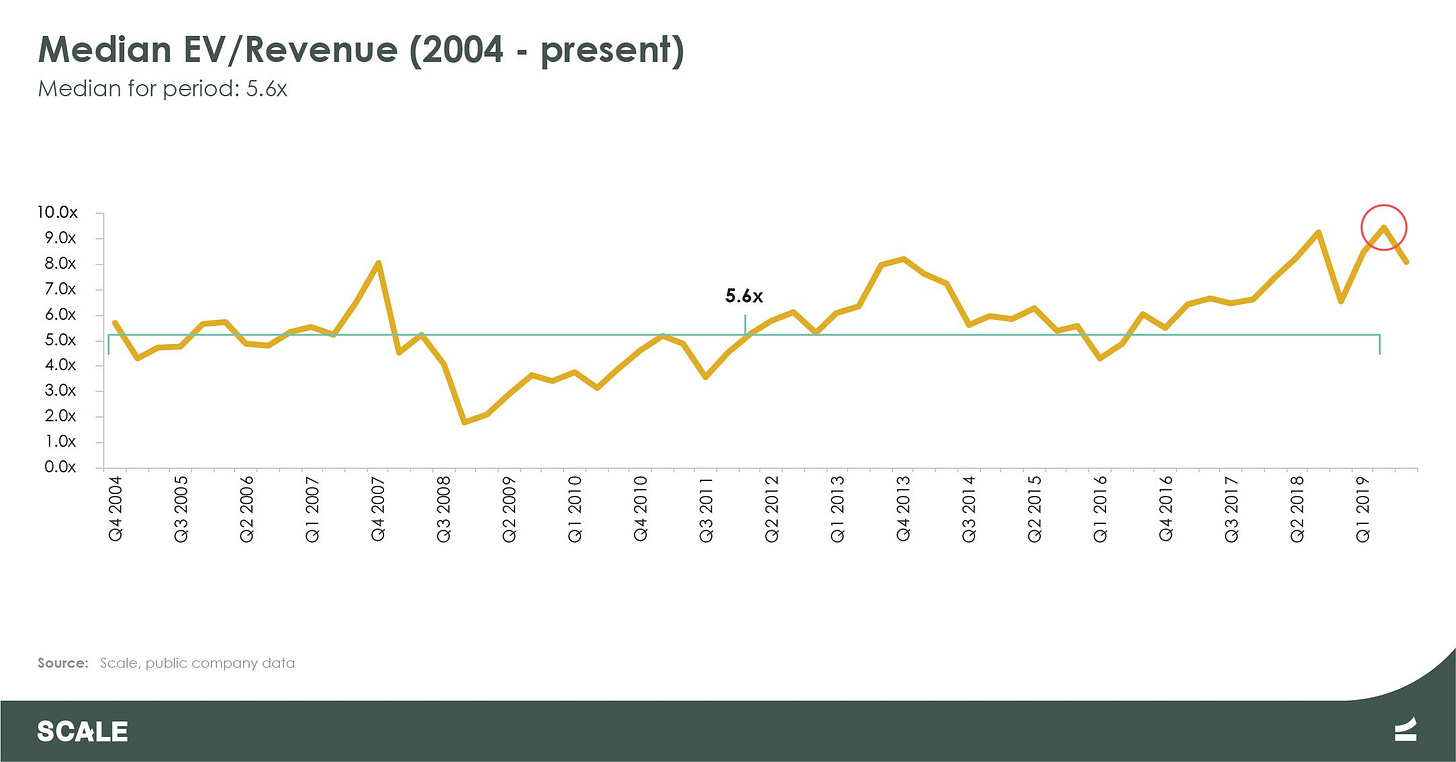

Rory O’Driscoll from Scale Venture Partners breaks down historical enterprise cloud multiples and why they aren’t sustainable moving forward. He also outlines 3 winning strategies for startups.

Solid thinking from Rory and just provides more reasoning about valuation at all time highs. However as an investor, where we get paid as VCs is to go after incumbents. After 10-15 years of domination, these public cos have technical debt and can't keep innovating at the current pace. Companies like Kustomer in our portfolio are taking this exact approach going after Zendesk and Service Cloud. I also believe he’s missing a huge growth opportunity in the developer first and bottom up markets and overplaying the role of AI. AI is table stakes.

Even 🦄 need to focus on spend and getting to profitability. Daniel Dines, founder and CEO of UIPath, pens an open letter about why the company laid off 10% of staff. Once again, this points back to the ever important balance between growth and spend vs. growth at all costs.

“However, growth alone is not the sole objective of a great company. Through the waves of our recent hiring, we have worried that we could become less agile and responsive to customers. There is nothing more important than the success of each and every customer and partner. Success we know is enabling and ensuring our customers can rapidly scale their RPA operations and deliver real, tangible business outcomes. We are 100% committed to this goal.”

Congrats to IOpipe (a portfolio co), one of the leaders in serverless monitoring which was just purchased by New Relic this week. Here’s the news from Techcrunch and New Relic. Bigger vision is to help modern software teams build better software and near term it’s about the increased growth of serverless at companies like Morningstar and others.

Markets

Twilio stock down 17% after beating revenue targets with $295.1mm but with net expansion lower than expected at 132% vs expectations of 138%.

Shopify hits 1 million merchants supported - insane numbers and stats from Tobi Lutke - $183 billion contributed in global economic activity from Shopify merchants with Shopify merchant growth of 59% vs 22% for industry